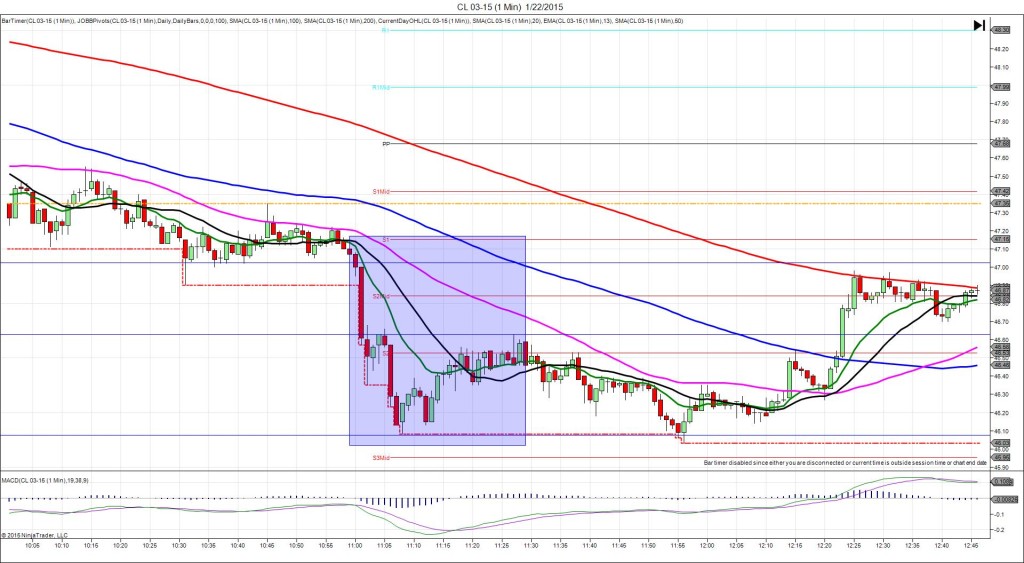

1/22/2015 Weekly Crude Oil Inventory Report (1100 EST)

Forecast: 2.62M

Actual: 10.07M

Gasoline

Forecast: 1.30M

Actual: 0.59M

Distillates

Forecast: 0.25M

Actual: -3.27M

SPIKE WITH 2ND PEAK

Started @ 47.02

1st Peak @ 46.35 – 1101:36 (1 min)

67 ticks

Reversal to 46.66 – 1105 (5 min)

31 ticks

2nd Peak @ 46.08 – 1108 (8 min)

94 ticks

Reversal to 46.63 – 1127 (27 min)

55 ticks

Notes: Very strong gain in inventories when a moderate gain was expected, while gasoline saw a negligible gain when a modest gain was expected, and distillates saw a moderate draw when a negligible gain was expected. With the collective news mostly supply sided, this caused a decisive short move of 67 ticks in about 1.5 min that started on the descending 13 SMA and fell to cross the S2 Pivot and extend the LOD. With JOBB and a 10 tick bracket, your short order would have filled at 46.87 with 5 ticks of slippage. It kept descending without much hovering until reaching the area of the S2 Pivot. This would have allowed up to 50 ticks to be captured. After a 31 tick reversal in 3 min, it fell for a 2nd peak of 27 more ticks in 3 min to nearly reach the S3 Mid Pivot. Then it reversed 55 ticks in 19 min.