7/24/2014 French Flash Manufacturing PMI (0300 EDT)

Forecast: 48.5

Actual: 47.6

Previous Revision: +0.4 to 48.2

Services PMI

Forecast: 48.9

Actual: 50.4

Previous Revision: n/a

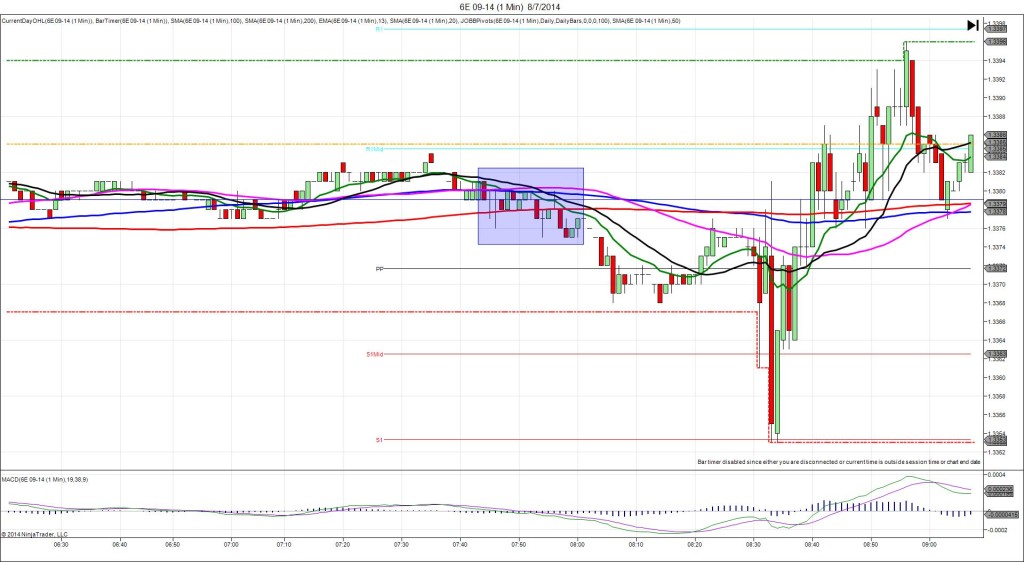

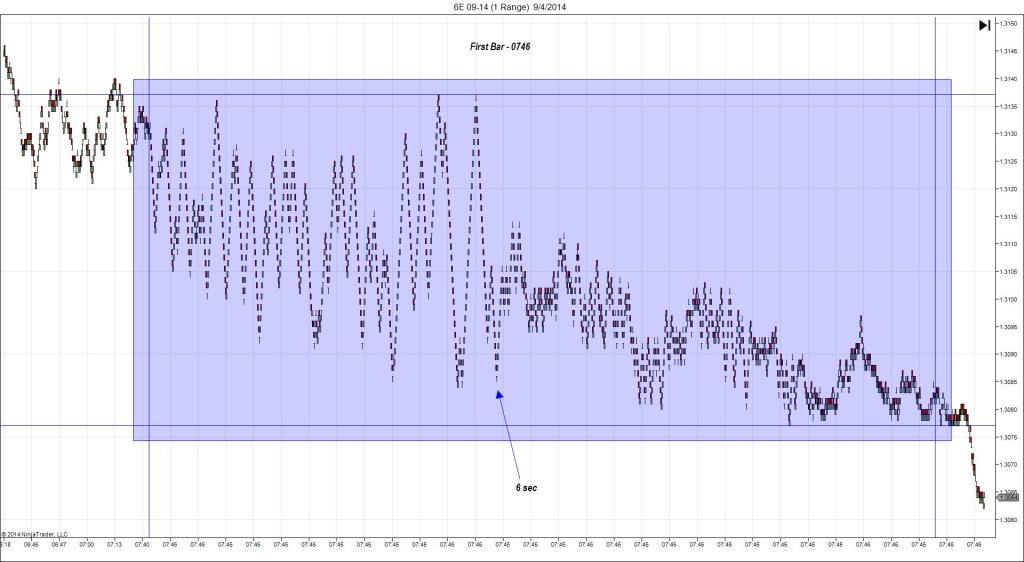

SPIKE / REVERSE

Started @ 1.3452

1st Peak @ 1.3458 – 0300:41 (1 min)

6 ticks

Reversal to 1.3447 – 0316 (16 min)

11 ticks

Notes: The manufacturing reading came in 0.9 points below the forecast to disappoint the market with a small upward revision on the previous report, and the simultaneous Services reading came in 1.5 points above the forecast with no revision. All of this conflicted and caused a tame long reaction as the services reading took the lead. We saw a long spike of 8 ticks on the :01 bar that crossed the 200 SMA 3 Major SMAs and the R1 Pivot. With JOBB you would have filled short at about 1.3605 with 5 ticks of slippage then seen it hover around your fill point before falling later. Since this report looks for a 2nd peak very often and the news was very bearishly biased, it would be wise to be patient and wait for a fall to 1.3600 or 1.3598 with the R1 Mid Pivot. It achieved a 2nd peak of 6 more ticks 11 min later as it eclipsed the R1 Mid Pivot and OOD. Then it reversed for 11 ticks in the next 17 min, crossing the 50 SMA as it headed into the German report release.