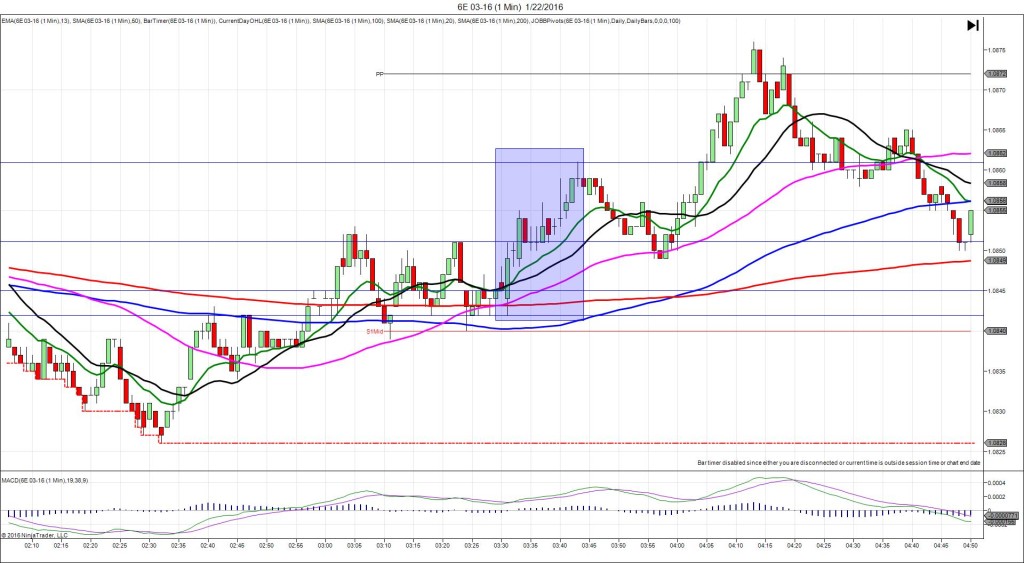

1/5/2015 EUR CPI Flash Estimate (0500 EST)

Forecast: 0.4%

Actual: 0.2%

Previous Revision: +0.1% to 0.2%

Core CPI Flash Estimate

Forecast: 1.0%

Actual: 0.9%

Previous Revision: n/a

INDECISIVE

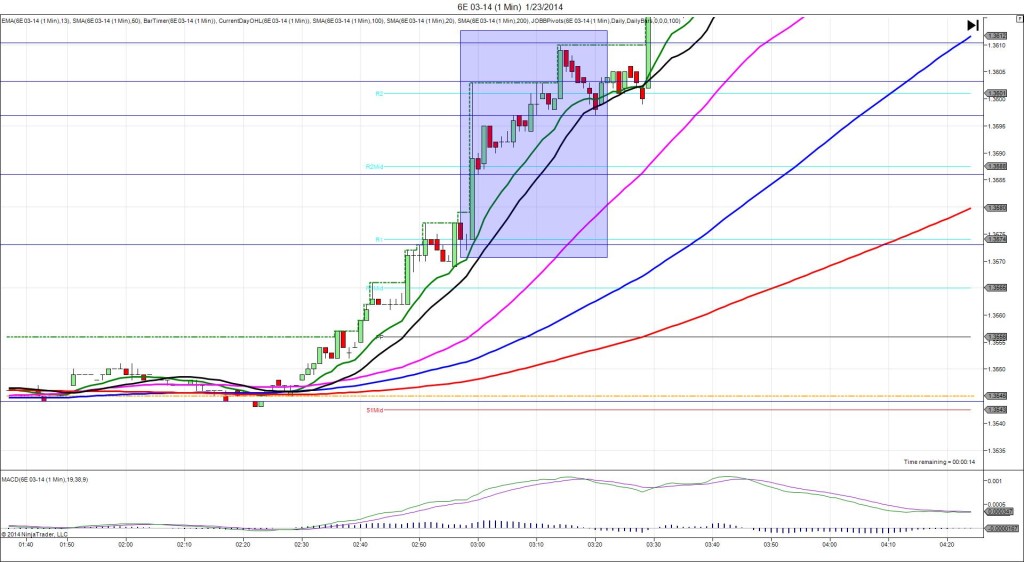

Started @ 1.0792

Whipsaw between 1.0786 and 1.0796 – 0500:01 (1 min)

-6/+4 ticks

Reversal to 1.0803 – 0500:30 (1 min)

11 ticks

Pullback to 1.0785 – 0506 (6 min)

18 ticks

Reversal to 1.0798 – 0517 (17 min)

13 ticks

Expected Fill: 1.0787 (short)

Slippage: 0 ticks

Best Initial Exit: 1.0895 – 8 tick loss (stopped)

Recommended Profit Target placement: n/a

Notes: Unfortunate whipsaw for an 8 tick loss. Still note the nice short setup after 0503 with 2 failed attempts to climb above the 50 SMA.