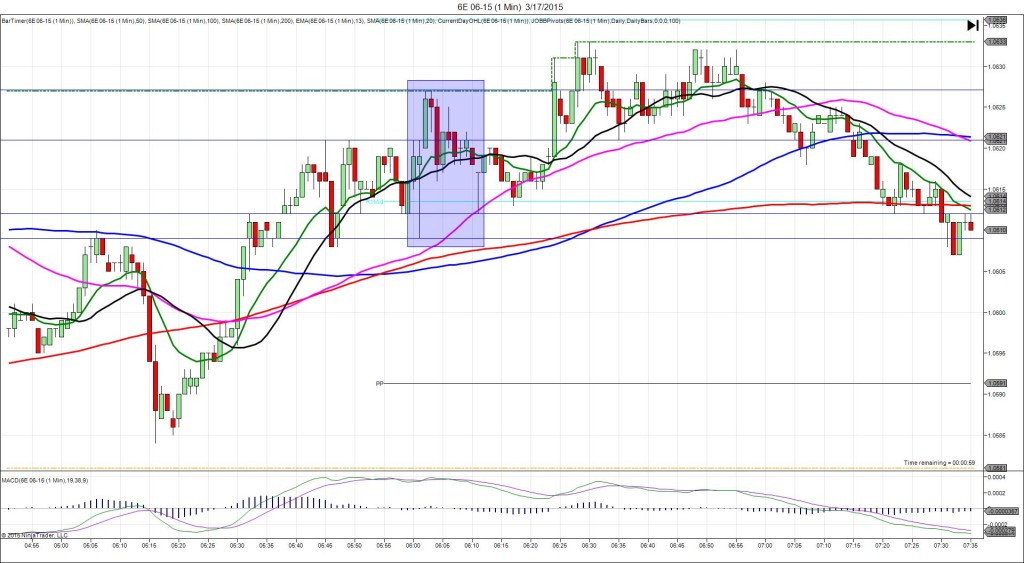

2/23/2015 German IFO Business Climate (0400 EST)

Forecast: 107.4

Actual: 106.8

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 1.1346

1st Peak @ 1.1326 – 0400:58 (1 min)

20 ticks

Reversal to 1.1338 – 0407 (7 min)

12 ticks

2nd Peak @ 1.1317 – 0408 (8 min)

29 ticks

Reversal to 1.1335 – 0414 (14 min)

18 ticks

Notes: The reading came in 0.6 pts below the forecast to disappoint the market. This resulted in a 20 tick short spike that trickled down over the entire :01 bar as it started on the 50 SMA and fell to extend the LOD. With JOBB, you would have filled short at about 1.1341 with 1 tick of slippage, then seen it fall for a nice profit with no support barrier encountered. Be patient and wait for hovering. This would have allowed 10-14 ticks to be captured. After the peak, it reversed 12 ticks in 6 min to the 20 SMA before falling for a 2nd peak of 9 more ticks 1 min later. Then it reversed 18 ticks in 6 min to the 20 SMA. After that it traded sideways and slowly drifted lower.