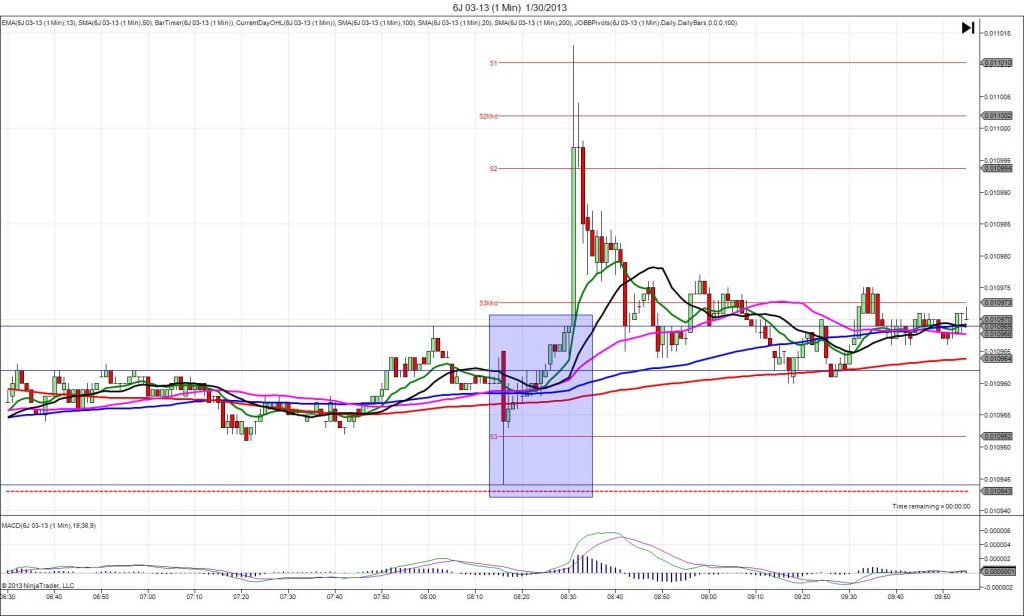

6/6/2013 Weekly Natural Gas Storage Report (1030 EDT)

Forecast: 101B

Actual: 111B

SPIKE/REVERSE

Started @ 3.926 (1029)

Premature Spike @ 3.908 – 1030 (1 min)

18 ticks

1st Peak @ 3.844 – 1032 (3 min)

82 ticks

Reversal to 3.883 – 1044 (14 min)

39 ticks

Notes: Moderately larger gain on the reserve compared to the forecast saw a small premature short spike 30 sec before the report that extended the LOD, then a consistent news based spike that fell 82 ticks. With JOBB, you would have filled short at 3.914 with about 2 ticks of slippage on the premature spike. Due to the timing (too early for news based) but small size, you could close out with a handful ot ticks or wait for the potential real spike. If you waited, you would have been able to capture 60+ ticks with ease. The peak was more sustainable than normal as it hit the S4 Pivot and stuck for about 7 min before the divergence built up to cause it to rebound for 39 ticks and eclipse the 20 SMA. After that it traded sideways between the S4 Mid Pivot and S4 Pivot.