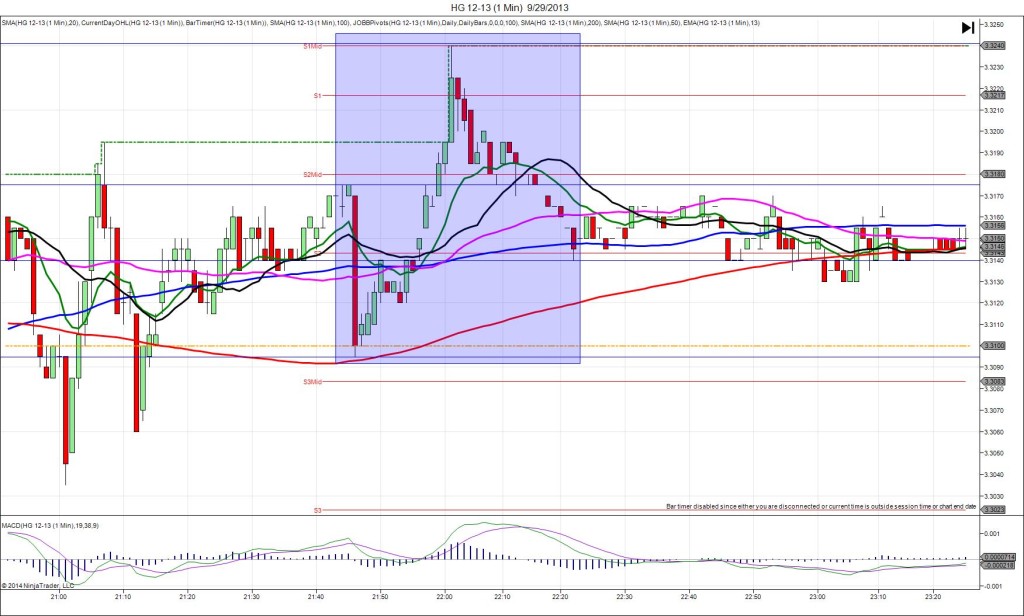

9/29/2013 CNY HSBC Final Manufacturing PMI (2145 EDT)

Forecast: 51.2

Actual: 50.2

SPIKE / REVERSE

Started @ 3.3175

1st Peak @ 3.3095 – 2146 (1 min)

16 ticks

Reversal to 3.3240 – 2201 (16 min)

29 ticks

Pullback to 3.3140 – 2222 (37 min)

20 ticks

Notes: Report fell short of the forecast by 1.0 pts, causing a moderate short spike of 16 ticks that started just below the S2 Mid Pivot, then fell to cross the 100/50 SMAs and hit the 200 SMA / OOD on the :46 bar. Look to exit at about 3.3100 where it hovered for most of the bar. After the peak, it reversed for 29 ticks in the next 16 min, all the way up to the S1 Mid Pivot. Then it pulled back for 20 ticks in the next 21 min back to the 100 SMA and S2 Pivot. After that it traded sideways near the SMAs and S2 Pivot.