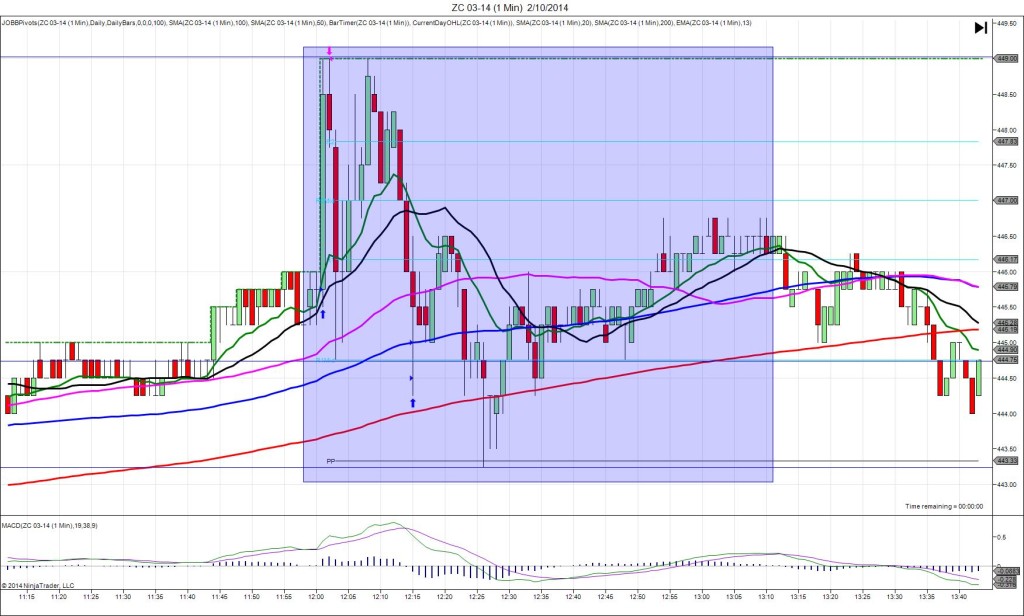

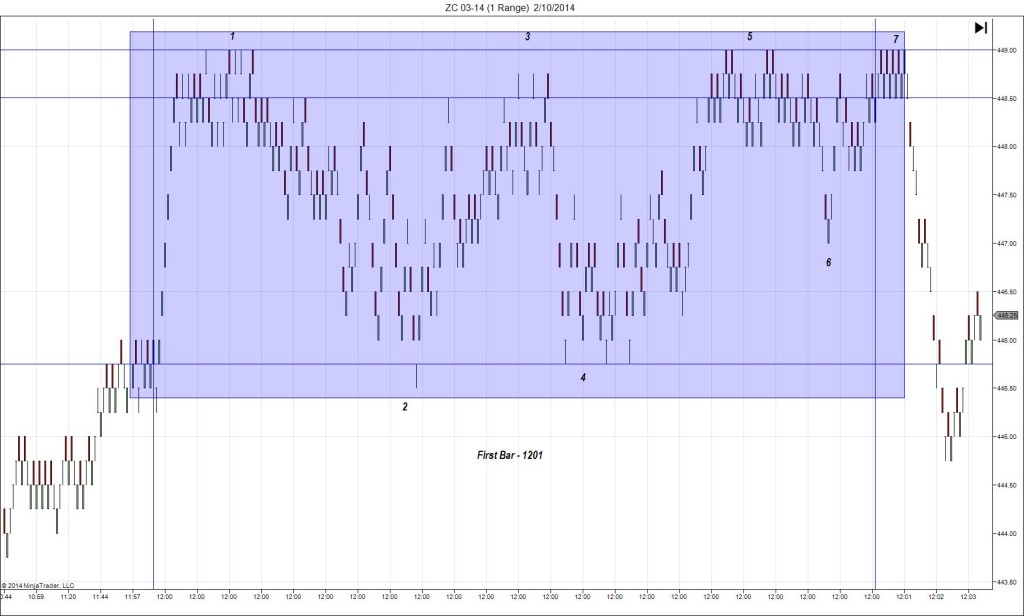

5/9/2014 World Agriculture Supply and Demand Estimates (WASDE) – Corn (1200 EST)

Forecast: n/a

Actual: n/a

SPIKE / REVERSE

Started @ 519.25

1st Peak @ 522.75 – 1200:00 (1 min)

14 ticks

Reversal to 513.75 – 1200:26 (1 min)

36 ticks

Double Top @ 522.75 – 1201:16 (2 min)

36 ticks

Reversal to 510.75 – 1205 (5 min)

48 ticks

Pullback to 519.00 – 1214 (14 min)

33 ticks

Reversal to 505.75 – 1234 (34 min)

53 ticks

Notes: Report Reaction caused a choppy and relatively small bullish reaction initially that turned into a short move at the end of the :01 bar. It climbed only 14 ticks, crossing the R2 Pivot, then reversed after about 7 sec reaching the origin in 9 sec, then 36 ticks after 26 sec. With JOBB, you would have filled long at about 520.75 with 1 tick of slippage, then seen it give only 5 ticks of profit for 3 sec before it started to back off. As this report can reverse quickly this is a trigger to exit near breakeven. This would have been achieved with an exit within the first 7 sec. After the large reversal, it climbed for a double top on the latter part of the :31 bar and early :32 bar. Then it continued to chop as it fell, neary reaching the S2 Pivot after 34 min. As this report can reverse quickly, it would be prudent to “reverse” the trade after the observation of the initial behavior or enter a short trade on the double top and look for 20-30 ticks.