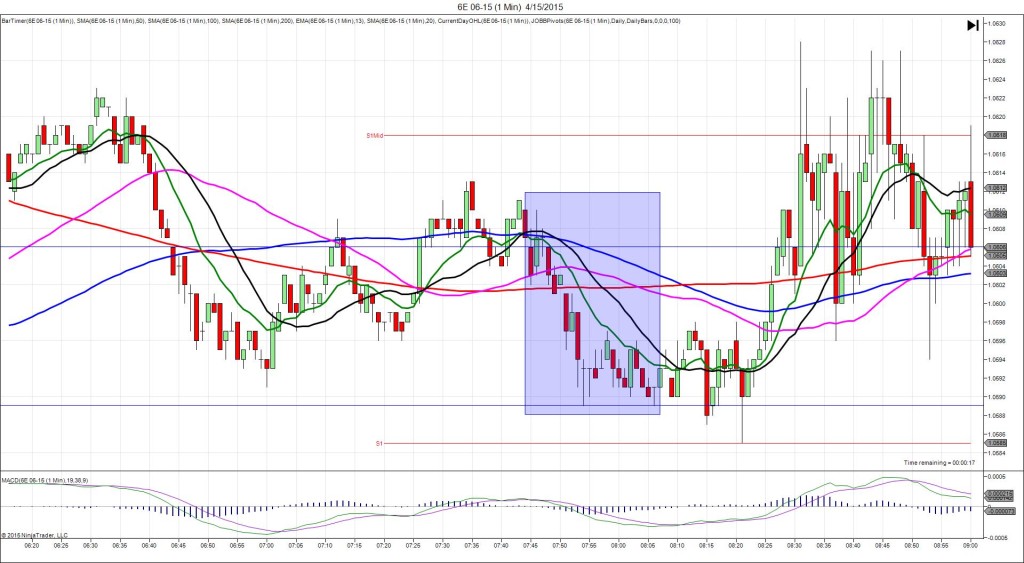

4/15/2015 ECB Minimum Bid Rate (0745 EST)

Forecast: 0.05%

Actual: 0.05%

TRAP TRADE – DULL NO FILL

Started @ 1.0606

————

Trap Trade:

)))1st Peak @ 1.0610 – 0745:05 (1 min)

)))4 ticks

)))Reversal to 1.0589 – 0753:10 (9 min)

)))-21 ticks

————

Trap Trade Bracket setup:

Long entries – 1.0586(just above the S1 Pivot) / 1.0578 (just below the LOD)

Short entries – 1.0625 (No SMA / Pivot near) / 1.0636 (No SMA / Pivot near)

Notes: The ECB has implemented stimulus and is waiting on the effects to set in. This caused a dull reaction of only 4 ticks long in 5 sec followed by a 21 tick reversal to matched the low from 0700. Cancel the Trap Trade due to the small move. Then it chopped sideways in a tight range waiting on the press conference at 0830.

-011013.jpg)

-120612.jpg)

-110812.jpg)

-100412.jpg)