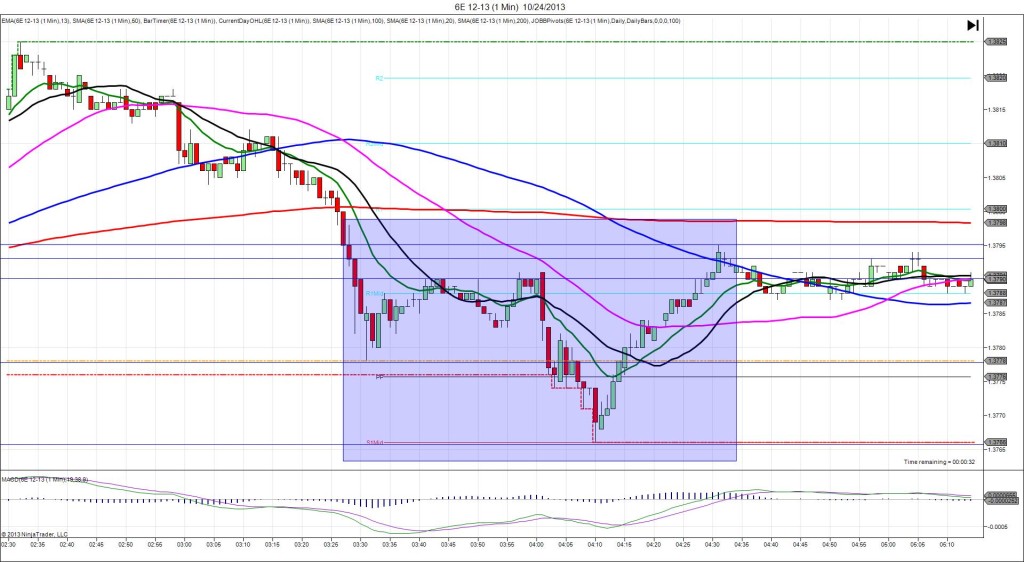

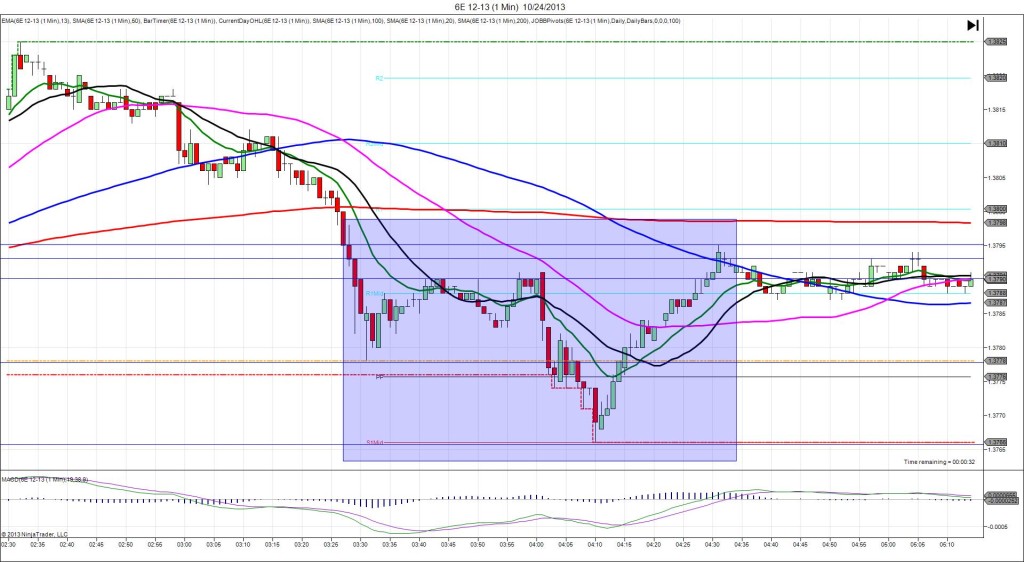

10/24/2013 German Flash Manufacturing PMI (0330 EDT)

Forecast: 51.6

Actual: 51.5

Previous Revision: -0.2 to 51.1

Services PMI

Forecast: 53.8

Actual: 52.3

Previous Revision: -0.7 to 53.7

SPIKE WITH 2ND PEAK

Started @ 1.3794 (0328)

1st Peak @ 1.3778 – 0331 (3 min)

16 ticks

Reversal to 1.3790 – 0343 (15 min)

12 ticks

2nd Peak @ 1.3766 – 0410 (42 min)

28 ticks

Reversal to 1.3795 – 0431 (63 min)

29 ticks

Notes: Report breaks 2 min early at 0328. The manufacturing reading came in matching the forecast with a negligible previous revision and the services reading came in 1.5 points below the forecast with a moderate bearish previous report revision to cause a stable bearish reaction. This resulted in a 16 tick short move that crossed the R1 Mid Pivot and hit the OOD on the :31 bar. With JOBB you would have filled short at about 1.3787 with 2 ticks of slippage, then it would have retreated to 5 ticks in the red and slowly come back down to give profit, then continue to fall on the next 2 bars. Given the solidly bearish results, this is a situation safe to wait for the delayed reaction. After the peak, it reversed 12 ticks in 12 min, back to the 20 SMA and R1 Mid Pivot. Then it fell for a 2nd peak of 12 more ticks in about 30 min after the Eurozone report came out bearish. After that it gave back 29 ticks in 20 min to the 100 SMA, and traded sideways.