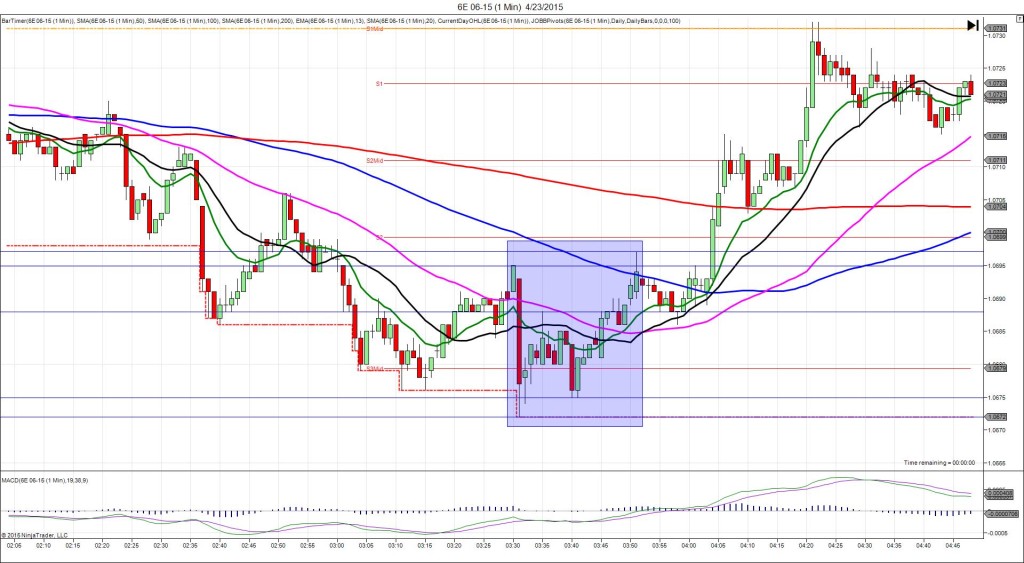

4/23/2015 French Flash Manufacturing PMI (0400 EDT)

Forecast: 49.4

Actual: 48.4

Previous Revision: +0.6 to 48.8

Services PMI

Forecast: 52.5

Actual: 50.8

Previous Revision: -0.4 to 52.4

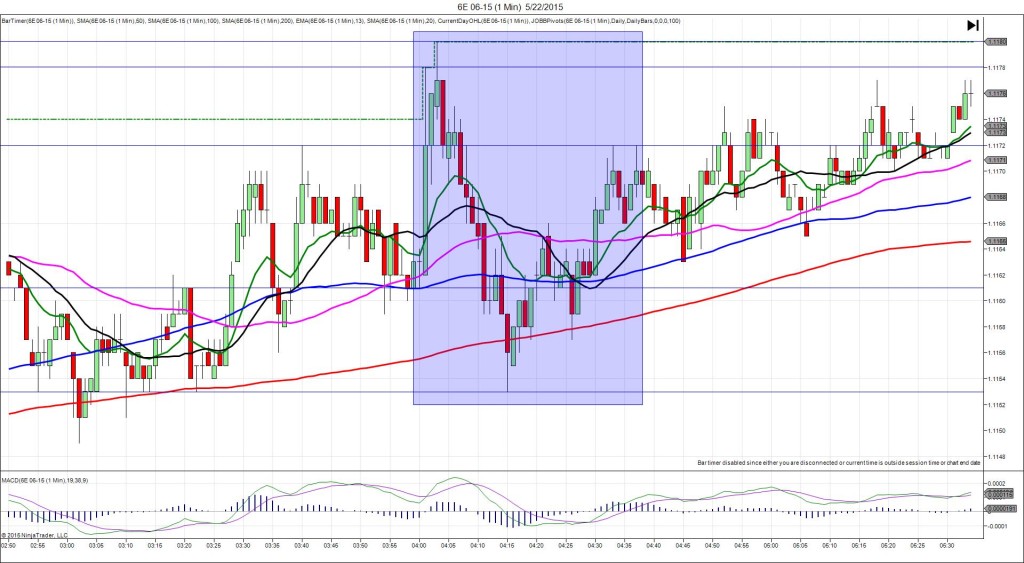

SPIKE WITH 2ND PEAK

Started @ 1.0697

1st Peak @ 1.0679 – 0303:40 (4 min)

18 ticks

Reversal to 1.0690 – 0307 (7 min)

11 ticks

2nd Peak @ 1.0676 – 0311 (11 min)

21 ticks

Reversal to 1.0691 – 0321 (21 min)

15 ticks

Notes: The manufacturing reading came in 1.0 points below the forecast to mildly disappoint the market with a moderate upward revision on the previous report, and the simultaneous Services reading came in 1.7 pts below the forecast with a moderate downward previous revision. This caused a slow developing short spike of 18 ticks in nearly 4 min to reach the S3 Mid Pivot. With JOBB and a 3 tick bracket, your short order would have filled at 1.0693 with 1 tick of slippage, then it would have trickled a little lower and hovered to allow a quick exit with 2 ticks. With the results consistently disappointing, it would be safe to wait for a longer term reaction as the average yield on this report is 17 ticks. It continued to fall for the next 3 min to allow an exit at 1.0680 for 13 ticks. Then it reversed 11 ticks in 3 min to the 13 SMA before falling for a 2nd peak of 3 more ticks in 4 min. After that it reversed 15 ticks in 10 min to the 50 SMA as it headed into the German report.