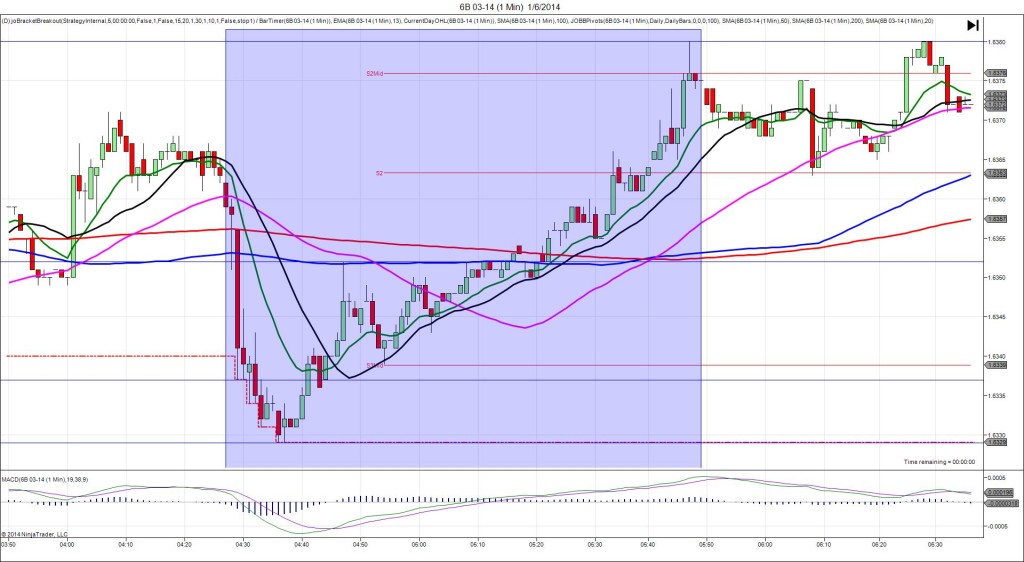

12/3/2013 Monthly Manufacturing PMI (0430 EST)

Forecast: 59.3

Actual: 62.6

SPIKE/REVERSE

Started @ 1.6393

1st Peak @ 1.6419 – 0431 (1 min)

26 ticks

Reversal to 1.6397 – 0434 (4 min)

22 ticks

Pullback to 1.6417 – 0455 (25 min)

20 ticks

Reversal to 1.6394 – 0517 (18 min)

23 ticks

Notes: Report came in much stronger than the forecast with 3.3 pts offset. This caused a long spike of 26 ticks that started on the 13/20 SMAs , then broke out to cross the R1 Pivot. Look to exitat about 1.6415 after it hit the R1 Pivot and started to back off. After the peak, it reversed back to the 13 SMA on the next 3 bars for 22 ticks. Then it climbed 20 ticks in the next 21 min in a failed attempt at a 2nd peal to nearly reach the R1 Pivot. Then we saw a reversal for 23 ticks in 18 min back to the 100 SMA.