9/23/2014 French Flash Manufacturing PMI (0300 EDT)

Forecast: 47.1

Actual: 48.8

Previous Revision: +0.4 to 46.9

Services PMI

Forecast: 50.2

Actual: 49.4

Previous Revision: -0.8 to 50.3

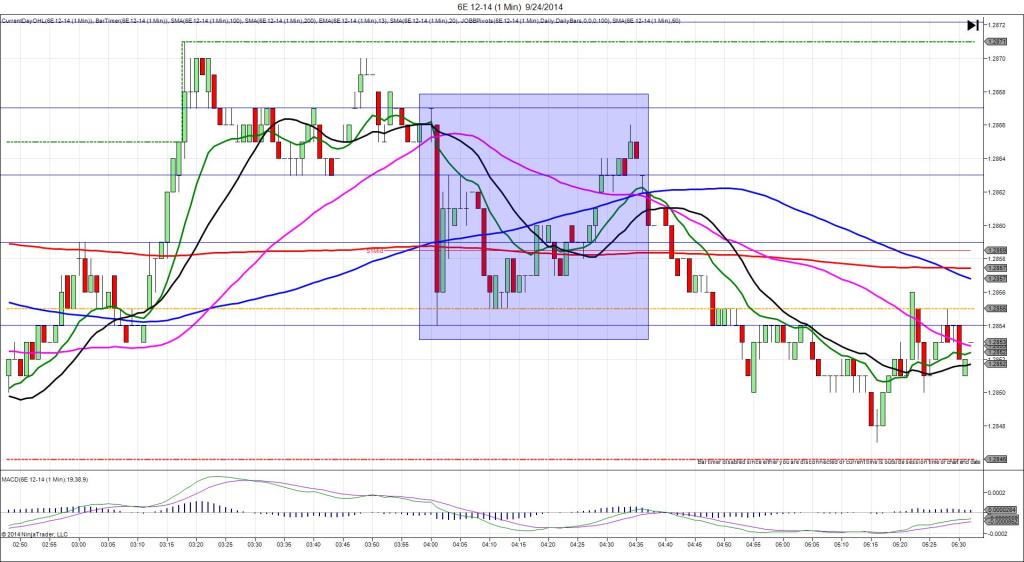

SPIKE / REVERSE

Started @ 1.2856

1st Peak @ 1.2869 – 0301:29 (2 min)

13 ticks

Reversal to 1.2861 – 0304 (4 min)

8 ticks

Double Top @ 1.2869 – 0309 (9 min)

8 ticks

Reversal to 1.2861 – 0315 (15 min)

8 ticks

Notes: The manufacturing reading came in 1.7 points above the forecast to impress the market with a moderate upward revision on the previous report, and the simultaneous Services reading came in 0.8 points below the forecast with a large downward revision. All of this conflicted but caused a small stable long spike of 13 ticks over 2 bars that crossed the 200/100 SMAs near the origin and the R1 Pivot. With JOBB you would have filled long at about 1.2859 with no slippage then seen it hover between 1-2 ticks of profit for most of the bar. With the results conflicting and the R1 Pivot only 2 ticks higher and yet to be contested, it would be safe and wise to exit there. It continued to climb for 8 more ticks in the next bar, but that was not predicted or predictable. Then it reversed 8 ticks back to the R1 Pivot in 2 min. It repeated the move for a double top and reversal back to the R1 Pivot in 11 min, then traded sideways into the German report release.