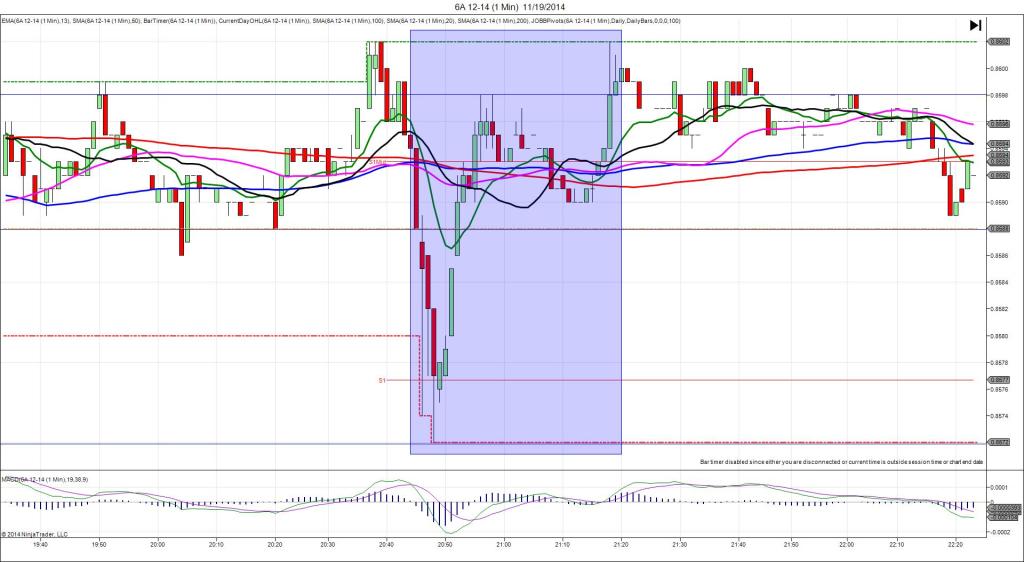

8/31/2014 CNY Manufacturing PMI (2100 EDT)

Forecast: 51.2

Actual: 51.1

Previous Revision: n/a

DULL REACTION (NO FILL)

Started @ 0.9319 (2059)

1st Peak @ 0.9324 – 2100:59 (2 min)

5 ticks

Reversal to 0.9320 – 2110 (11 min)

4 ticks

Notes: Report fell short of the forecast and yielded only 5 ticks about 2 min after the news was released. Once again it was released at 2059:12 (48 sec early). We advised setting the activation time at 20:57:30. We saw 3 ticks deviation from the anchor point in the nearly 2 min wait time, and the news broke when it was 2 ticks from the anchor point. The spike started just above the OOD and rose to cross the S1 Mid Pivot and 200 SMA on the :01 bar. With JOBB you would not have seen a move more than 1 tick after the news release, so cancel the order at 2100. After the peak, it reversed for 4 ticks to the 100/50 SMAs in 9 min. The release on a Sunday evening when Monday was a US holiday may have also contributed to the dull reaction.