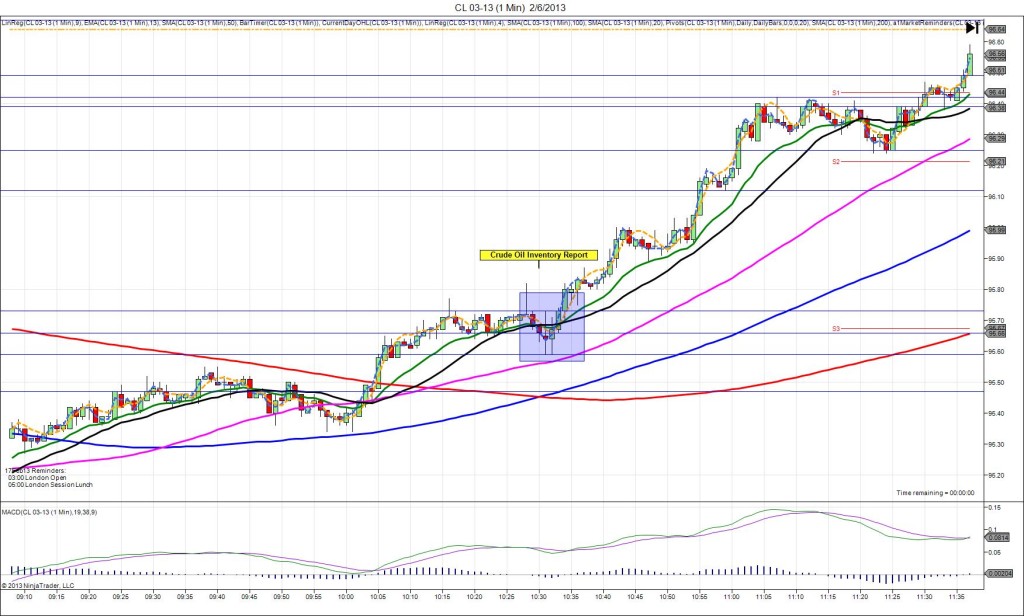

2/6/2013 Weekly Crude Oil Inventory Report (1030 EST)

Forecast: 2.7M

Actual: 2.6M

DULL REACTION

Started @ 95.66

1st Bar Hi/Lo @ 95.73 / 95.59 – 1031 (1 min)

7 ticks

Notes: Matching gain in crude inventories, while gasoline saw a moderate rise and distillates saw a small drop. This caused a dull reaction with all results near the expectation and the market trading on the S3 Pivot. With JOBB and a 10 tick buffer, you would not have filled in 15 sec, so cancel the order. As the market was engaged in a bullish correction prior to the report, it continued its slow and deliberate long run 2 min after the report. This is the first dull reaction inventory report since we have been monitoring this report in 18 months.

-011613.jpg)

-010913.jpg)

-120512.jpg)

-112812.jpg)

-112112.jpg)

-111512.jpg)

-110712.jpg)

-110112.jpg)