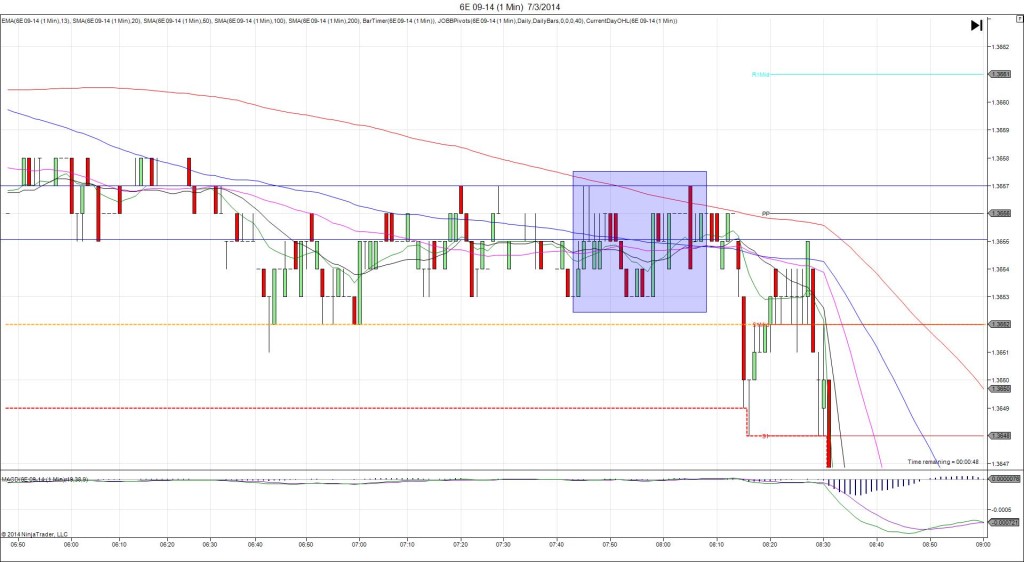

5/8/2014 ECB Minimum Bid Rate (0745 EDT)

Forecast: 0.25%

Actual: 0.25%

TRAP TRADE (DULL REACTION-NO FILL)

Started @ 1.3932 (last price)

————

Trap Trade:

)))1st Peak @ 1.3949 – 0745:08 (1 min)

)))17 ticks

)))Reversal to 1.3937 – 0745:10 (1 min)

)))-12 ticks

)))2nd Peak @ 1.3959 – 0745:49 (1 min)

)))27 ticks

————

Reversal to 1.3938 – 0804 (19 min)

21 ticks

Trap Trade Bracket setup:

Long entries – 1.3912 (just below the S1 Mid Pivot) / 1.3901 (just above the S2 Mid Pivot)

Short entries – 1.3950 (just above the R2 Pivot) / 1.3962 (on the R3 Mid Pivot)

Notes: The ECB decided to leave the Minimum Bid Rate unchanged at 0.25% and took no further action. This resulted in a more decisive long spike that was not ideal for the Trap Trade, but still would have worked it played correctly. Your inner tier short entry would have filled right around the 20 sec mark if you did not cancel. Then it would have made a 2nd push higher as the :46 bar closed to see 9 ticks of heat. Then it backed off to hover between 1 and 5 ticks in the red for about 10 min before it fell further. In all previous reactions in the last 4 months, it has reversed immediately to the origin, so this was an anomaly. Be sure to cancel the outer tier and move the stop to 1.3960 and look to exit when it first reaches the 20 SMA. This would have yielded 6 ticks on the :57 bar after 12 min. It eventually fell to the major SMAs and R2 Mid Pivot 7 min later to allow a max of 10 ticks. Then it recovered to the R2 Pivot and traded sideways into the press conference.