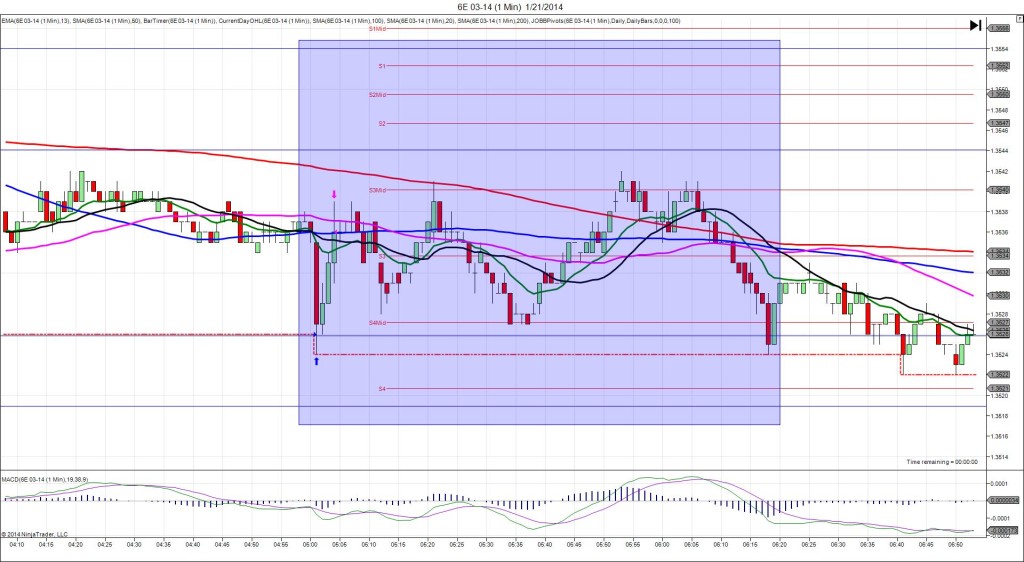

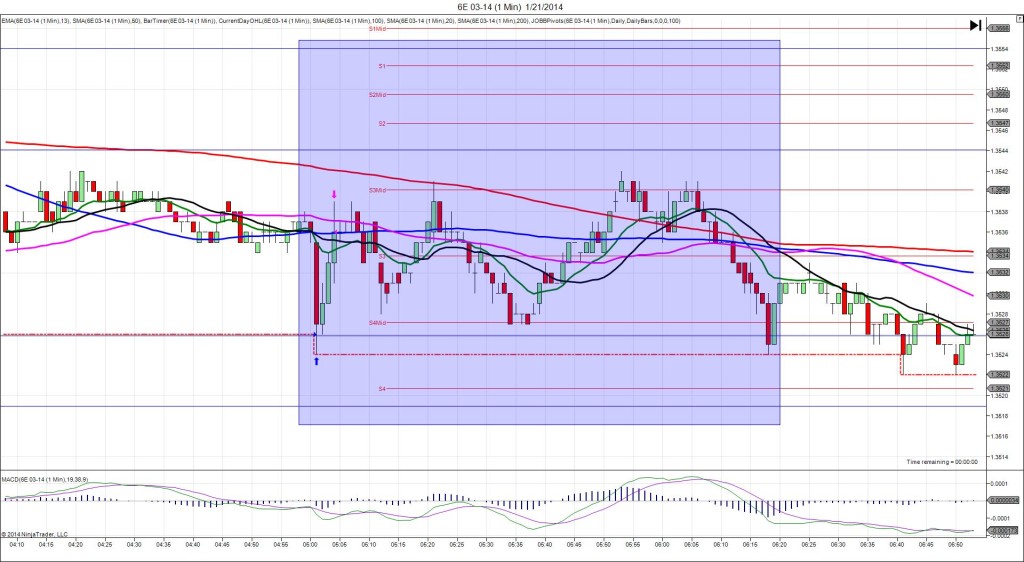

1/21/2014 German ZEW Economic Sentiment (0500 EST)

Forecast: 63.4

Actual: 61.7

TRAP TRADE (SPIKE / REVERSE)

Anchor Point @ 1.3536 (last price and recent avg)

————

Trap Trade:

)))1st Peak @ 1.3526 – 0500:07 (1 min)

)))-10 ticks

)))Reversal to 1.3533 – 0500:23 (1 min)

)))7 ticks

)))Pullback to 1.3524 – 0500:49 (1 min)

)))-9 ticks

)))Reversal to 1.3539 – 0504 (4 min)

)))15 ticks

————

Trap Trade Bracket setup:

Long entries – 1.3526 (below the S4 Mid Pivot and on the LOD) / 1.3519 (just below the S4 Pivot)

Short entries – 1.3544 (just above the 200 SMA) / 1.3554 (in between the S1 Mid and S1 Pivots)

Notes: Report mildly fell short of the forecast by 1.7 points. This caused a short move of 10 ticks initially that hit the S4 Mid Pivot, then a reversal of 7 ticks back to the S3 Pivot, followed by a pullback to extend the LOD by 2 ticks. This was an ideal setup of the Trap Trade. The inner long entry would have filled later in the :01 bar as the initial impulse hit the limit order without filling. You would have seen 2 ticks of heat followed by a 3 bar reversal that gave back 15 ticks, beyond the origin and nearly reaching the S3 Mid Pivot. I placed a target on the 100 SMA and captured 10 ticks with ease. After the reversal, it continued to oscillate for a few cycles between the S4 Mid Pivot and the S3 Mid Pivot for about another 75 min, then it trended lower.