6/10/2015 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: -1.72M

Actual: -6.81M

Gasoline

Forecast: 0.28M

Actual: -2.94M

Distillates

Forecast: 1.34M

Actual: 0.87M

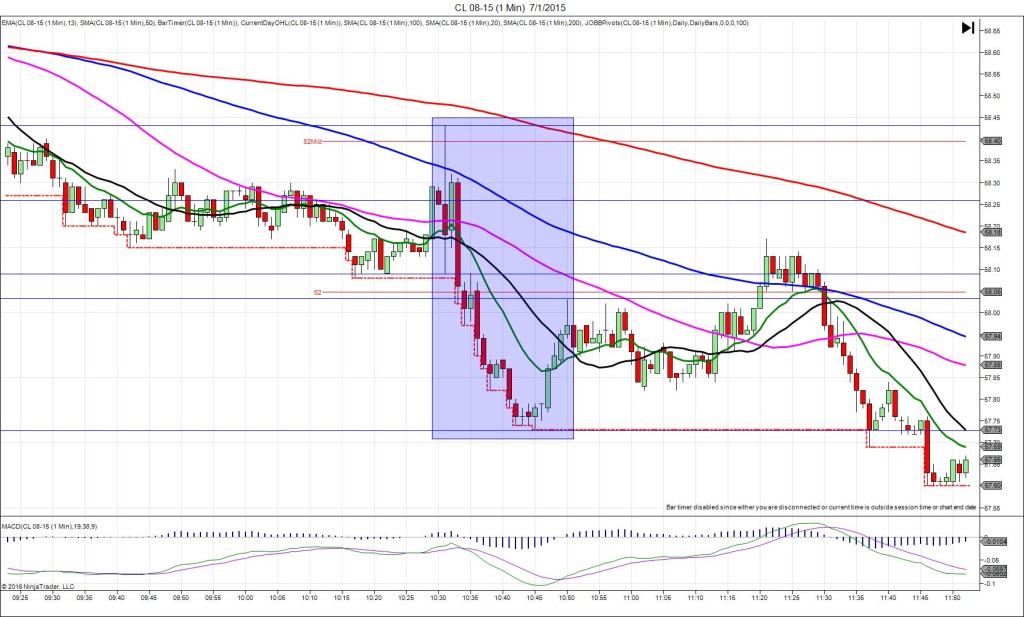

INDECISIVE

Started @ 61.25

1st Peak @ 61.62 – 1030:00 (1 min)

37 ticks

Reversal to 61.27 – 1030:07 (1 min)

35 ticks

Continued swings between 61.30 – 61.62 – to 1038 (8 min)

Reversal to 60.81 – 1042 (12 min)

81 ticks

Pullback to 61.29 – 1056 (26 min)

48 ticks

Reversal to 60.48 – 1153 (83 min)

81 ticks

Notes: Large draw in inventories when a modest draw was expected, while gasoline saw a moderate draw when a negligible gain was expected, and distillates saw a negligible gain when a modest gain was expected. This caused a long spike of 37 ticks that started on the 13/20 SMAs and rose to cross all 3 major SMAs and the R3 Mid Pivot then collapsed a few sec later. With JOBB and a 10 tick bracket, your long order would have filled at 61.41 with 6 ticks of slippage. Then it would have peaked and backed off to hover just above the fill point for 5 sec before reversing to the origin. If you were quick you could have exited with a handful of ticks, otherwise you would have been stopped with a 15 tick loss after 7 sec. It continued to chop between 61.62 an d61.30 for 7 more min before reversing 81 tic in 4 min to the R2 Pivot. Then it pulled back 48 ticks in 14 min to the 50 SMA before reversing 81 ticks to the R1 Pivot in 57 min.