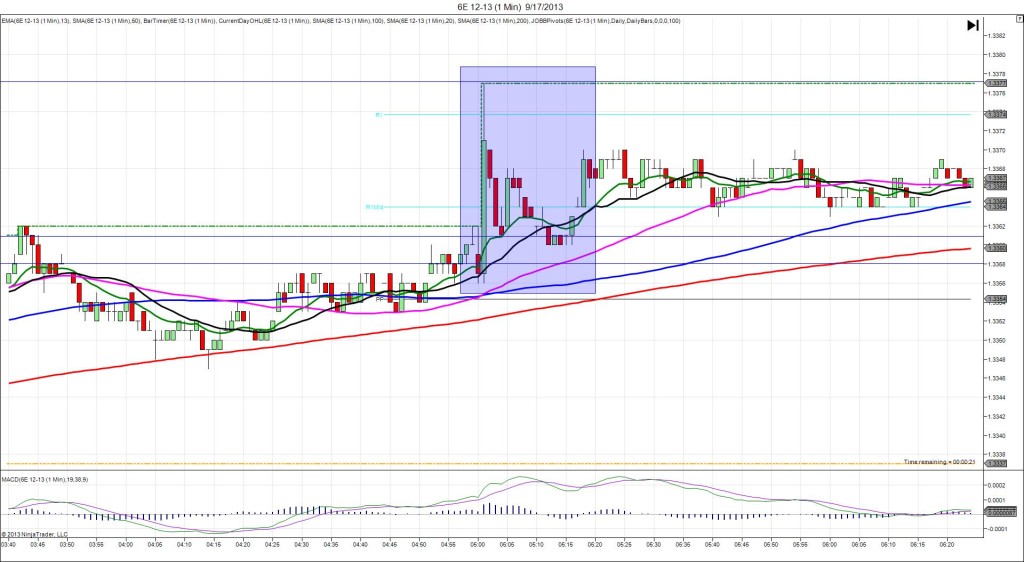

10/15/2013 German ZEW Economic Sentiment (0500 EDT)

Forecast: 49.2

Actual: 52.8

TRAP TRADE (SPIKE / REVERSE)

Started @ 1.3545

Trap Trade:

————

)))1st Peak @ 1.3556 – 0500:03 (1 min)

)))11 ticks

)))Reversal to 1.3530 – 0501:22 (2 min)

)))-26 ticks

————

Extended Reversal to 1.3501 – 0533 (33 min)

55 ticks

Notes: Report was moderately impressive by beating the forecast, but was caught in a short trend that had begun just about 30 min before the report. This caused an initial long move that was quickly overcome by the sentiment to fall short in the later moments. This created a trickier situation for the setup of the Trap Trade. While the long move and subsequent reversal were ideal, the placement of the orders is not as easy. If you used 1.3550 as the anchor point, the long move would have missed a short order, and then filled the long entry at about 1.3540 and caused an eventual loss. An anchor point of 1.3545 would have been better, but only taken into account the movement of the :00 bar. This would have caused a short entry at 1.3555 to fill, then fall like a rock for 20+ ticks easily. After the first 2 bars, it never wanted to rebound, and methodically fell for almost 30 more ticks in the next 30 min to the S3 Pivot. Then it came back a few ticks and traded sideways.