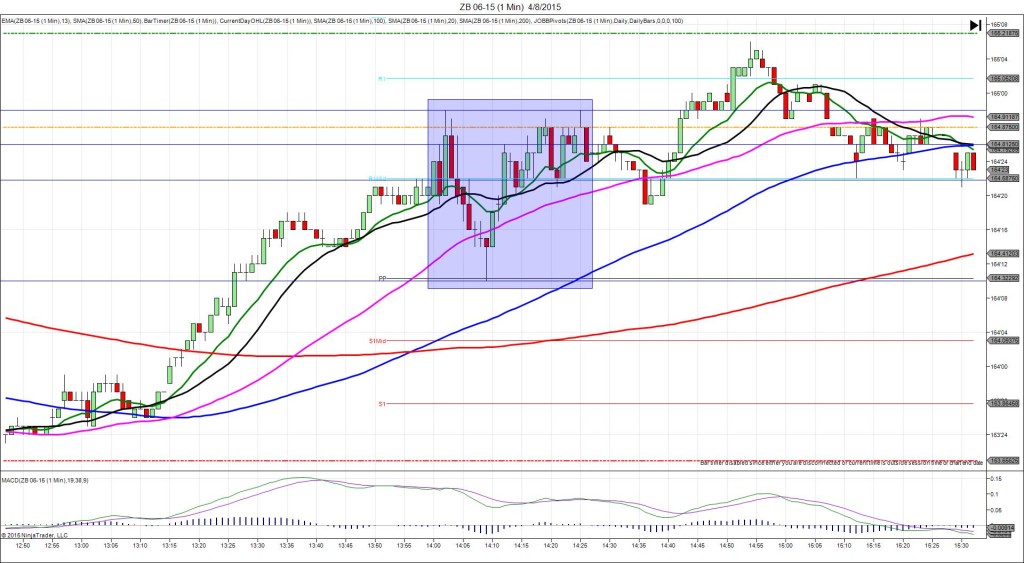

4/8/2015 FOMC Meeting Minutes (1400 EDT)

Previous: n/a

Actual: n/a

TRAP TRADE – DULL NO FILL

Anchor Point @ 164’22

————

Trap Trade:

)))1st Peak @ 164’26 – 1400:05 (1 min)

)))4 ticks

)))Reversal to 164’19 – 1400:44 (1 min)

)))-7 ticks

————

2nd Peak @ 164’30 – 1402 (2 min)

8 ticks

Reversal to 164’10 – 1409 (9 min)

20 ticks

Pullback to 164’29 – 1419 (19 min)

19 ticks

Trap Trade Bracket setup:

Long entries – 164’17 (just below the 20 SMA) / 164’14 (just above the 50 SMA)

Short entries – 164’27 (just below the OOD) / 164’30 (just above the HOD)

Notes: The minutes revealed that the FED was divided on when to hike rates (June or later). This caused a long spike of only 4 ticks that started a few sec premature and peaked 5 sec into the :01 bar. It lingered for only 3 sec to not allow a manual shifted entry before reversing, so cancel the order. It fell 7 ticks in about 40 sec before climbing for a 2nd peak of 4 more in 1 min as it eclipsed the OOD. Then it reversed 20 ticks in 7 min, crossing the 50 SMA and reaching the PP Pivot. After that it pulled back 19 ticks in 10 min to the OOD.