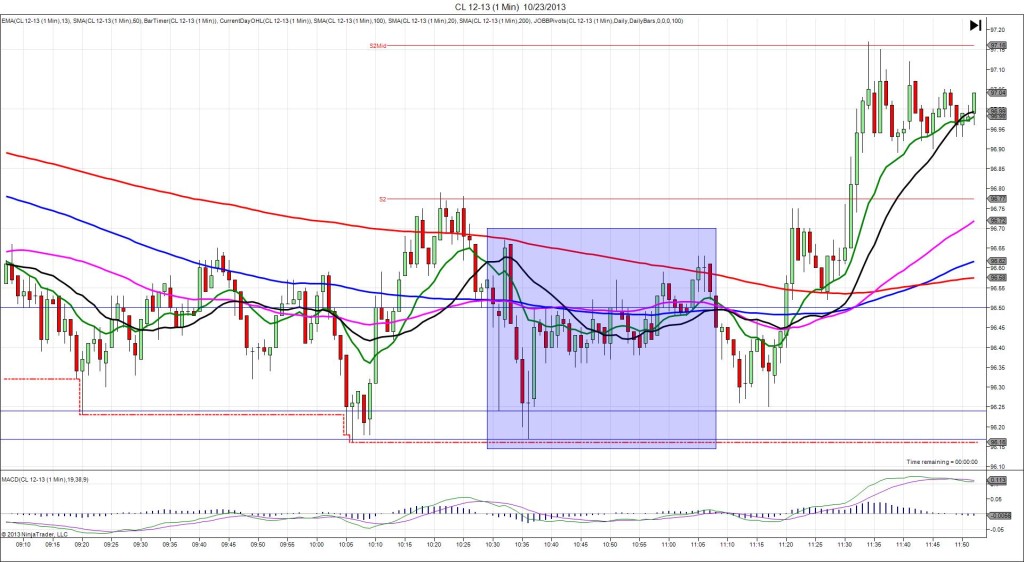

11/6/2013 Weekly Crude Oil Inventory Report (1030 EST)

Forecast: 1.63M

Actual: 1.58M

Gasoline

Forecast: -0.34M

Actual: -3.76M

Distillates

Forecast: -1.30M

Actual: -4.90M

SPIKE WITH 2ND PEAK

Started @ 94.38

1st Peak @ 94.69 – 1031 (1 min)

31 ticks

Reversal to 94.27 – 1033 (3 min)

42 ticks

2nd Peak @ 94.78 – 1045 (15 min)

40 ticks

Reversal to 94.43 – 1109 (39 min)

35 ticks

Notes: Nearly matching gain in inventories when a modest gain was expected, while gasoline and distillates both saw healthy draws when modest draws were expected. With the results, the product draws drove the news. We saw a long spike of 31 ticks in 1 min that started on the upward trending 13/20 SMAs, then crossed the R2 Mid Pivot prior to leaving 13 ticks on the wick naked. With JOBB and a 10 tick buffer, you would have filled long at about 94.52 with 4 ticks of slippage, then place your target in the vicinity of the R2 Pivot at 94.82. After peaking at 94.69 12 sec into the bar, then hovering and falling, exit before the reversal surrenders all of your profit. After the peak, it reversed for 42 ticks on the next 2 bars as it eclipsed the 50 SMA, then geared up for the 2nd peak. It only achieved another 9 ticks, unable to quite reach the R2 Pivot, then it fell for 35 ticks in the next 24 min to the R2 Mid Pivot. After that it continued the long term rally, stepping higher.