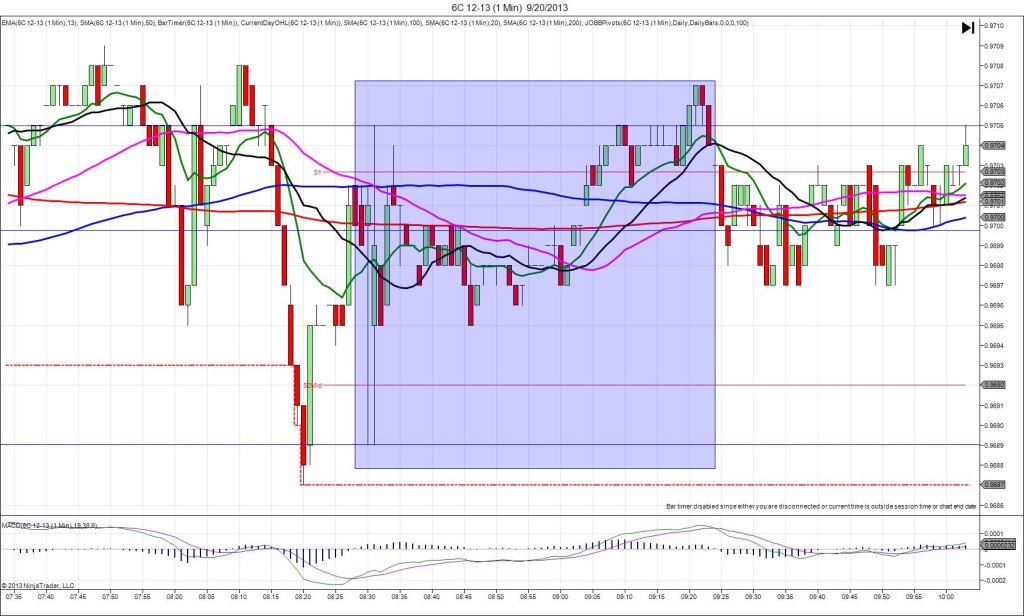

7/10/2015 Employment Change (0830 EDT)

Employment Change Forecast: -9.0K

Employment Change Actual: -6.4K

Previous Revision: n/a

Rate Forecast: 6.9%

Rate Actual: 6.8%

INDECISIVE

Started @ 0.7869

Whipsaw between 0.7855 and 0.7886 – 0830:00 (1 min)

31 tick span

Pullback to 0.7889 – 0830:24 (1 min)

20 ticks

Reversal to 0.7872 – 0844 (14 min)

17 ticks

Extended Reversal to 0.7834 – 0942 (72 min)

55 ticks

Pullback to 0.7855 – 1008 (98 min)

21 ticks

Notes: This report lived up to the advertised risk and gave us a whipsaw spanning 31 ticks in the opening second. This would have filled either long or short, then stopped with a few ticks of slippage for about a 20 tick loss. In the remainder of the :31 bar, it pulled back 20 ticks to eclipse the R1 Pivot and HOD before reversing on the back end of the bar. Then it hit a triple top in the next 3 min before reversing 17 ticks in 13 min to the R1 Mid Pivot. It continued to reverse for another 38 ticks in about an hour to the S1 Pivot before pulling back 21 ticks in 26 min after crossing the S1 Mid Pivot / 50 SMA.