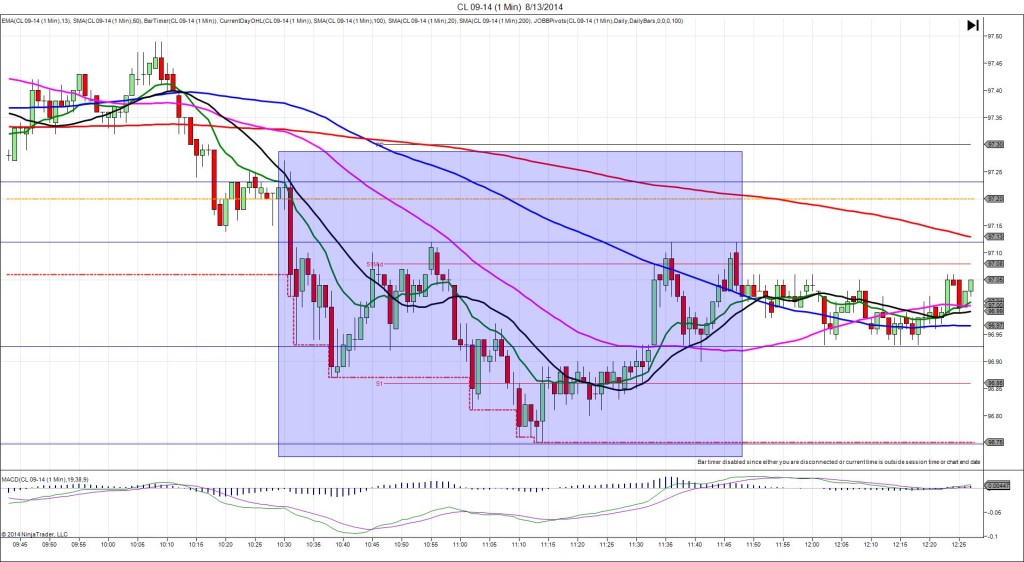

8/13/2014 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: -2.03M

Actual: 1.40M

Gasoline

Forecast: -1.06M

Actual: -1.16M

Distillates

Forecast: 0.21M

Actual: -2.42M

DULL REACTION (NO FILL)

Started @ 97.23

1st Peak @ 96.93 – 1031:07 (1 min)

30 ticks

Reversal to 97.11 – 1032 (2 min)

18 ticks

Final Peak @ 96.75 – 1113 (43 min)

48 ticks

Reversal to 97.12 – 1136 (66 min)

37 ticks

Notes: Modest gain in inventories when a modest draw was expected, while gasoline saw a near matching modest draw, and distillates saw a modest draw when a negligible draw was expected. This caused a dull reaction initially that failed to launch more than 10 ticks away from the origin until 12 sec into the bar. It eventually crossed the S1 Mid Pivot and extended the LOD. With JOBB and a 10 tick buffer, you would have seen all movement contained inside of the bracket in the first 10 sec, so cancel the order on the lack of conviction. We see a fill would have happened short at 97.13 with no slippage, then seen some heat before continuing to fall late in the :31 bar and into the :32 bar to allow about 18 ticks to be captured. Then it reversed 18 ticks in the next minute back to the S1 Mid Pivot. It stepped down to a final peak of 18 more ticks, crossing the S1 Pivot after the top of the hour. Then it reversed for 37 ticks back to the S1 Mid Pivot and 100 SMA about an hour after the report.