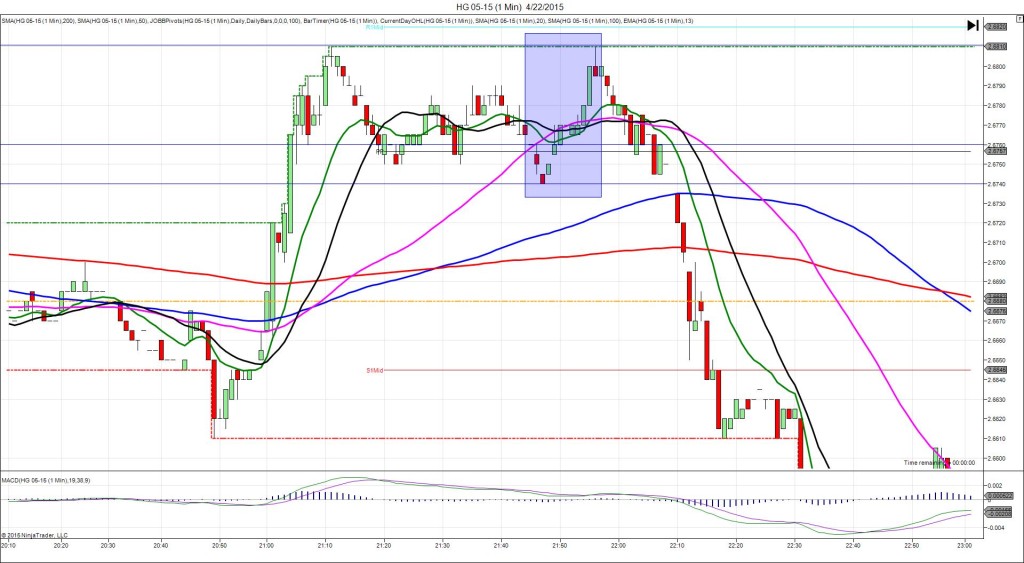

1/19/2015 CNY Quarterly GDP (2100 EST)

Forecast: 7.2%

Actual: 7.3%

Previous Revision: n/a

INDECISIVE

Started @ 0.8165 (2159:20)

1st Peak @ 0.8156 – 2159:32 (1 min)

9 ticks

Reversal to 0.8180 – 2100:00 (2 min)

24 ticks

Pullback to 0.8161 – 2104 (5 min)

19 ticks

Reversal to 0.8181 – 2106 (7 min)

20 ticks

Pullback to 0.8126 – 2201 (62 min)

55 ticks

Notes: Nearly matching report caused an unstable reaction. It drifted lower 9 ticks in about 13 sec, then would have reversed to stop you out 5 sec later. This is the second report in a row that behaved this way (small initial spike followed by a large reversal. This is a quarterly report with rare occurrences, so trends are harder to establish, but me may shift on the next report. With JOBB and a 5 tick bracket, your short order would have filled at 0.8160 with no slippage, then briefly shown 4 ticks of profit as it hit the 200 SMA before reversing to stop you out at 0.8165 for a 5 tick loss with no slippage. It continued to reverse for a total of 24 ticks as it reached the PP Pivot. Then it pulled back 19 ticks in 3 min to the S2 Mid Pivot / 20 SMA before reversing to the PP Pivot again 2 min later. Then it fell 55 ticks in 55 min to the S4 Mid Pivot. With the matching report and unstable reaction, a trade on the HG would not be recommended.