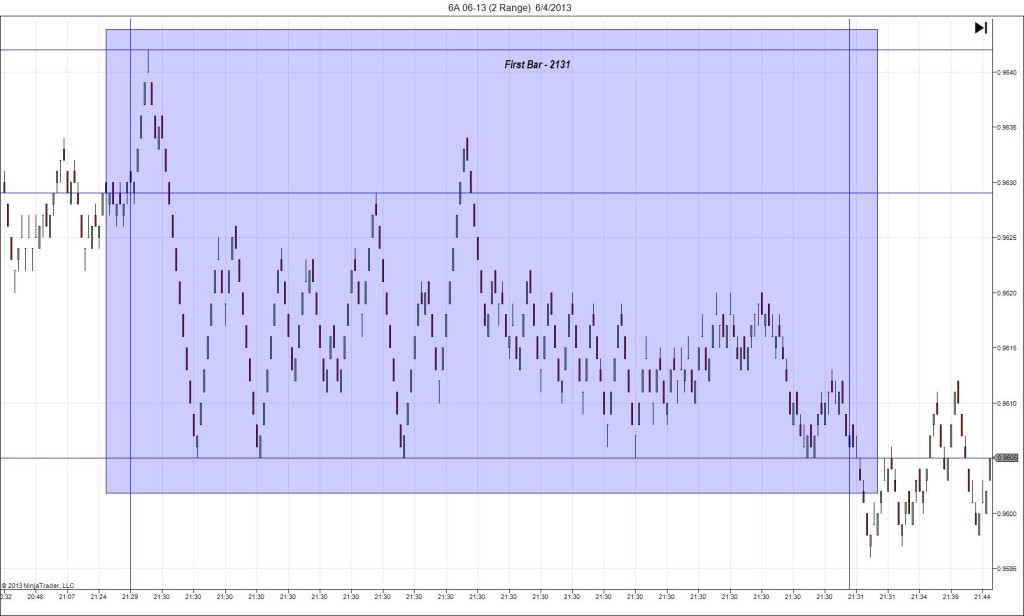

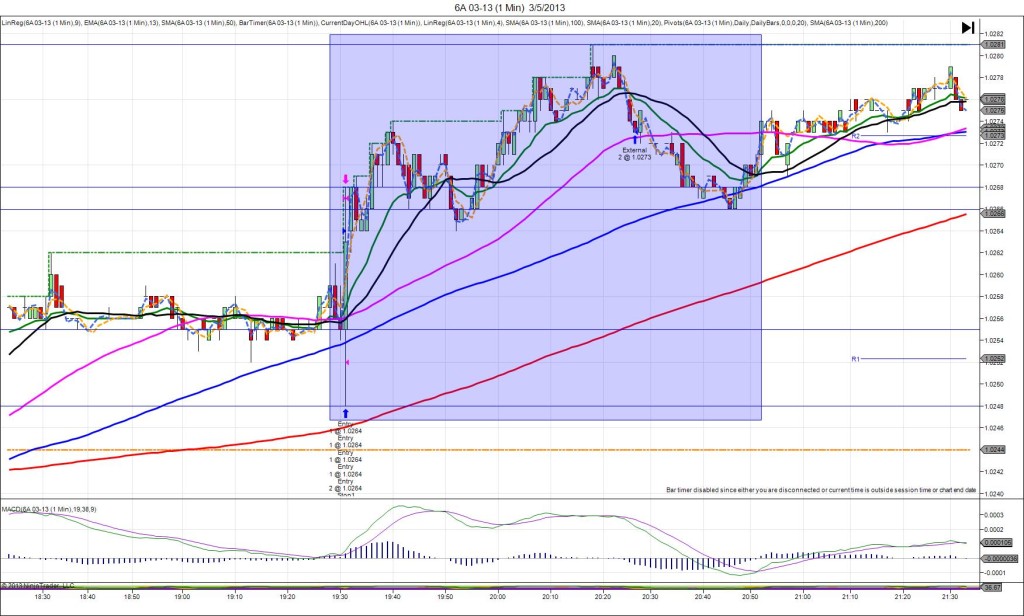

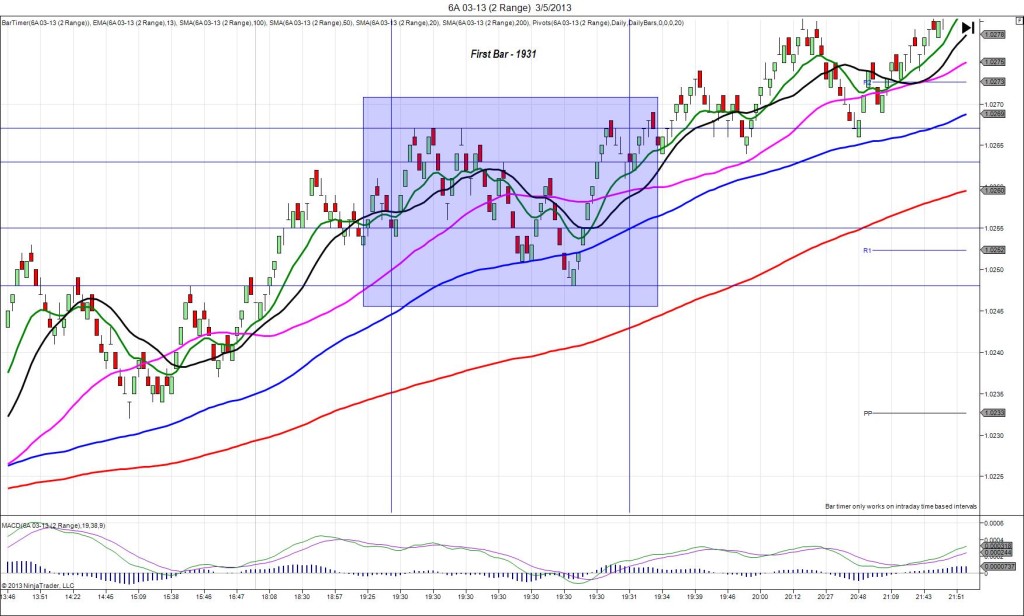

9/3/2013 Quarterly Advance GDP (2130 EDT)

Forecast: 0.6%

Actual: 0.6%

Previous Revision: -0.1% to 0.5%

UPWARD FAN

Started @ 0.9043

1st Peak@ 0.9075 – 2131 (1 min)

32 ticks

Reversal to 0.9066 – 2132 (2 min)

9 ticks

Final Peak @ 0.9098 – 2244 (74 min)

55 ticks

Reversal to 0.9088 – 2305 (95 min)

10 ticks

Notes: Report matched the forecast with a 0.1% previous downward revision. This caused a choppy long reaction that crossed all 3 major SMAs and the R1 Pivot, then eventually turned into an Upward Fan. With JOBB, you would have filled long at 0.9051 with 3 ticks of slippage, then seen it peak quickly then hover between 0.9062 and 0.9074 for the rest of the :31 bar. A target just above the R1 Pivot at .9070 would have filled for 19 ticks. After the 1st peak, it backed off 9 ticks, then slowly stepped higher to a final peak of 23 more ticks in the next 73 min, crossing the R2 Pivot. Then it reversed 10 ticks back to the 50 SMA in about 20 min.

-120412.jpg)

-090412.jpg)

-090412.jpg)

-060512.jpg)

-060512.jpg)

-030612.jpg)

-030612.jpg)