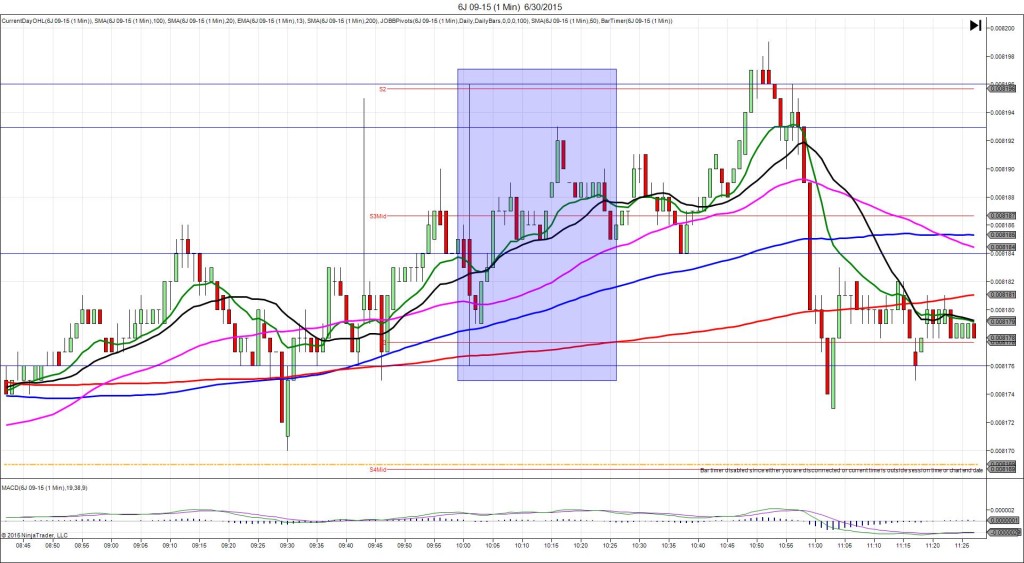

9/30/2014 Grain Stocks – Corn (1200 EDT)

Forecast: n/a

Actual: n/a

SPIKE WITH 2ND PEAK

Started @ 324.25

1st Peak @ 321.00 – 1200:30 (1 min)

13 ticks

Reversal to 323.25 – 1200:54 (1 min)

9 ticks

2nd Peak @ 319.50 – 1206 (6 min)

19 ticks

Reversal to 324.00 – 1242 (42 min)

18 ticks

Notes: Report Reaction caused a mild bearish reaction. It fell 13 ticks, reaching the S3 Mid Pivot and extending the LOD. With JOBB, you would have filled short after a 25 sec wait with about 1-2 ticks of slippage at 322.50 or 322.25, then seen it hover just above the S3 Mid Pivot for about 20 sec. Exiting after seeing the hovering at about 321.25 would have been safe for about 4-5 ticks. After the hovering, it reversed for 9 ticks in the next 24 sec to the S2 Mid Pivot as the :01 bar was expiring. Then it fell for a 2nd peak of 6 more ticks to the S3 Pivot 5 min later. After that it reversed 18 ticks in 36 min to the 200 SMA. Then it backed off and traded sideways into the session close.