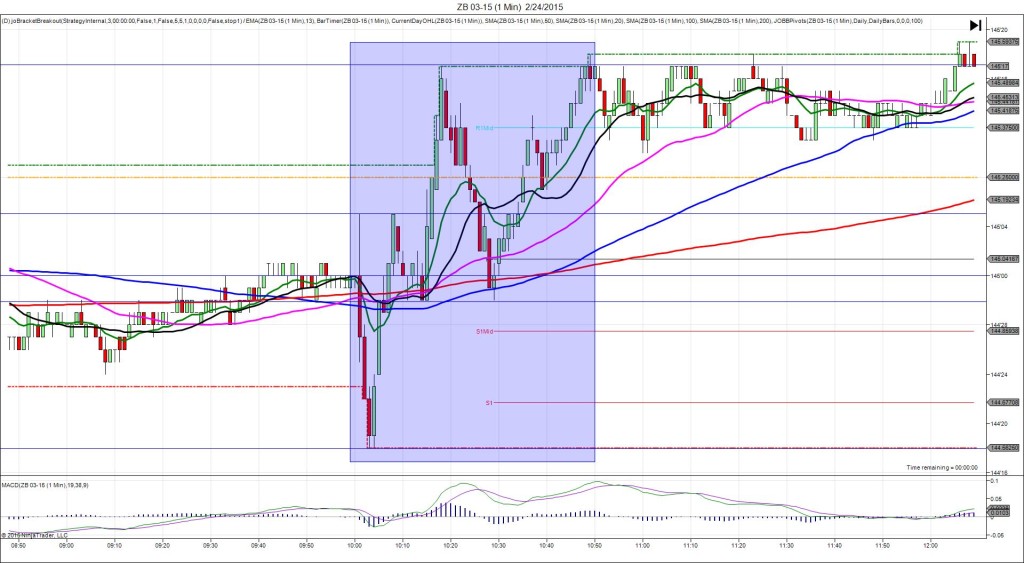

2/18/2015 FOMC Meeting Minutes (1400 EST)

Previous: n/a

Actual: n/a

TRAP TRADE – OUTER TIER STOPPED (SPIKE WITH 2ND PEAK)

Anchor Point @ 144’08 (shift to 147’28)

————

Trap Trade:

)))1st Peak @ 144’22 – 1400:15 (1 min)

)))14 ticks

)))Reversal to 144’15 – 1400:56 (1 min)

)))-7 ticks

————

Final Peak @ 145’07 – 1437 (37 min)

31 ticks

Reversal to 144’17 – 1548 (108 min)

22 ticks

Trap Trade Bracket setup:

Long entries – 144’03 (just above the S1 Mid Pivot) / 144’00 (just below the S1 Mid Pivot)

Short entries – 144’13 (no SMA / Pivot near) / 144’17 (just below the HOD)

Notes: The minutes revealed that the FED was still accommodative to dovish policy while taking a tolerant approach to risk assets and in no hurry to evaluate economic growth as a precursor for a rate hike. This caused a quick long spike of 14 ticks in 15 sec as it climbed to eclipse the PP Pivot and extend the HOD. This would have filled both short entries then the stop to the tick at 144’22 for a 14 tick loss. This was unfortunate as it reversed 7 ticks in the next few sec to allow an exit with 2-4 ticks loss had the stop been 1 tick larger. Still the trend of the small moves and reversals in the season of tapering easing is now over. It continued to rally after the reversal for another 17 ticks to eclipse the R1 Mid Pivot in 36 min before reversing 22 ticks in 71 min to the 200 SMA.