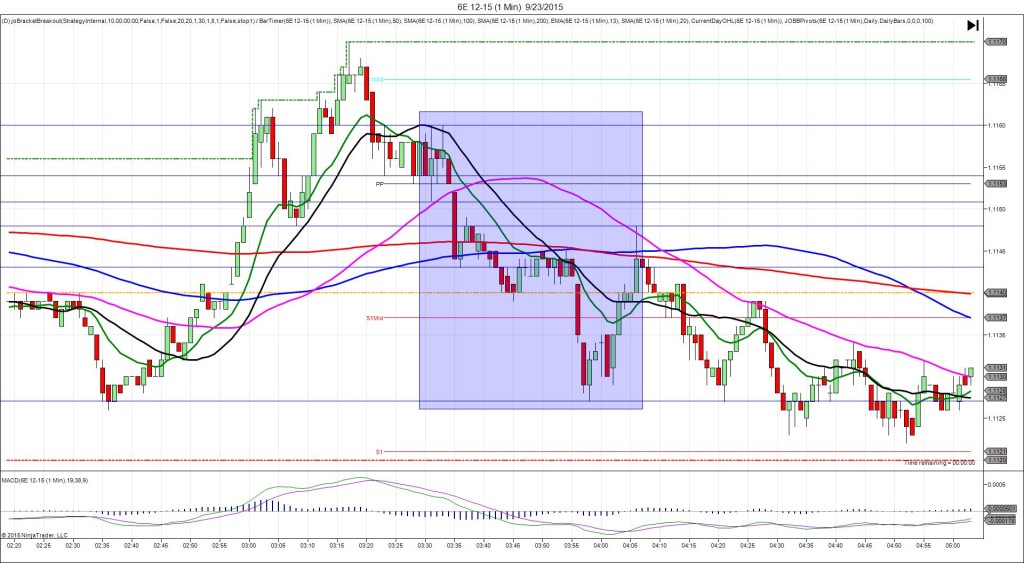

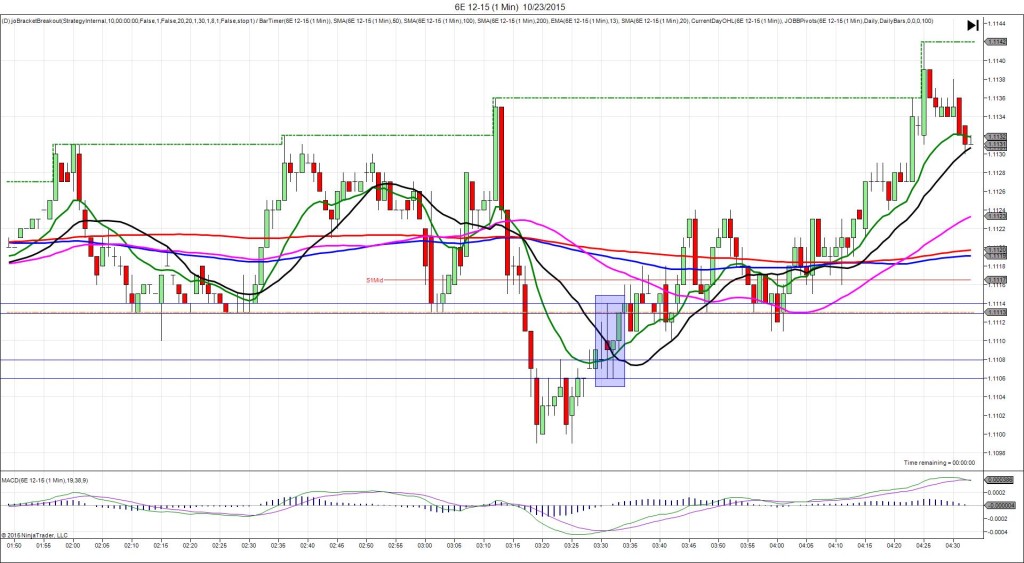

12/17/2015 German IFO Business Climate (0400 EDT)

Forecast: 109.2

Actual: 108.7

Previous Revision: n/a

DULL NO FILL

Started @ 1.0894

1st Peak @ 1.0889 – 0401:03 (2 min)

5 ticks

Reversal to 1.0905 – 0408 (8 min)

16 ticks

Pullback to 1.0891 – 0420 (20 min)

14 ticks

Expected Fill: n/a – cancel

Slippage: n/a

Best Initial Exit: n/a

Recommended Profit Target placement: n/a

Notes: Report caused no movement for 41 sec, then a 5 tick drop. Cancel the order. Good reversal to trade as usual for 10+ ticks.