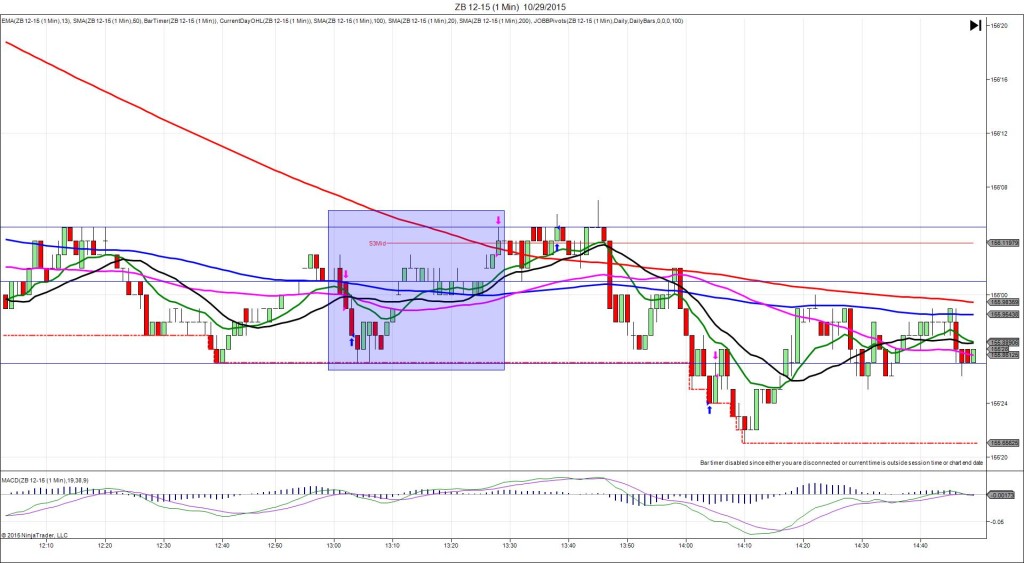

08/29/2013 7-yr Bond Auction (1301 EDT)

Previous: 2.03/2.5

Actual: 2.22/2.4

SPIKE WITH 2ND PEAK

Started @ 131’10 (1301)

1st Peak @ 131’20 – 1306 (5 min)

10 ticks

Reversal to 131’16 – 1307 (6 min)

4 ticks

2nd Peak @ 131’27 – 1337 (36 min)

17 ticks

Reversal to 131’18 – 1427 (86 min)

9 ticks

Notes: Report is not found on Forex Factory, but the spike always breaks about 1:30 min late as with other bond auctions. The highest yield of 2.22 rose quite a bit from last month. This caused a slow developing, but average size 9 tick long spike in 5 min. With JOBB, you would have filled long at 131’12 with no slippage, then seen it hover within 1 tick of the fill point for about 2 min. You could have exited within 1 tick of break even or if patient, exited with 5+ ticks on the :06 bar. After last month saw a dull reaction and the previous 2 months has larger quick reactions, this is a bit of an anomaly with the slow movement, but quite safe. After a quick 4 tick reversal, the 2nd peak achieved another 7 ticks in 30 min, as it rode the 13/20 SMAs upward and eclipsed the R2 Pivot. Then it gave back 9 ticks in the next 50 min, back to the 100 SMA and R2 Mid Pivot.