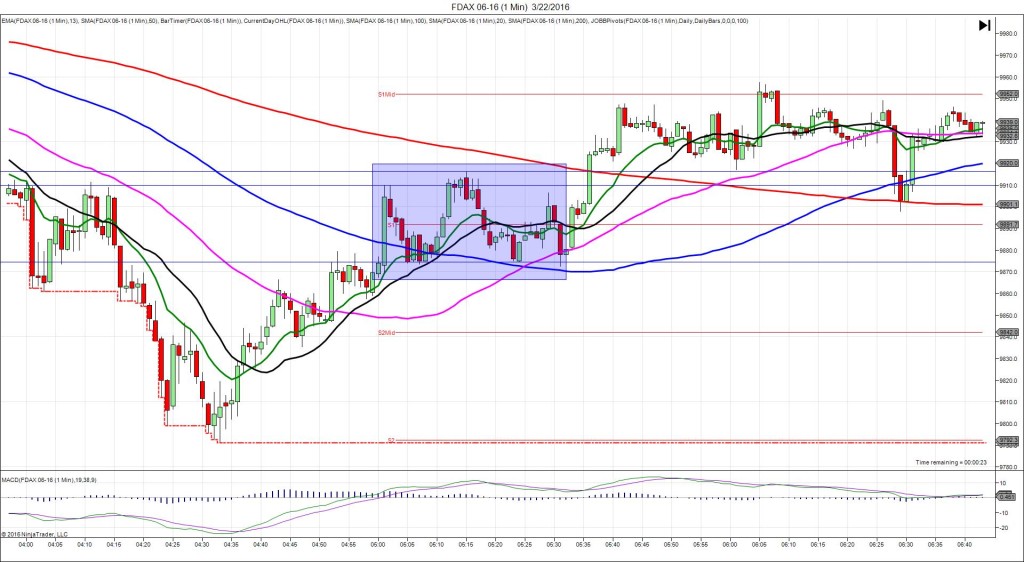

3/31/2016 Monthly Manufacturing PMI (0430 EDT)

Forecast: -21.1B

Actual: -32.7B

Previous revision: n/a

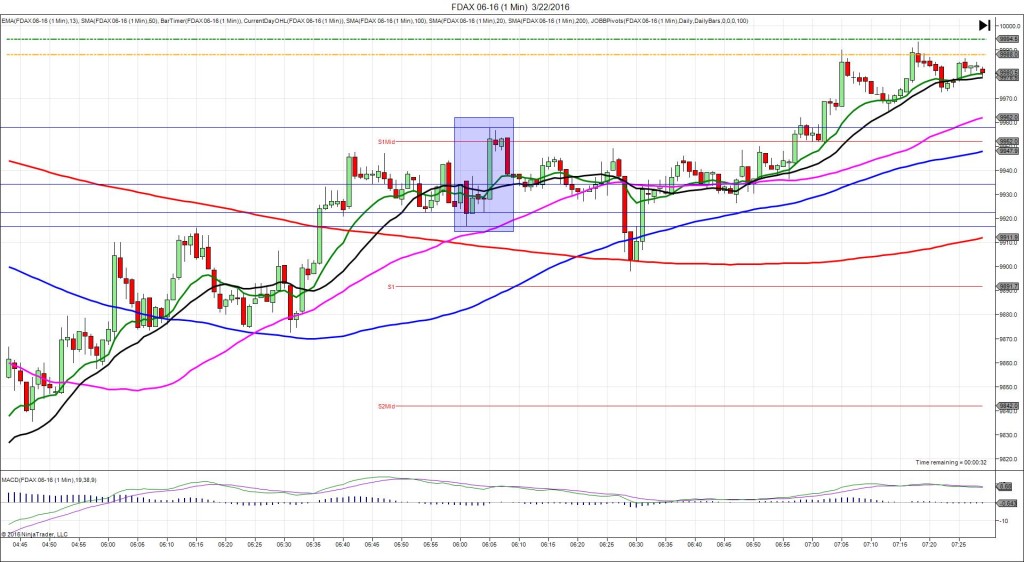

SPIKE WITH 2ND PEAK

Started @ 1.4365

1st Peak @ 1.4380 – 0430:24 (1 min)

15 ticks

2nd Peak @ 1.4398 – 0444 (14 min)

33 ticks

Reversal to 1.4370 – 0504 (34 min)

28 ticks

Pullback to 1.4397 – 0518 (48 min)

27 ticks

Reversal to 1.4447 – 0614 (104 min)

12 ticks

Expected Fill: 1.4370 (long)

Slippage: 1 tick

Best Initial Exit: 1.4379 – 9 ticks

Recommended Profit Target placement: 1.4384 (just above the HOD) – move lower

Notes: Small spike climbed to the S1 Mid Pivot and found resistance. Look to exit there with the hovering in the middle of the :31 bar with about 8 ticks. Then it climbed for a 2nd peak of 18 more ticks before reversing to the S1 Mid Pivot / 50 SMA area.