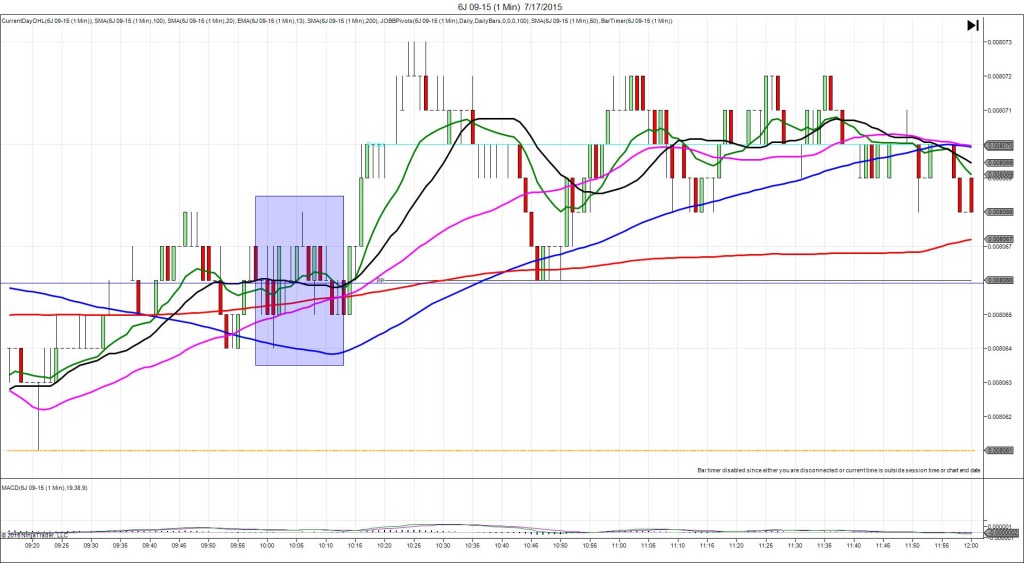

7/17/2015 Prelim UoM Consumer Sentiment (1000 EDT)

Forecast: 96.0

Actual: 93.3

Previous Revision: +1.5 to 96.1

TRAP TRADE – DULL NO FILL

Anchor Point @ 0.008066 (last price)

————

Trap Trade:

)))1st Bar Span 0.008064 – 0.008067 – 0831 (1 min)

)))3 ticks

————

Trap Trade Bracket setup:

Long entries – 0.008060 (in between the LOD / S1 Mid Pivot) / 0.008052 (just below the S1 Pivot / LOD)

Short entries – 0.008073 (just below the R1 Pivot) / 0.008081 (just above the R2 Mid Pivot)

Notes: The report came in below the forecast by 2.7 points. This caused no movement on :01 bar, so cancel the order with no fill after 20 sec.