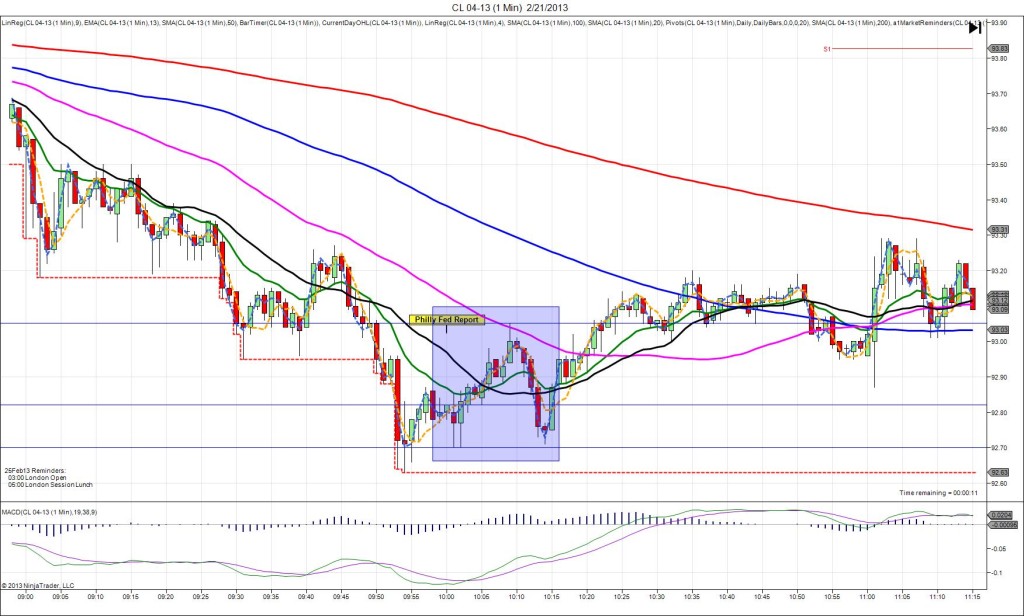

5/16/2013 Monthly Philly FED Manufacturing Index (1000 EDT)

Forecast: 2.5

Actual: -5.2

Previous revision: n/a

INDECISIVE then SPIKE WITH 2ND PEAK

Started @ 94.57

1st Peak @ 94.46 – 1001 (1 min)

11 ticks

Reversal to 94.65 – 1001 (1 min)

-19 ticks

2nd Peak @ 94.08 – 1008 (8 min)

49 ticks

Reversal to 94.77 – 1033 (33 min)

69 ticks

Extended Reversal to 95.57 – 1124 (84 min)

149 ticks

Notes: Report fell moderately short of the forecast with a delta of nearly 8, but this caused an indecisive :31 bar that had to contend with the 100 SMA, but a prolonged bearish reaction that was proper. This is the pattern with the CL these days. The results are decisive , but the initial reaction is muted and indecisive, then it delivers on the following 5 or so bars. With JOBB, your order would have filled short at about 94.53 with no slippage, then it would have only given you a fleeting 7 ticks as it oscillated between 4 ticks in the red and 7 in the green. The 10 tick stop was taken out, but a 15 tick stop would have ridden out the heat. There are 2 ways to play a report like this. 1) do not use JOBB, but upon seeing the bearish results, setup a sell limit up near the 50 SMA, or 2) move the stop up higher to about 3 ticks above the 50 SMA and wait for the delayed move. It conquered the 100 SMA on the :33 bar then paused briefly at the R1 Mid Pivot at 94.33 before crashing through the 200 SMA for a total 2nd peak of 49 ticks. Then it reversed for 69 ticks in 25 min and achieved an extended reversal of 149 ticks in a little less than 1.5 hrs.

-011713.jpg)

-111512.jpg)

-101812.jpg)

-092012.jpg)

-081612.jpg)

-071912.jpg)