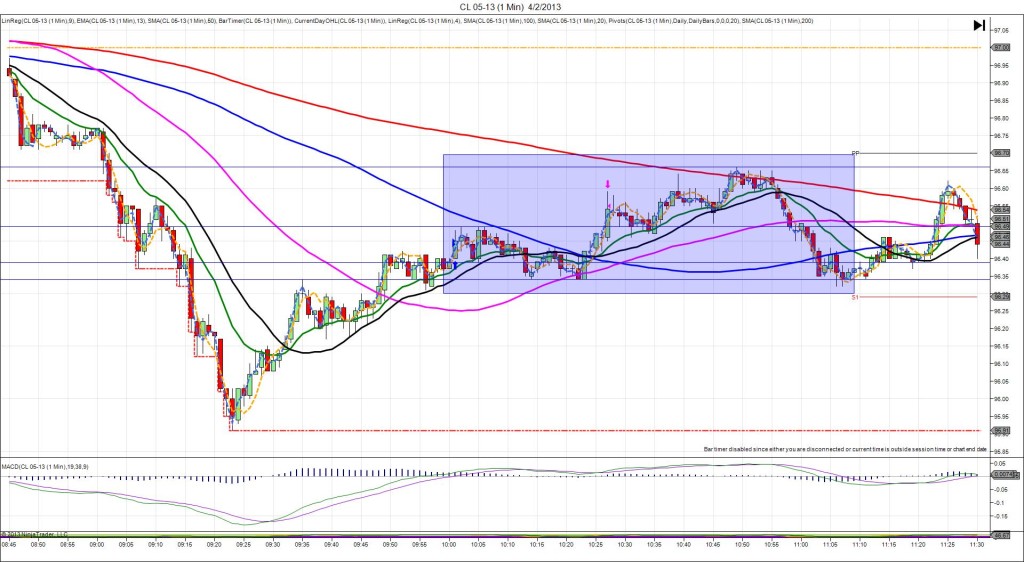

8/2/2013 Monthly Factory Orders (1000 EDT)

Forecast: 2.3%

Actual: 1.5%

Previous Revision: +0.9% to 3.0%

SPIKE WITH 2ND PEAK

Started @ 0.010080

1st Peak @ 0.010095 – 1002 (2 min)

15 ticks

Reversal to 0.010083 – 1012 (12 min)

12 ticks

2nd Peak @ 0.010109 – 1033 (33 min)

29 ticks

Reversal to 0.010098 – 1034 (34 min)

11 ticks

Notes: Report fell short of the forecast offset with a sizable upward revision to the previous report. This caused a long reaction that achieved 15 ticks on 2 bars, using the 13/20 SMAs as a launching point, crossing the PP Pivot and nearly reaching the R1 Mid Pivot. With JOBB, you would have filled long at 0.010085 with 1 tick of slippage, then look to exit at 0.010090 for about 5 ticks when it hovered. After the peak, it reversed for 12 ticks in the next 10 min to the PP Pivot, then it rebounded upward aided by the negative NFP results earlier and achieved a 2nd peak of 24 more ticks in the next 20 min. After a quick 11 tick reversal, it continued the rally, but the impact of this report has likely expired.