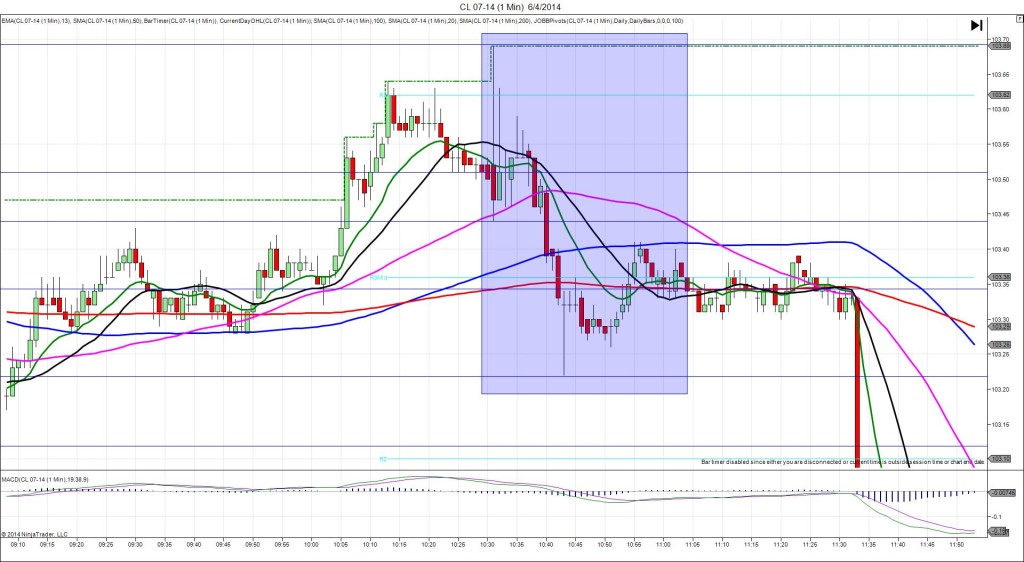

6/4/2014 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: -0.27M

Actual: -3.43M

Gasoline

Forecast: -0.16M

Actual: 0.21M

Distillates

Forecast: 0.43M

Actual: 2.01M

SPIKE / REVERSE

Started @ 103.51

1st Peak @ 103.69 – 1030:00 (1 min)

18 ticks

Reversal to 103.44 – 1030:52 (1 min)

25 ticks

Pullback to 103.58 – 1031:16 (2 min)

14 ticks

Reversal to 103.22 – 1043 (13 min)

36 ticks

Notes: Moderate draw in inventories when a negligible draw was expected, while gasoline saw a negligible gain when a negligible draw was expected, and distillates saw a moderate gain when a negligible gain was expected. The news was conflicting as the drawdown on the crude contributed to the build up on the distillates, causing indecision. This resulted in a 18 tick long spike that rose to cross the R3 Pivot and extend the HOD. With JOBB and a 10 tick buffer, you would have filled long at about 103.64 with 3 ticks of slippage. It would have hovered near the fill point for about 15 sec within 5 ticks of breakeven before reversing. This is a case we warn about in the alert where hovering in excess of 5 sec is often a precursor for a reversal. In this case the prudent course of action would be exiting with about 3-5 ticks loss as it hovered. The alternative would have seen it march toward an unadjusted stop at 45 sec. After the reversal, it pulled back for 14 ticks in the next 24 sec, then reversed for 36 ticks after crossing all 3 Major SMAs.