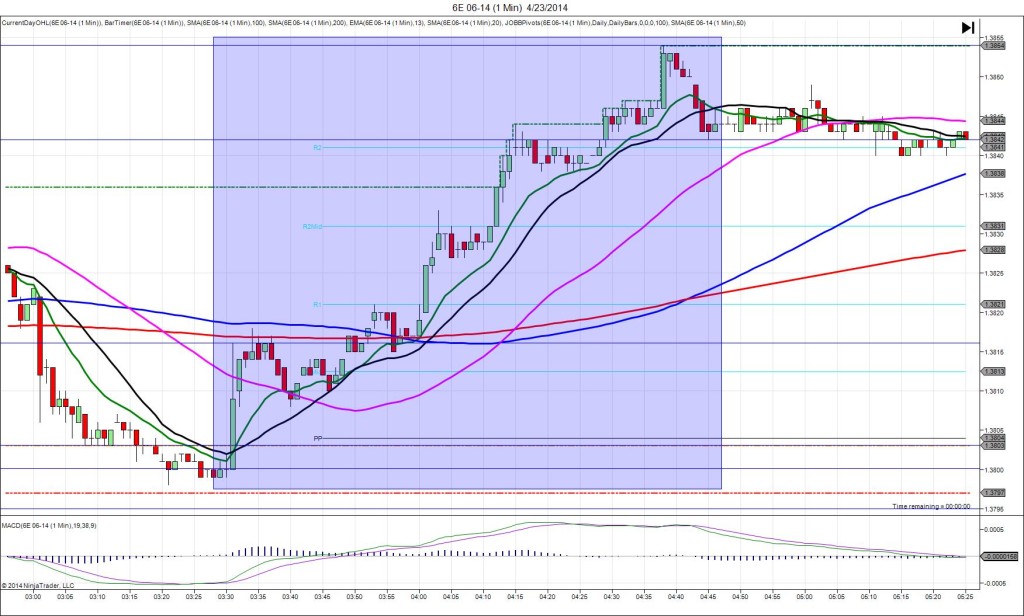

3/24/2014 French Flash Manufacturing PMI (0400 EDT)

Forecast: 49.8

Actual: 51.9

Previous Revision: +1.2 to 49.7

Services PMI

Forecast: 47.9

Actual: 51.4

Previous Revision: +0.3 to 47.2

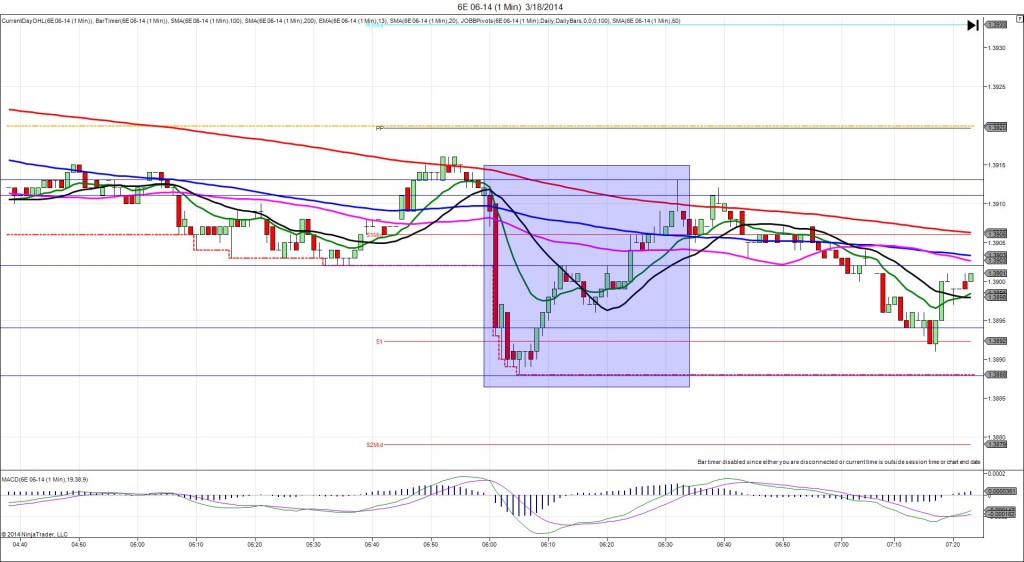

SPIKE / REVERSE

Started @ 1.3796

1st Peak @ 1.3839 – 0401 (1 min)

43 ticks

Reversal to 1.3812 – 0404 (4 min)

27 ticks

Notes: Report normally breaks 2 min early at 0358, but the protocol was changed on this report to be at 0400. The manufacturing reading came in 2.1 points above the forecast to impress the market with a healthy upward revision on the previous report, and the simultaneous Services reading came in 3.5 points above the forecast with a negligible upward revision. All of this served to cause a large long spike of 43 ticks on the :01 bar that was shortly sustained. It started just underneath the 100/200 SMAs, then crossed the LOD and R2 Pivot. With JOBB you would have filled long at about 1.3811 with 12 ticks of slippage then seen it hover between 7 and 10 ticks of profit for most of the rest of the bar. After the opening few seconds, if your profit target was not filled, move the profit target to about 1.3820, just above the R2 Mid Pivot. After the :01 bar, it fell for another 7 ticks to 1.3812 on the :04 bar, then made a small pullback above the R2 Mid Pivot before trading sideways heading into the German report release.