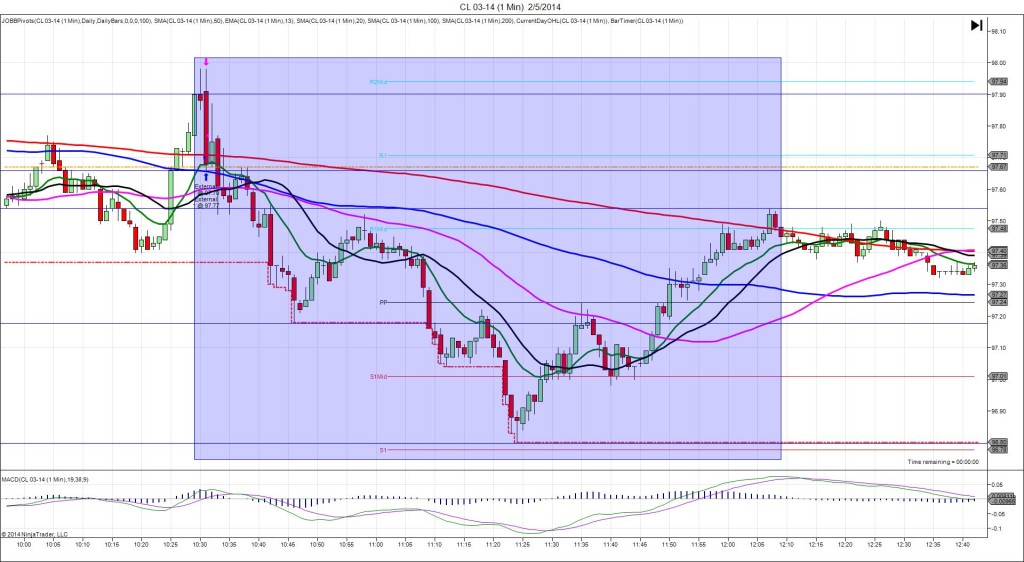

2/5/2014 Weekly Crude Oil Inventory Report (1030 EST)

Forecast: 2.30M

Actual: 0.44M

Gasoline

Forecast: 1.48M

Actual: 0.51M

Distillates

Forecast: -1.58M

Actual: -2.36M

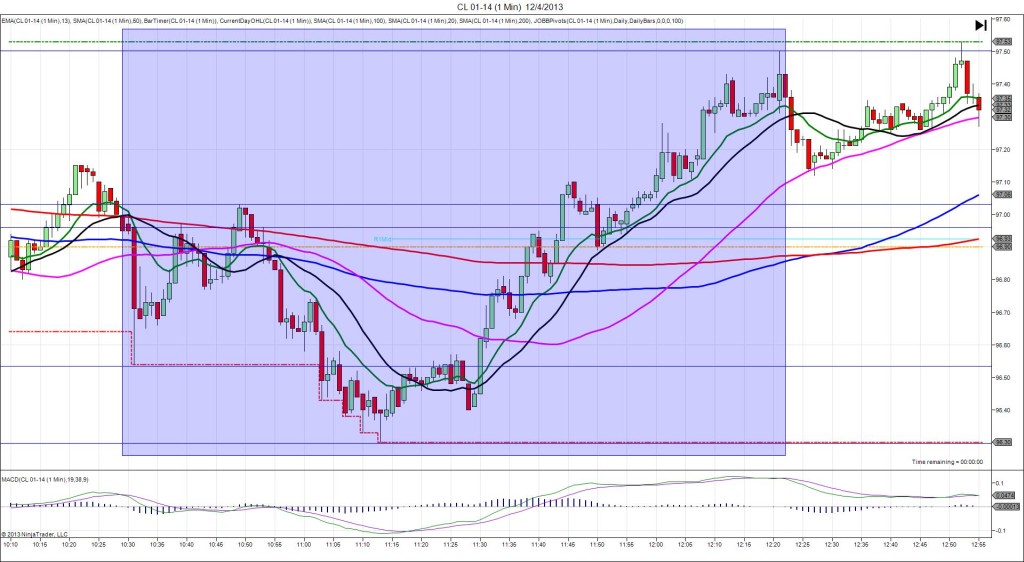

SPIKE / REVERSE

Started @ 97.90

1st Peak @ 97.66 – 1031 (1 min)

24 ticks

Reversal to 97.87 – 1032 (2 min)

21 ticks

2nd Peak @ 97.18 – 1046 (16 min)

72 ticks

Reversal to 97.52 – 1058 (28 min)

34 ticks

Final Peak @ 96.80 – 1124 (54 min)

110 ticks

Reversal to 97.54 – 1207 (97 min)

74 ticks

Notes: Modest draw in inventories when a moderate gain was expected, while gasoline saw a modest draw when a small gain was expected and distillates saw a moderate draw when a smaller draw was expected. While the results were all in line as more than expected loss of inventory, it did not create the expected bullish reaction. The overall reaction was bearish, delivering a small 24 tick short spike on the :31 bar after some early noise that crossed the 200 SMA and hit the OOD. With JOBB and a 10 tick buffer, you would have filled short at 97.78 with 2 ticks of slippage, then seen it chop to reach a low of 96.66 toward the end of the bar. A profit target placed just below the 200 SMA would have yielded about 10 ticks. After the peak, we saw it reverse, then fall to step lower to a final peak of 110 ticks to reach the S1 Pivot nearly an hour after the report. Then it reclaimed 74 ticks back to the R1 Mid Pivot and 200 SMA 43 min later.