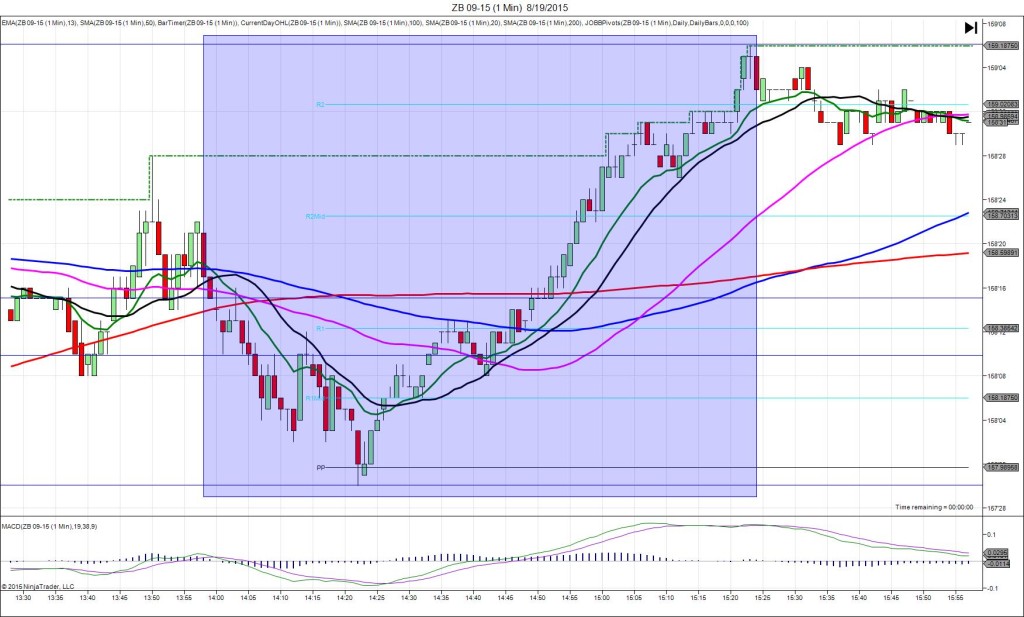

5/20/2015 FOMC Meeting Minutes (1400 EDT)

Previous: n/a

Actual: n/a

TRAP TRADE – OUTER TIER

Anchor Point @ 152’28 (shift up 2 ticks to 152’30)

————

Trap Trade:

)))1st Peak @ 153’08 – 1400:10 (1 min)

)))10 ticks

)))Reversal to 152’25 – 1401:30 (2 min)

)))-15 ticks

————

Continued Reversal to 152’10 – 1405 (5 min)

30 ticks

Pullback to 152’27 – 1408 (8 min)

17 ticks

Reversal to 152’13 – 1411 (11 min)

14 ticks

Pullback to 153’10 – 1430 (30 min)

29 ticks

Reversal to 152’23 – 1435 (35 min)

13 ticks

Trap Trade Bracket setup:

Long entries – 152’26 (in between the 100 / 200 SMAs) / 152’21 (just below the 200 SMA)

Short entries – 153’03 (just above the PP Pivot) / 153’07 (just below the HOD)

Notes: The minutes revealed that the FED was taking the possibility of a June rate hike off the table. This causes a perfect setup for the Trap Trade. You would have seen a 10 tick spike long in 10 sec that reached the HOD and collapsed. This would have filled both short tiers for an average position of about 153’05. Then it fell 15 ticks in about 80 sec to the 100 SMA to allow up to about 22 total ticks to be captured. Then it stalled for a min before falling for 15 more ticks. After that it pulled back 17 ticks in 3 min to the 50 SMA before reversing 14 ticks in 3 min. Then it climbed for a double top in 19 min before reversing 13 ticks in 5 min to the 200 SMA. After that it settled down and trickled lower into the close.