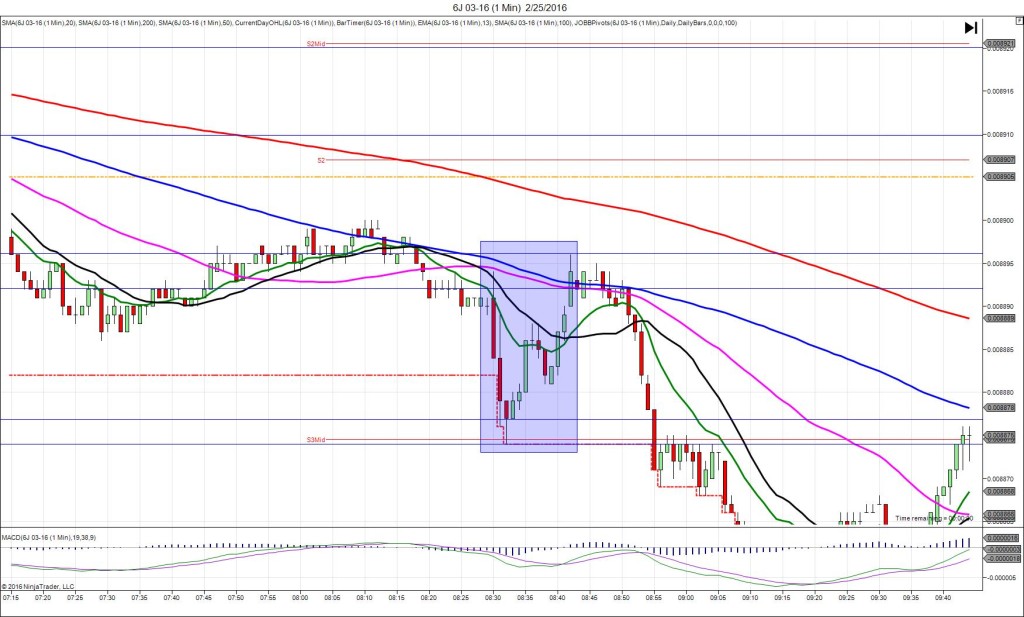

3/24/2016 Monthly Durable Goods Orders (0830 EDT)

Core Forecast: -0.2%

Core Actual: -1.0%

Previous revision: -0.1% to 1.7%

Regular Forecast: -3.0%

Regular Actual: -2.8%

Previous Revision: -0.2% to 4.7%

TRAP TRADE – DULL NO FILL

Anchor Point @ 0.008899

————

Trap Trade:

)))1st Peak @ 0.008908 – 0830:00 (1 min)

)))9 ticks

)))Reversal to 0.008897 – 0833:58 (4 min)

)))-11 ticks

————

2nd Peak @0.008917 – 0847 (17 min)

18 ticks

Reversal to 0.008907 – 0859 (6 min)

10 ticks

Trap Trade Bracket setup:10-12/20-24

Long entries – 0.008888 (on the S1 Pivot) / 0.008877 (No SMA/Pivot near)

Short entries – 0.008910 (No SMA/Pivot near) / 0.008921 (just above the R1 Mid Pivot/ OOD)

Expected Fill: n/a – cancel

Best Initial Exit: n/a.

Recommended Profit Target placement: n/a

Notes: Conflicting report caused a quick spike that reversed. Unfortunately the spike was a few ticks too small to breach the inner short tier. Cancel the order on the miss. After a reversal to the S1 Mid Pivot, it rebounded for a 2nd peak to the OOD.