5/22/2013 FOMC Meeting Minutes (1400 EDT)

Forecast: n/a

Actual: n/a

Previous Revision: n/a

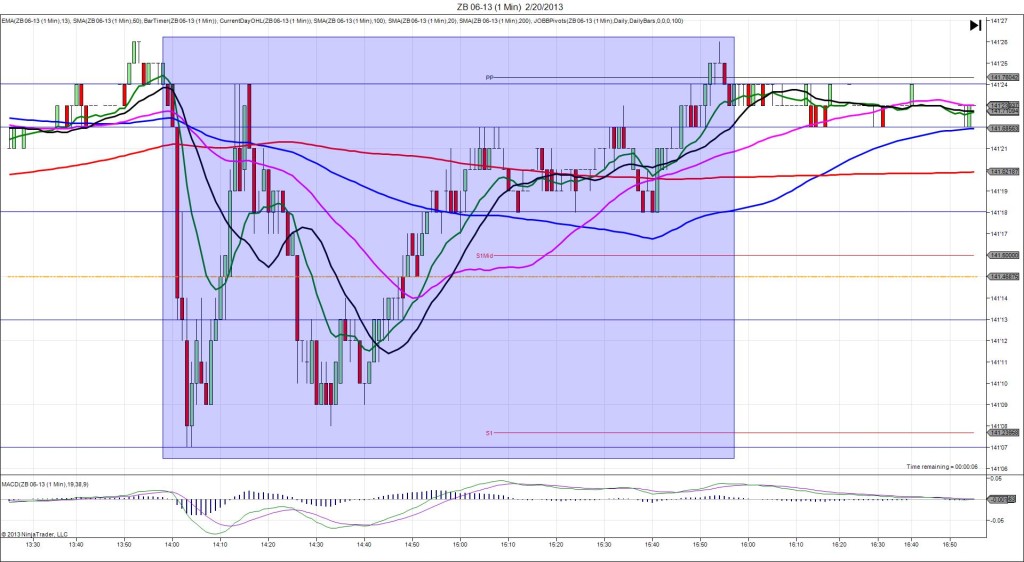

SPIKE/REVERSE

Started @ 143’00

1st Peak @ 143’10 – 1401 (1 min)

10 ticks

Reversal to 142’25 – 1401 (1 min)

17 ticks

Notes: Several FED members were willing to slow down the pace of the purchases as early as the June meeting if the data continued to improve. A growing number of Fed officials want to see the slowdown rate of bond purchases, but it is likely that process will take a few months at least. This caused the bonds to rally for 10 ticks on the 1st peak, crossing the S1 Pivot and the 200 SMA to peak at 20 sec into the :01 bar, then reverse 17 ticks in the next 10 sec before returning to near the origin as the bar expired. With JOBB you would have filled long at 143’03 with no slippage, then look to exit at 143’07 on the 200 SMA with 4 ticks, before it reversed. After the large swing of the :01 bar, it traded between the S2 Mid Pivot and the S1 Pivot / 200 SMA for 20 min and failed to achieve a 2nd peak. Then it drifted slightly lower to trade between the S2 Pivot and S2 Mid Pivot.