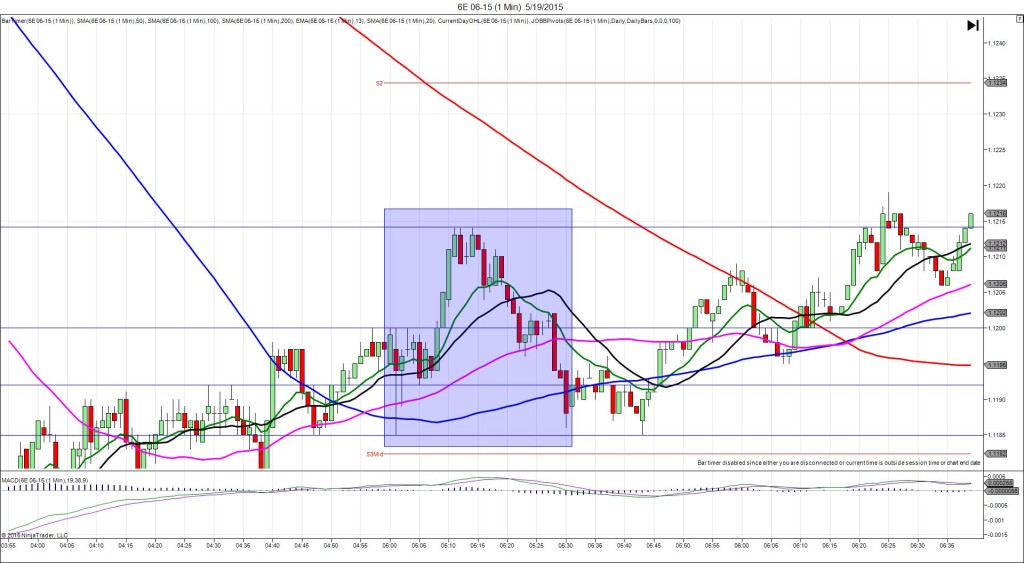

10/14/2014 German ZEW Economic Sentiment (0500 EDT)

Forecast: 0.2

Actual: -3.6

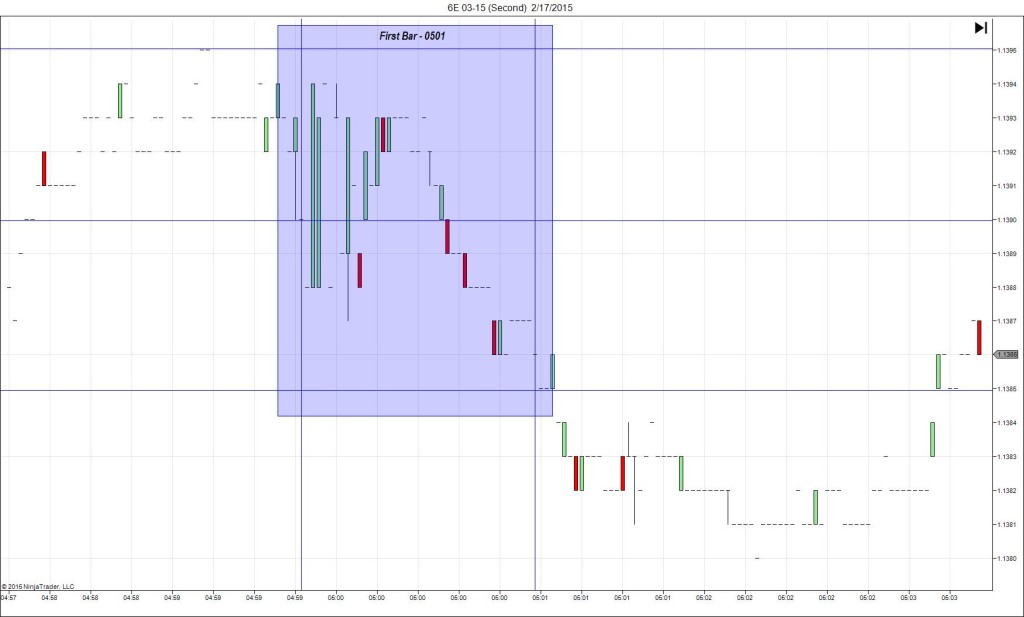

TRAP TRADE – DULL NO FILL (SPIKE WITH 2ND PEAK)

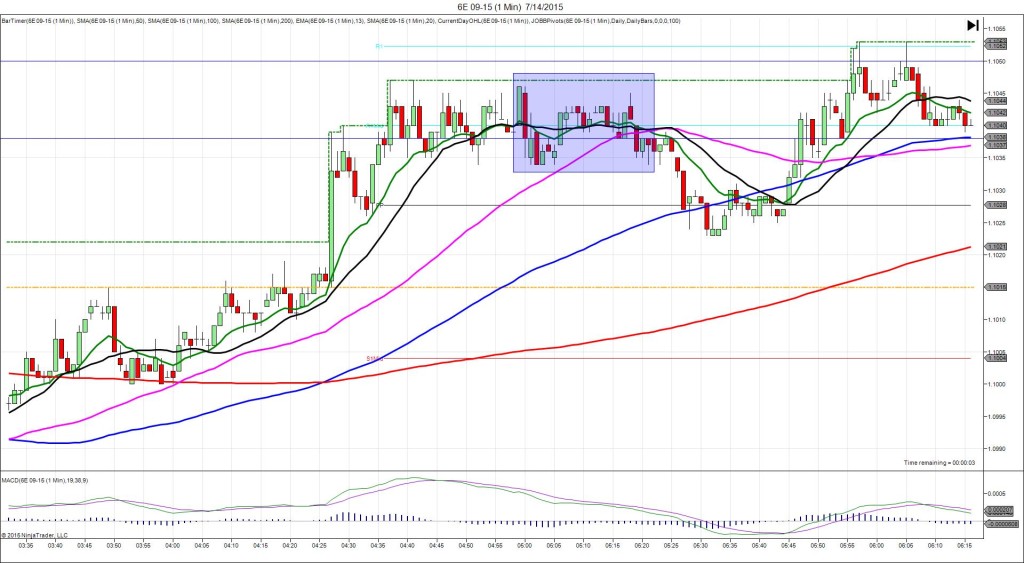

Anchor Point @ 1.2693 – shift to 1.2687 after downward drift

————

Trap Trade:

)))1st Peak @ 1.2679 – 0500:20 (1 min)

)))-8 ticks

)))Reversal to 1.2683 – 0500:33 (1 min)

)))4 ticks

)))Pullback to 1.2674 – 0500:56 (1 min)

)))-9 ticks

————

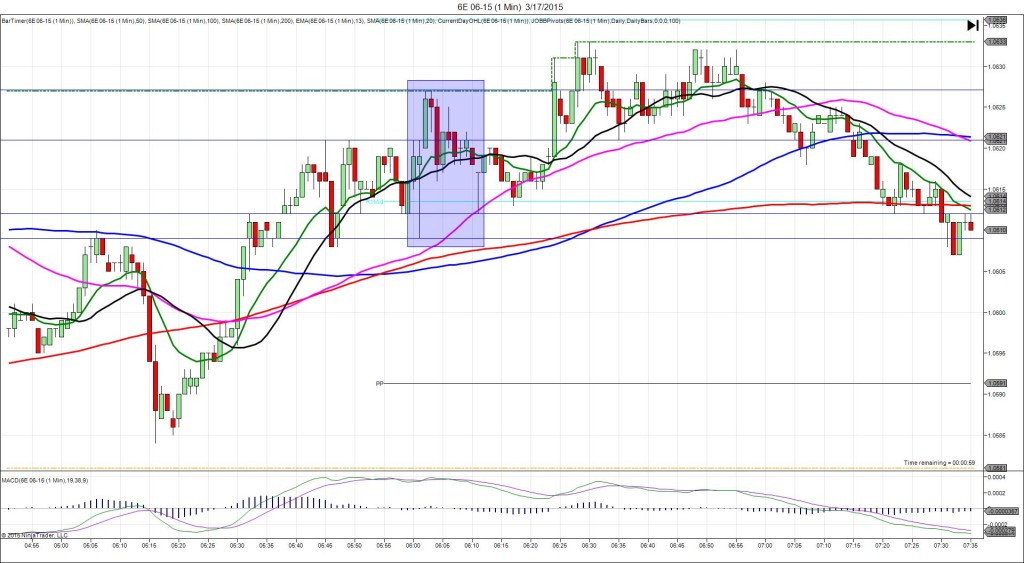

Reversal to 1.2682 – 0506 (6 min)

8 ticks

Final Peak @ 1.2645 – 0554 (54 min)

42 ticks

Reversal to 1.2666 – 0629 (89 min)

21 ticks

Trap Trade Bracket setup:

Long entries – 1.2677 (just below the S1 Mid Pivot) / 1.2667 (just below the S1 Pivot)

Short entries – 1.2696 (just above the R1 Mid Pivot)/1.2704 (just above the R1 Pivot)

Notes: Report fell short of the forecast by modest margin of 3.8 points but was negative for the first time in 2 yrs. Your anchor point at 45 sec early would have setup at 1.2693, but it drifted down and hovered around the PP Pivot at 1.2687, so bias your orders about 5-6 ticks lower. As the report broke it did a head fake long for 5 ticks, then trickled lower to fall 8 ticks in 20 sec. Cancel the order due to the slow approach and falling short of the inner long entry by 2 ticks. It continued to step lower eventually falling 42 total ticks on the final peak after 54 min.