8/28/2013 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 0.20M

Actual: 2.99M

Gasoline

Forecast: -1.19M

Actual: -0.59M

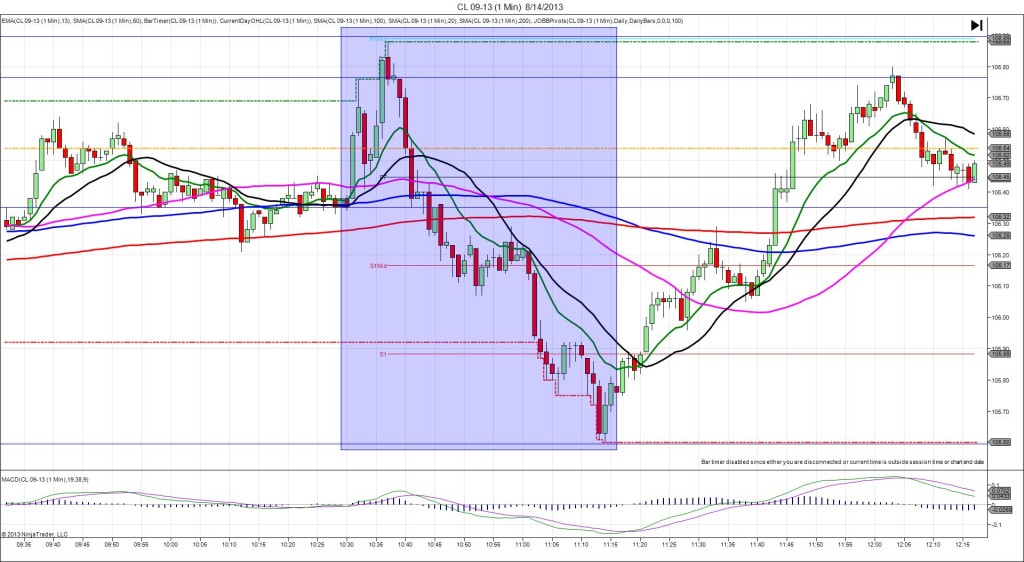

SPIKE / REVERSE

Started @ 109.94

1st Peak @ 109.63 – 1031 (1 min)

31 ticks

Reversal to 110.45 – 1050 (20 min)

82 ticks

Notes: Moderate gain in inventories when a negligible gain was expected, while gasoline saw a negligible draw when a modest draw was expected. With consistent results, we saw a short reaction as expected. It fell for 31 ticks, crossing the 50 SMA and the R2 Mid Pivot on the :31 bar. With JOBB and a 10 tick buffer, you would have filled short at 109.82 with 2 ticks of slippage, then seen it back off to about 10 ticks in the red before falling again. A target just below the R2 Mid Pivot would have filled for about 15 ticks profit. After the :31 bar, the next 2 bars hovered on the R2 Mid Pivot, then it reversed for 82 ticks in about 17 min, crossing all 3 major SMAs and nearly reaching the R3 Mid Pivot. Then it fell and oscillated around the SMAs.