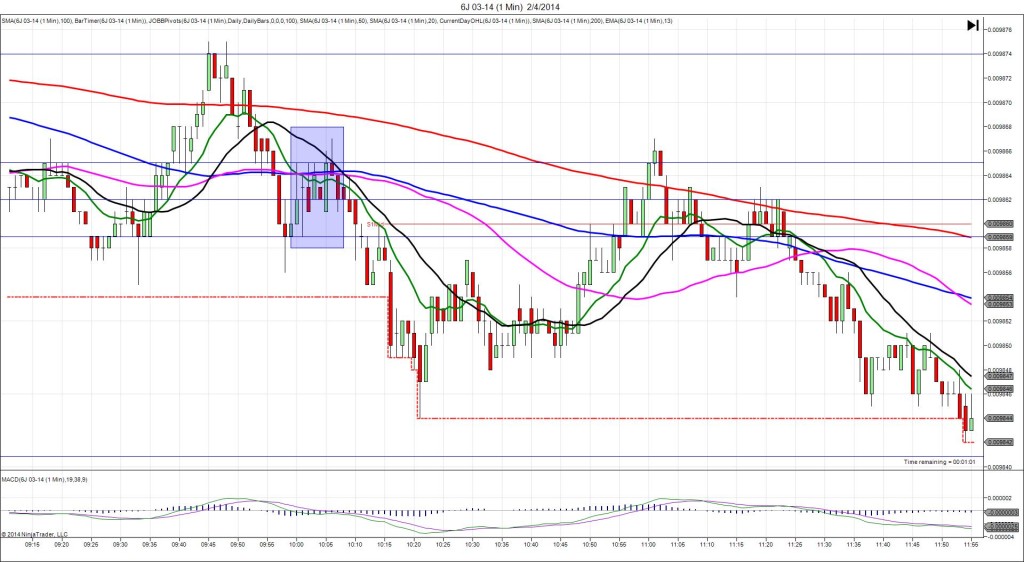

3/6/2014 Monthly Factory Orders (1000 EST)

Forecast: -0.4%

Actual: -0.7%

Previous Revision: -0.5% to -2.0%

DULL REACTION (No FILL)

Started @ 0.009701

1st Bar span 0.009700 – 0.009702 – 1001 (1 min)

+/- 1 ticks

Notes: Report came in lower than the forecast with a weak reading coupled with a sizeable downward revision to the previous report. This caused a dull reaction that spanned only +/- 1 ticks from the origin. It did have a delayed reaction on the :02 – :05 bars for about 9 ticks, but be safe and cancel the order with no fill after 10 sec.

-110212.jpg)

-100412.jpg)