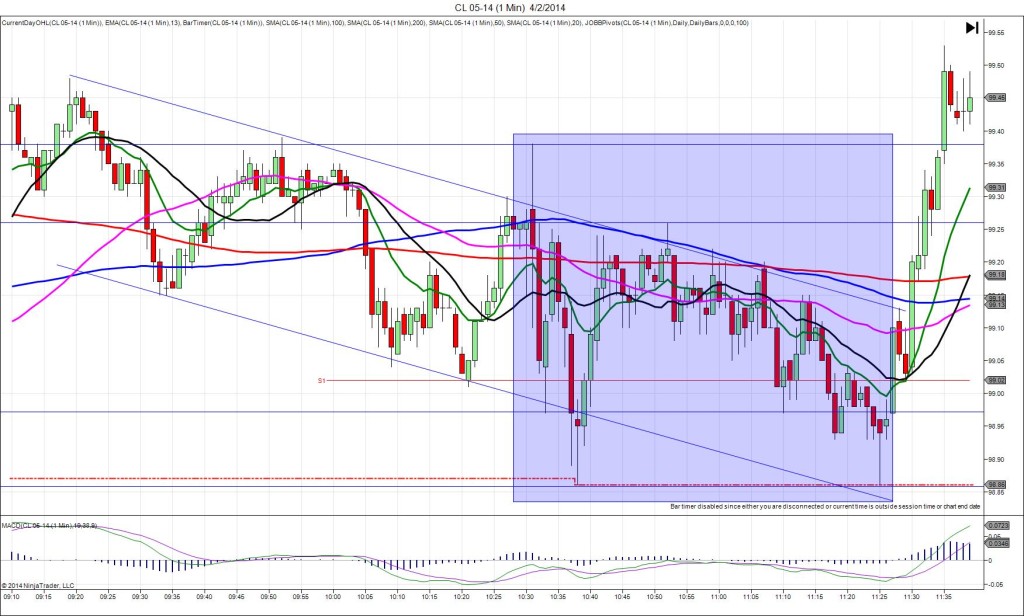

3/26/2014 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 2.74M

Actual: 6.62M

Gasoline

Forecast: -1.21M

Actual: -5.10M

Distillates

Forecast: -1.35M

Actual: 1.56M

SPIKE WITH 2ND PEAK

Started @ 100.06

1st Peak @ 99.83 – 1030:08 (1 min)

23 ticks

Reversal to 100.13 – 1030:41 (1 min)

30 ticks

2nd Peak @ 99.70 – 1035 (5 min)

36 ticks

Reversal to 100.07 – 1047 (17 min)

37 ticks

Notes: Large gain in inventories when a moderate gain was expected, while gasoline saw a large draw when a modest draw was expected, and distillates saw a modest gain when a modest draw was expected. The mixed news caused a small short spike that would not have reversed on the back end of the :31 bar. With JOBB and a 10 tick buffer, you would have filled short at 99.94 with about 2 ticks of slippage, then seen it give you about 10 ticks and pullback quickly to hover about 3 ticks on either side of the fill point around the 50 SMA. Look to exit with 2-3 ticks because this means a reversal is likely coming. Sure enough, it reversed to touch the HOD 41 sec into the :31 bar. Then it fell for a 2nd peak of 13 more ticks, reaching the R1 Mid Pivot and 200 SMA in the next 4 bars. After that it reversed for 37 back to the R1 Pivot in the next 12 min. It continued to swing between the R1 and R1 Mid Pivots, then the swings shifted lower using the trend line as resistance.