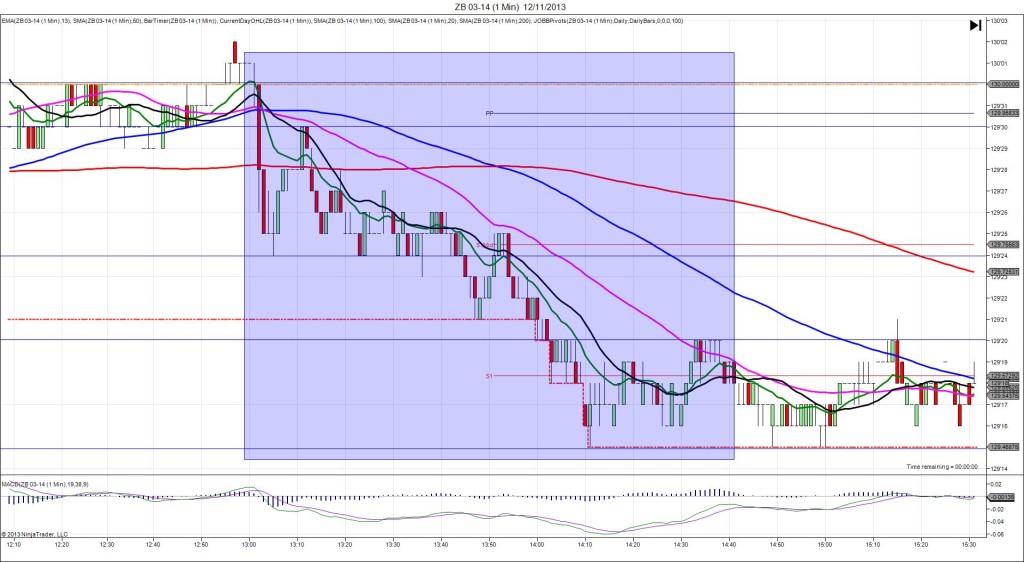

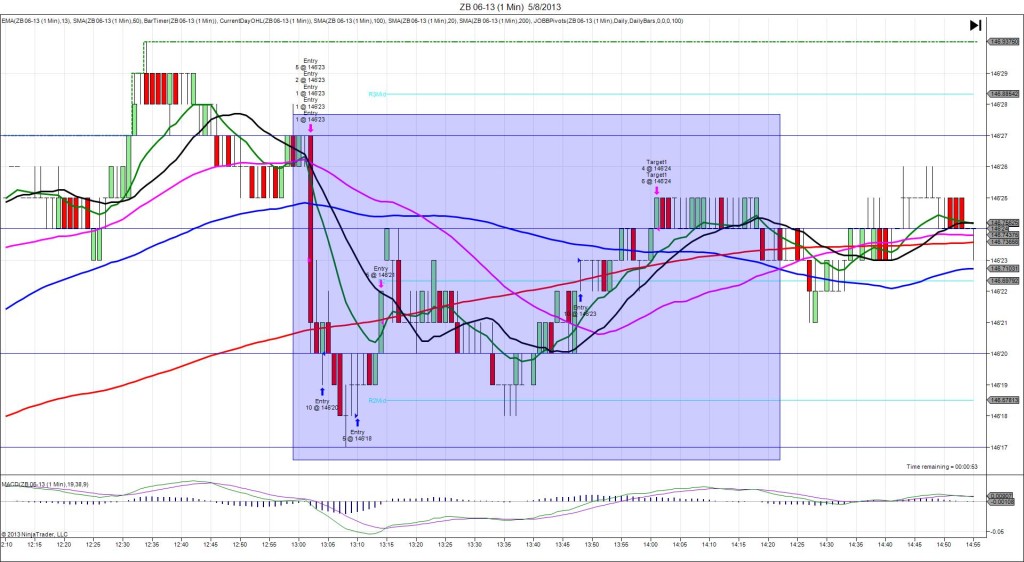

12/11/2013 10-yr Bond Auction (1301 EST)

Previous: 2.75/2.7

Actual: 2.82/2.6

SPIKE WITH 2ND PEAK

Started @ 130’00 (1301)

1st Peak @ 129’24 – 1305 (4 min)

8 ticks

Reversal to 129’30 – 1311 (10 min)

6 ticks

2nd Peak @ 129’15 – 1411 (70 min)

17 ticks

Reversal to 129’20 – 1433 (92 min)

5 ticks

Notes: Report is scheduled on Forex Factory at the top of the hour, but the spike always breaks 1 min late. The highest yield rose moderately since last month. This caused the ZB to fall for 8 ticks in 4 bars as it contended with the 200 SMA, then reached the S1 Mid Pivot. With JOBB, you would have filled short at 129’30 with no slippage, then seen it fall to struggle briefly with the 200 SMA, then break free for a few more. I would move the stop to 129’29 and place the target at 129’26. This would have given you 4 ticks with ease as the S1 Mid Pivot held. After the 1st peak, it reversed for 6 ticks in the next 6 min back to the 50 SMA. Then it fell for a slow developing 2nd peak of 9 more ticks in the next hour, crossing the S1 Pivot. After that it reversed for 5 ticks in about 20 min, back to the 50 SMA.