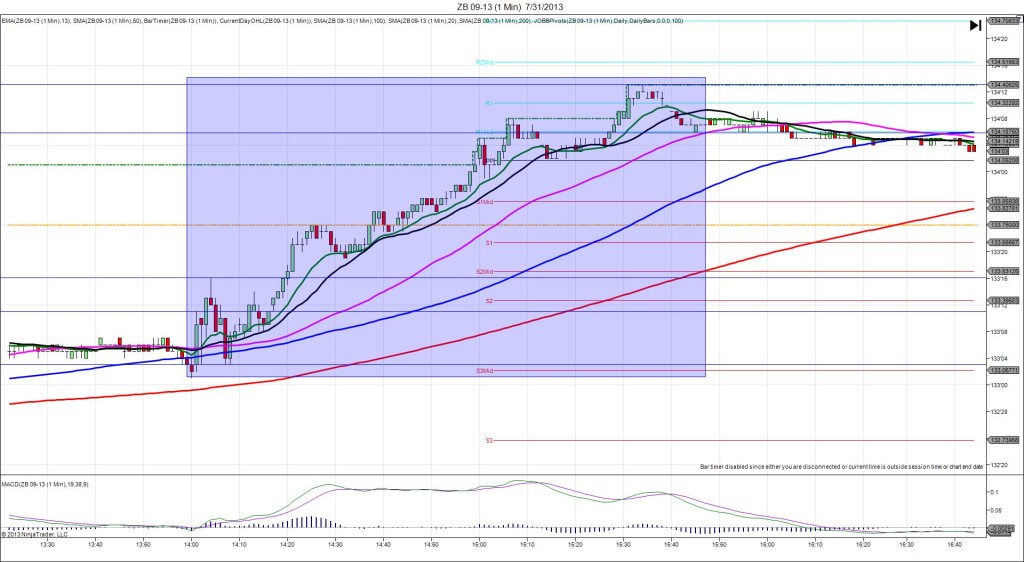

7/31/2013 FOMC Statement / FED Funds Rate (1400 EDT)

Forecast: n/a

Actual: n/a

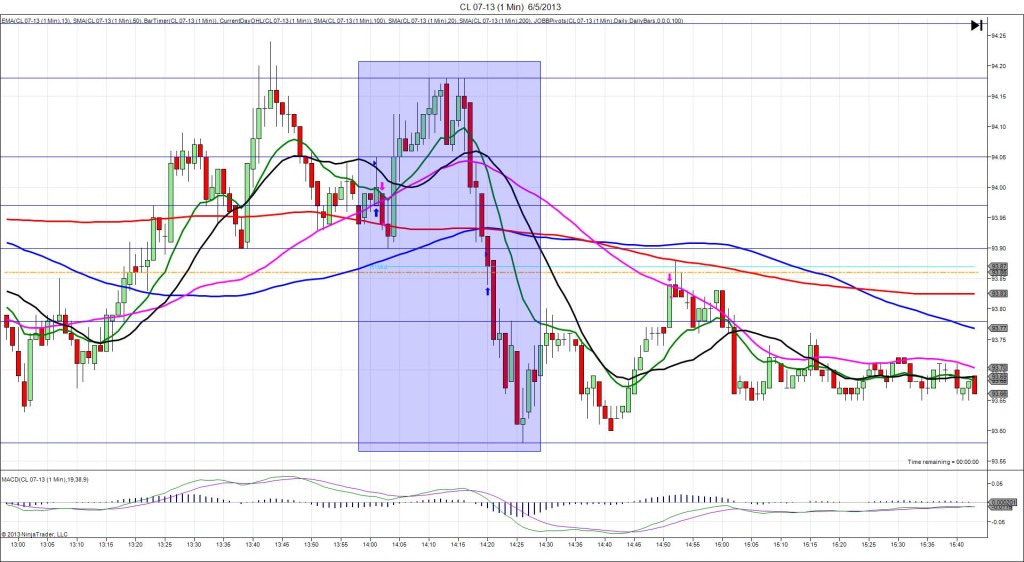

TRAP TRADE (UPWARD FAN)

Started @ 133’03 (1400)

————

Trap Trade:

)))1st Peak @ 133’11 – 1400:19 (1 min)

)))8 ticks

)))Reversal to 133’03 – 1401:25 (2 min)

)))-8 ticks

)))2nd Peak @ 133’16 – 1403:20 (4 min)

)))13 ticks

)))Reversal to 133’03 – 1407:03 (8 min)

)))-13 ticks

————

Final Peak @ 134’13 – 1531 (91 min)

42 ticks

Reversal to 134’06 – 1545 (105 min)

7 ticks

Notes: Report released on time, as the FED chose to continue the existing open ended QE3 policy despite seeing certain indications of improving economic conditions, but reiterated previous comments about tapering off the bond buying later in the year. This caused an initial long move that nearly reached the S2 Pivot for 8 ticks, then a return to the origin. It repeated the cycle before developing into an upward fan for the long term reaction. A Trap Trade with 6-8 ticks offset would use the S3 Mid Pivot at 133’02 as the anchor point, then go with 133’08 – 133’10 for the short entry and 132’28 – 132’26 for the long entry. The initial burst long would have filled the short entry easily, then see the reversal give at least 4 ticks if you targeted the 100 SMA. Later opportunities to buy low and sell high were available, as it achieved a 2nd peak, then fell to the origin one more time. Then it rode the 13/20 SMAs for nearly an hour and a half as it eclipsed the R1 Pivot for 42 ticks. Then we saw a reversal of 7 ticks in the next 14 min.