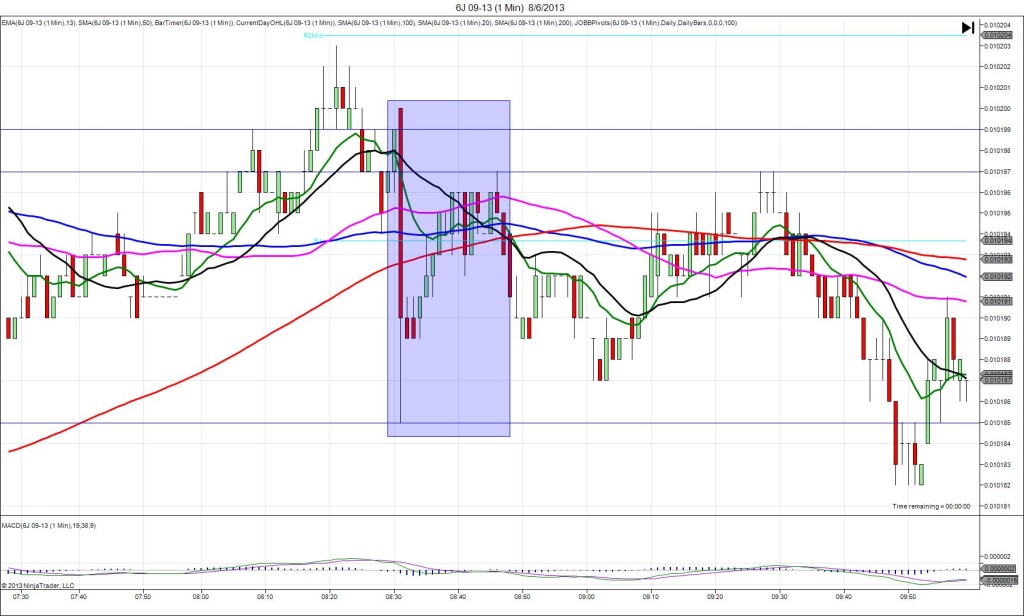

8/5/2013 Monthly ISM Non-Manufacturing PMI (1000 EDT)

Forecast: 53.2

Actual: 56.0

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 0.010147

1st Peak @ 0.010128 – 1001 (1 min)

19 ticks

Reversal to 0.010137 – 1002 (2 min)

9 ticks

2nd Peak @ 0.010125 – 1007 (7 min)

22 ticks

Reversal to 0.010148 – 1102 (62 min)

23 ticks

Notes: Strongly positive report exceeded the forecast by 2.8 points. This caused a short spike of 19 ticks on the :01 bar as it started on the 50/100 SMAs, then terminated about 2 ticks above the R1 Mid Pivot. With JOBB, you would have filled short at about 0.010135 with 9 ticks of slippage, then seen it hover with a handful of ticks. Look to exit with about 5 ticks. After the peak, it reversed for 9 ticks, then fell for a 2nd peak of 3 more ticks to cross the R1 Mid Pivot 5 min later. After that it reversed slowly back to the origin, crossing all 3 SMAs in the next hour.