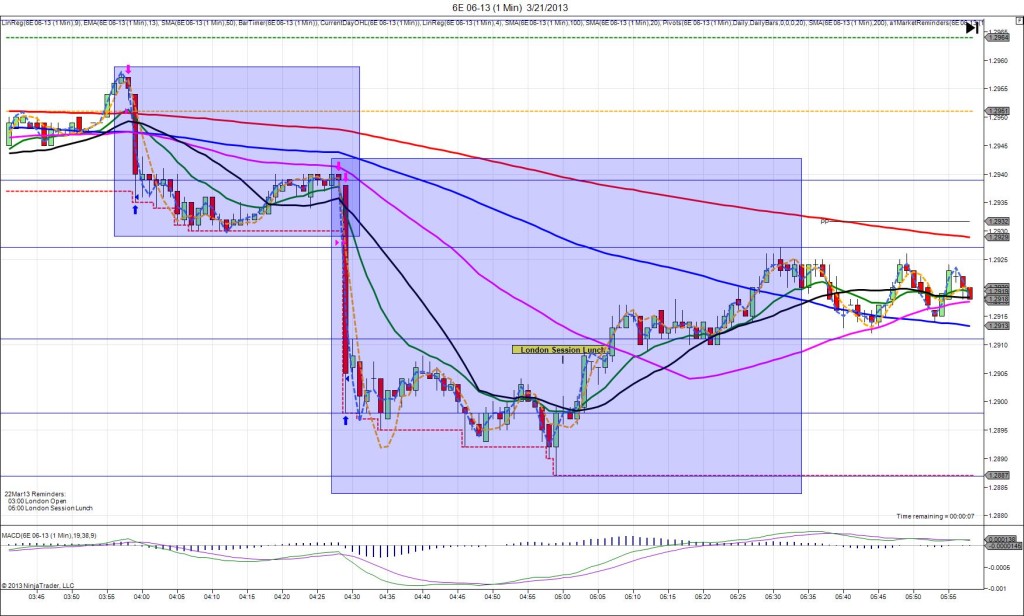

6E 06-13 (1 Min) 3.21.2013

3/21/2013 German Flash Manufacturing PMI (0430 EDT)

Forecast: 50.8

Actual: 48.9

Previous Revision: +0.2 to 50.3

SPIKE WITH 2ND PEAK

Started @ 1.2939 (0428)

1st Peak @ 1.2898 – 0429 (1 min)

41 ticks

Reversal to 1.2911 – 0430 (2 min)

13 ticks

2nd Peak @ 1.2887 – 0459 (31 min)

52 ticks

Reversal to 1.2927 – 0531 (63 min)

40 ticks

Notes: Report breaks 2 min early at 0428. The reading came in 0.9 points below the forecast to moderately disappoint while the services reading also came in 3.3 points lower than expected. This caused a large 41 tick short spike over 1 bar that crossed the PP Pivot and extended the LOD 32 ticks, bottoming outside of any key level of support. With JOBB you would have filled short at about 1.2928 with 7 ticks of slippage. Look to exit near the time of the bar expiring as it will typically finish at the extreme at about 1.2900 – 05 for about 25 ticks. After the 1st peak, it pulled back for 13 ticks, then stepped lower for 11 more ticks as the EUR flash report broke. Then it reversed for 40 ticks in about 30 min, crossing the 50 and 100 SMAs.

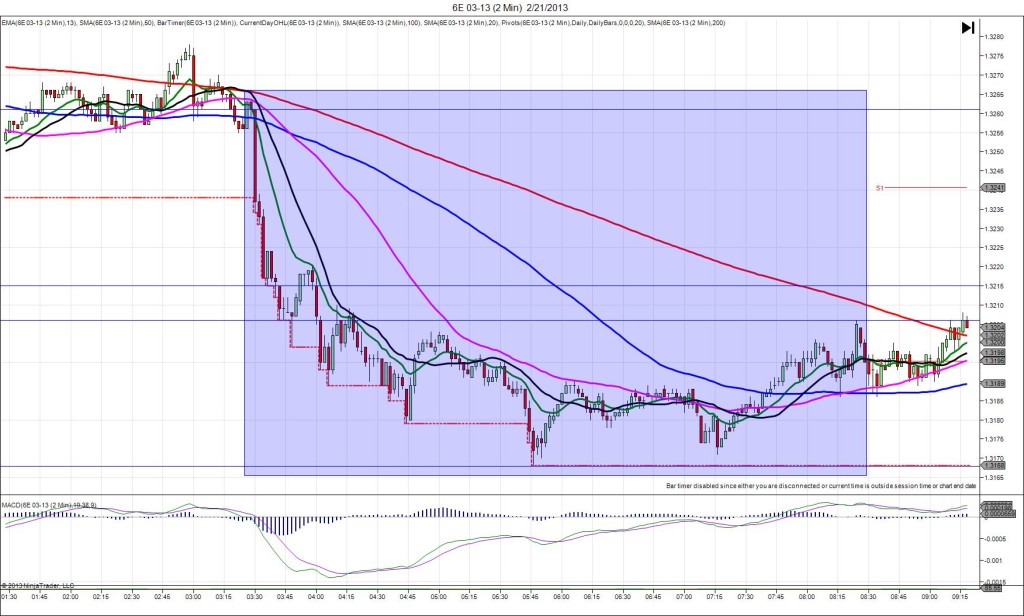

6E 03-13 (2 Min) 2.21.2013

2/21/2013 German Flash Manufacturing PMI (0330 EST)

Forecast: 50.4

Actual: 50.1

Previous Revision: +1.0 to 49.8

DOWNWARD FAN

Started @ 1.3261 (0328)

1st Peak @ 1.3215 – 0335 (7 min)

46 ticks

Final Peak @ 1.3168 – 0546 (138 min)

93 ticks

Reversal to 1.3206 – 0824 (296 min)

38 ticks

Notes: Report breaks 2 min early at 0328. The reading came in 0.3 points below the forecast to mildly disappoint while the services reading also came in 1.4 points lower than expected. This caused a large 46 tick short spike over 7 bars that crossed the 200 SMA and the S1 Pivot, bottoming about 25 ticks below the S1 Pivot. With JOBB you would have filled short at about 1.3256 with no slippage. Look to exit initially just below the S1 Pivot and LOD at about 1.3235 for about 20 or so ticks. If you stayed in for longer, wait until it crosses the 13 on the :51 bar to exit with about 43 ticks. After the 1st peak, the bearish sentiment was evident as it kept stepping lower, eventually hitting a final peak of 93 ticks over 2 hrs after the report. Then it took another 2.5 hrs to reverse for 38 ticks

6E 03-13 (1 Min) 1.24.2013

1/24/2013 German Flash Manufacturing PMI (0330 EST)

Forecast: 47.1

Actual: 48.8

Previous Revision: -0.3 to 46.0

SPIKE WITH 2ND PEAK

Started @ 1.3306 (0328)

1st Peak @ 1.3338 – 0329 (1 min)

32 ticks

Reversal to 1.3313 – 0345 (17 min)

25 ticks

2nd Peak @ 1.3348 – 0416 (48 min)

42 ticks

Reversal to 1.3317 – 0501 (93 min)

31 ticks

Notes: Report breaks 2 min early at 0328. The reading came in nearly 2 points above the forecast to strongly impress. This caused a large 32 tick long spike over 1 bar that crossed all 3 major SMAs and the PP Pivot, peaking about 9 ticks above the 100 SMA. This completely undid the reaction of the negative French report 30 min earlier. With JOBB you would have filled long at about 1.3310 with no slippage. Look to exit above the 100 SMA for about 20-25 ticks. After the 1st peak, it traded sideways above the the 100 SMA, then reversed down to eclipse the PP Pivot. Then it rebounded strongly for a 2nd peak of 10 more ticks than the initial peak 48 min after the report. The final reversal fell 31 ticks to just above the PP Pivot about 45 min after the 2nd peak.

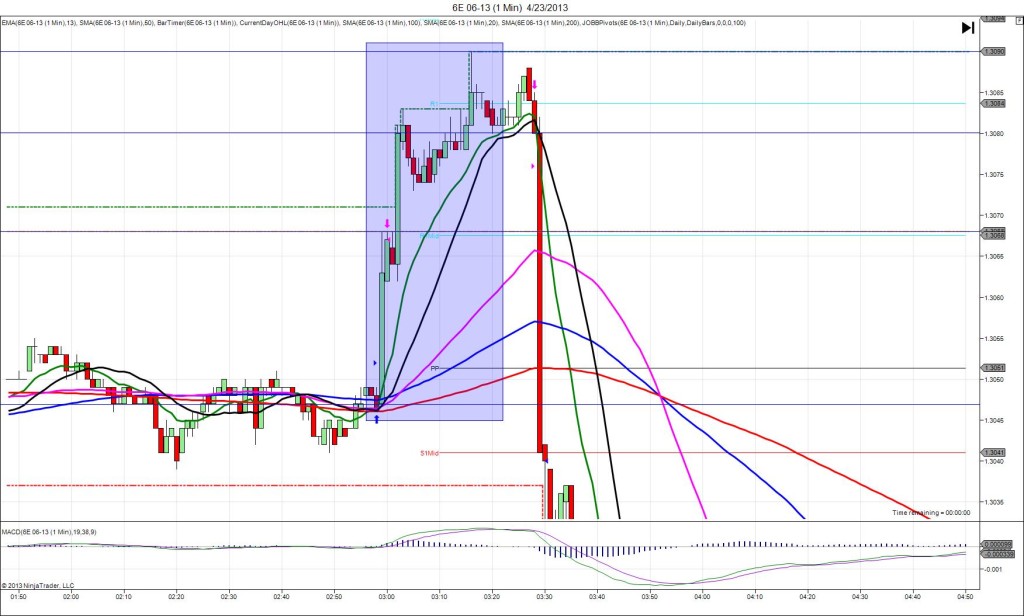

6E 06-13 (1 Min) 4.23.2013

4/23/2013 French Flash Manufacturing PMI (0300 EDT)

Forecast: 44.2

Actual: 44.4

Previous Revision: +0.1 to 44.0

SPIKE WITH 2ND PEAK

Started @ 1.3047 (0258)

1st Peak @ 1.3068 – 0259 (1 min)

21 ticks

Final Peak @ 1.3090 – 0316 (18 min)

43 ticks

Reversal to 1.3080 – 0320 (22 min)

10 ticks

Notes: Report breaks 2 min early at 0358. The reading came in 0.2 points above the forecast to mildly impress, but the simultaneous Services reading came in 1.8 points better than the forecast. This caused a 21 tick long spike over 1 bar that peaked on the R1 Mid Pivot, using all 3 SMAs in a tight fist at the origin as support. With JOBB you would have filled long at about 1.3052 with 2 ticks of slippage. Look to exit at the R1 Mid Pivot on the :59 or :00 bar for 15 ticks, or leave a few contracts active for the highly likely 2nd peak that gained another 22 ticks as the overall news was very bullish. After the 1st peak, it ascended on the :02 bar for another 15 ticks, then achieved a final peak of 7 more ticks after a brief reversal on the :16 bar. It never fell below the 13 SMA until the German report broke as it hovered around the R1 Pivot prior to the release.

6E 06-13 (1 Min) 3.21.2013

3/21/2013 French Flash Manufacturing PMI (0400 EDT)

Forecast: 44.4

Actual: 43.9

Previous Revision: +0.3 to 43.9

SPIKE WITH 2ND PEAK

Started @ 1.2955 (0358)

1st Peak @ 1.2935 – 0359 (1 min)

20 ticks

Reversal to 1.2943 – 0400 (2 min)

8 ticks

2nd Peak @ 1.2930 – 0407 (9 min)

25 ticks

Reversal to 1.2940 – 0419 (21 min)

10 ticks

Notes: Report breaks 2 min early at 0358. The reading came in 0.5 points below the forecast to mildly disappoint, but the simultaneous Services reading came in 2.2 points off the forecast. This caused a 20 tick short spike over 1 bar that crossed all 3 of the major SMAs near the origin. With JOBB you would have filled short at about 1.2951 with 1 tick of slippage. Look to exit at the LOD on the :59 bar or it is normally safe to wait for a few more ticks in the following bars for 12 – 15 ticks. After the 1st peak, it pulled back to reverse for 8 ticks in 1 min. Then it fell for a 2nd peak of 5 more ticks 8 min later, before the final reversal reclaimed 10 ticks 21 min after the report. Then it chopped sideways just before the German report released.

6E 03-13 (1 Min) 2.21.2013

2/21/2013 French Flash Manufacturing PMI (0300 EST)

Forecast: 43.9

Actual: 43.6

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 1.3275 (0258)

1st Peak @ 1.3258 – 0300 (2 min)

17 ticks

Reversal to 1.3270 – 0312 (14 min)

12 ticks

2nd Peak @ 1.3255 – 0321 (23 min)

20 ticks

Reversal to 1.3263 – 0326 (28 min)

8 ticks

Notes: Report breaks 2 min early at 0258. The reading came in 0.3 points below the forecast to mildly disappoint, but the simultaneous Services reading came in 1.8 points off the forecast. This caused an average 17 tick short spike over 2 bars that crossed all 3 of the major SMAs near the terminus. With JOBB you would have filled short at about 1.3271 with no slippage. Look to exit in the midst of the SMAs on the :59 or :00 bar for about 7-12 ticks. After the 1st peak, it struggled to reverse for 12 ticks in 12 min to eclipse the 20 SMA. Then it fell for a 2nd peak of 3 more ticks 9 min later, before the final reversal reclaimed 8 ticks just before the German report released.

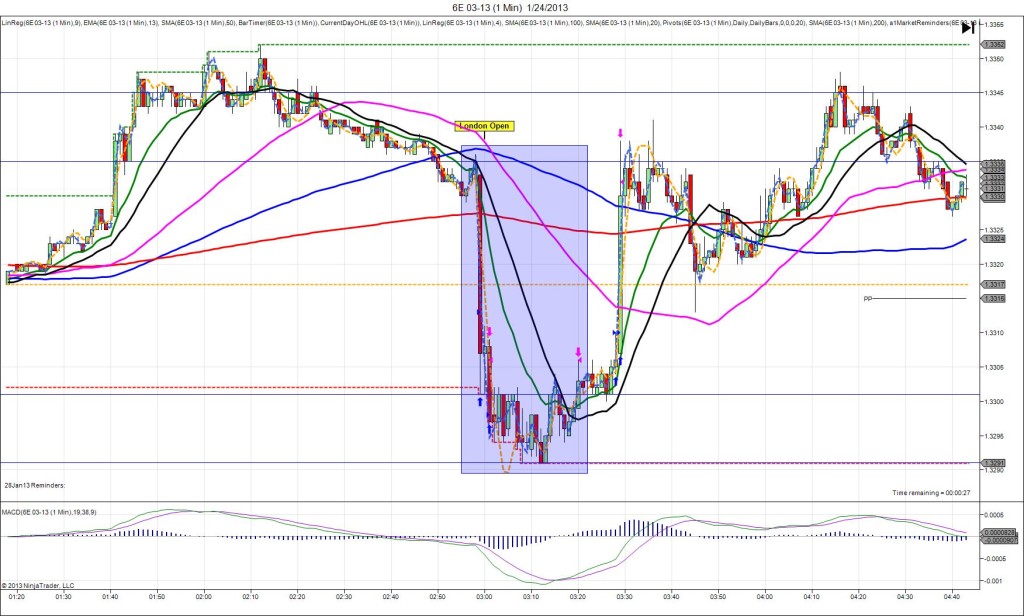

6E 03-13 (1 Min) 1.24.2013

1/24/2013 French Flash Manufacturing PMI (0300 EST)

Forecast: 44.9

Actual: 42.9

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 1.3335 (0258)

1st Peak @ 1.3301 – 0259 (1 min)

34 ticks

Reversal to 1.3311 – 0300 (2 min)

10 ticks

2nd Peak @ 1.3291 – 0308 (10 min)

44 ticks

Reversal to 1.3306 – 0320 (22 min)

15 ticks

Notes: Report breaks 2 min early at 0258. The reading came in 2 points below the forecast to strongly disappoint. This caused a large 34 tick short spike over 1 bar that crossed the 200 SMA near the origin and the PP Pivot about halfway down. With JOBB you would have filled short at about 1.3329 with 2 ticks of slippage. Look to exit as the bar expires near the LOD with about 25 ticks. After the 1st peak, it bounced up off of the LOD for 10 ticks, then fell for a 2nd peak of 10 more ticks a few min later. The reversal snagged about 15 ticks in another 10 min, fighting through the 20 and 13 SMAs then traded sideways for about 8 min awaiting the German report results.

6E 03 13 (1 Min) 01.10.13

1/10/2013 ECB Minimum Bid Rate (0745 EST)

Forecast: 0.75%

Actual: 0.75%

SPIKE WITH 2ND PEAK

Started @ 1.3101

1st Peak @ 1.3122 – 0746 (1 min)

21 ticks

Reversal to 1.3112 – 0750 (5 min)

10 ticks

2nd Peak @ 1.3130 – 0808 (23 min)

29 ticks

Reversal to 1.3106 – 0834 (49 min)

24 ticks

Notes: The ECB decided to leave the Minimum Bid Rate unchanged at 0.75% in line with most economists expectations in the face of a possible but unlikely rate cut to 0.50%. There continues to be a wait-and -see approach as the ECB bond buying program works its way through the economy. The optimism was enough to cause a rally. The 6E initially spiked long for 21 ticks, crossing all 3 major SMAs and R2 Pivot and peaking as it extended the HOD 4 ticks. After a quick and small reversal of 10 ticks in 5 min, it eventually achieved a 2nd peak of 8 more ticks in 23 min. Then it traded sideways for several minutes until the gravity of the press conference commentary caused a minor reversal back to the R2 Pivot initially, then a large rally lasting several hours. With JOBB, your order would have filled long at 1.3109 with 1 tick of slippage, and given you an opportunity to achieve at least 10 ticks toward the end of the bar.

6E 12 12 (1 Min) 12.11.12

12/11/2012 German ZEW Economic Sentiment (0000 HI time / 0500 EDT)

Forecast: -11.4

Actual: 6.9

SPIKE/REVERSE

Started @ 1.2964

1st Peak @ 1.2979 – 0001 (1 min)

15 ticks

Reversal to 1.2958 – 0047 (47 min)

21 ticks

Notes: The reading came in over 18 points better than the forecast to impress. This caused a 15 tick long spike on 1 bar that crossed the R3 Pivot and extended the HOD by 13 ticks and was unsustainable, leaving 7 ticks of the wick naked. With JOBB you would have filled long at about 1.2968 with 1 tick of slippage. Look to exit with about 9 ticks as it crossed the R3 Pivot. After the spike, it pulled back, traded sideways for 45 min, then the reversal fell to 1.2958 for 21 ticks total. After that it trended higher about 90 min after the report.

-011013.jpg)

-121112.jpg)