1/7/2015 EUR CPI Flash Estimate (0500 EST)

Forecast: 0.0%

Actual: -0.2%

Previous Revision: n/a

Core CPI Flash Estimate

Forecast: 0.6%

Actual: 0.8%

Previous Revision: n/a

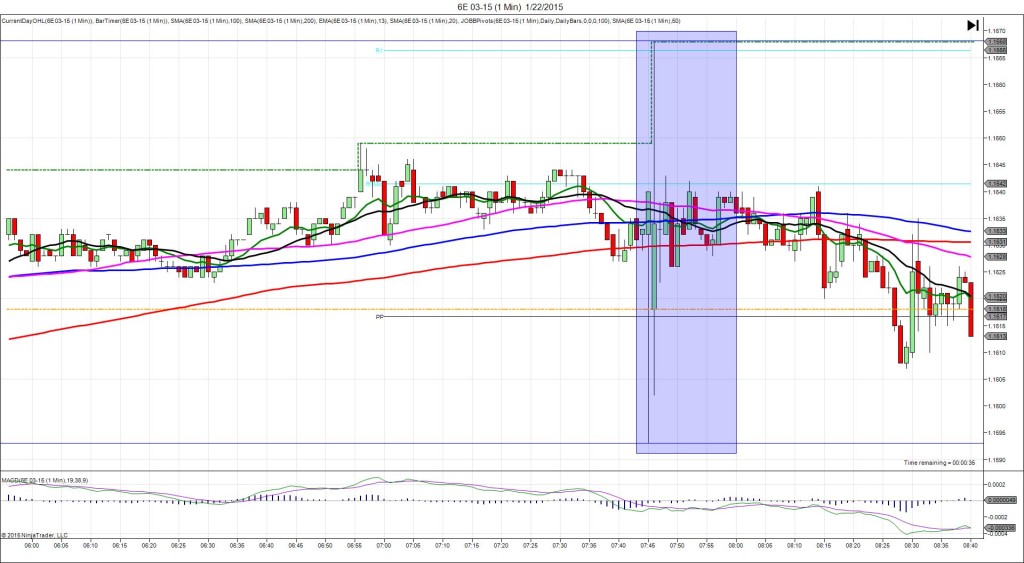

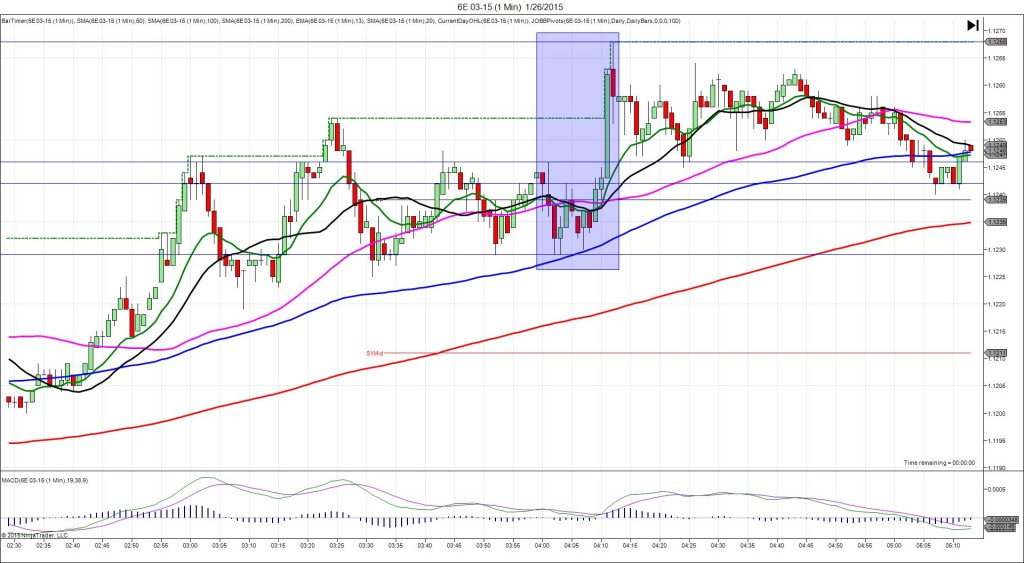

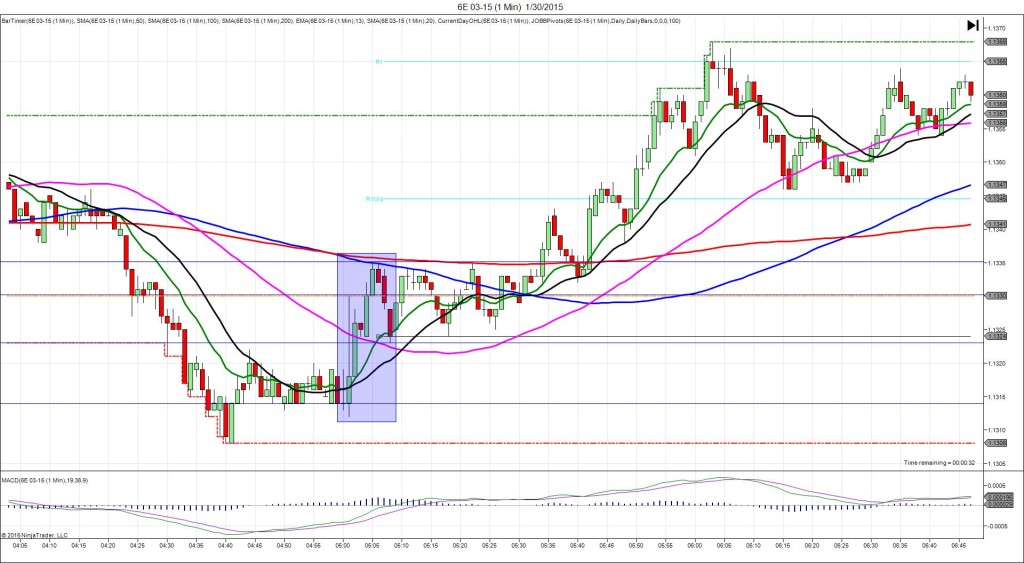

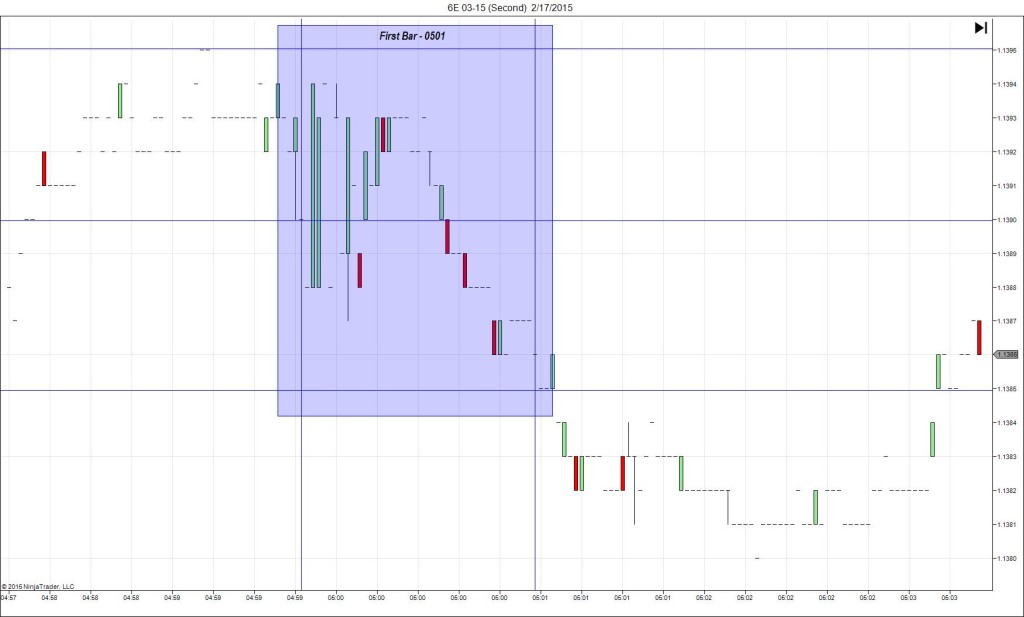

INDECISIVE

Started @ 1.1861

1st Peak @ 1.1855 – 0500:00 (1 min)

-6 ticks

Reversal to 1.1880 – 0500:19 (1 min)

25 ticks

Pullback to 1.1855 – 0501:30 (2 min)

25 ticks

Reversal to 1.1884 – 0510 (10 min)

29 ticks

Pullback to 1.1855 – 0536 (36 min)

29 ticks

Notes: The broader reading fell short of the forecast by 0.2% while the core reading exceeded the forecast by 0.2%. As the broader reading almost always comes in matching and the instance of conflict between the results is even rarer, we saw a whipsaw. It fell 6 ticks immediately to the S2 Pivot followed by a 21 tick reversal in the next 2 sec, then another 4 ticks in 17 sec to cross the 50/100 SMAs and reach the 200 SMA. With JOBB and a 5 tick bracket, your short order would have filled at 1.1856 with no slippage then stopped you out at 1.1865 instantly for a 9 tick loss including 1 tick of slippage. It continued to chop up and down as the period between the his and lows grew between swings. Then after about an hour it started to drift lower. As the first time we made this report ready for primetime, it resulted in a loss, but the cause was valid with the results.