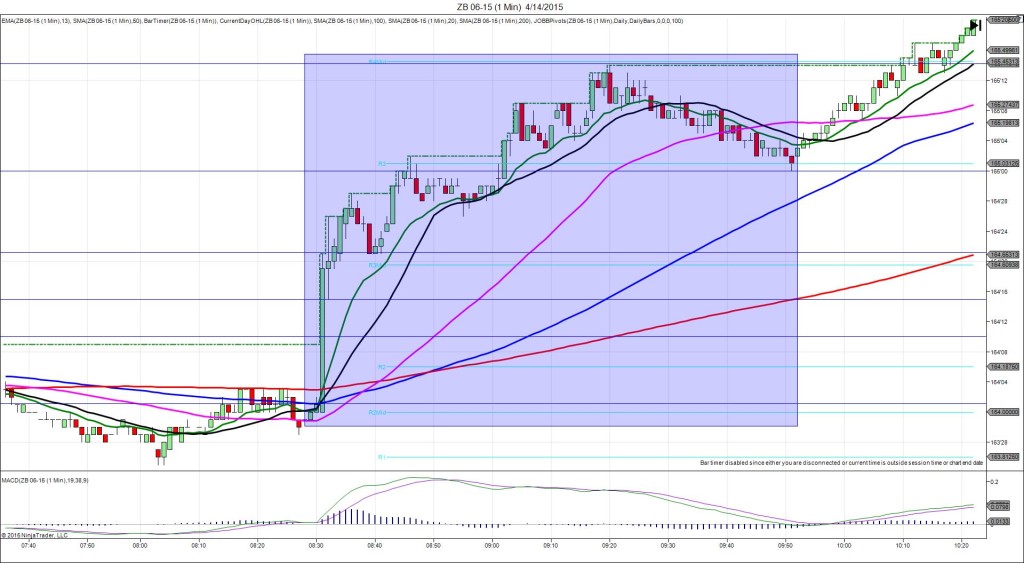

4/14/2015 Monthly Retail Sales (0830 EDT)

Core Forecast: 0.7%

Core Actual: 0.4%

Previous revision: +0.1% to 0.0%

Regular Forecast: 1.1%

Regular Actual: 0.9%

Previous Revision: +0.1% to 0.5%

SPIKE WITH 2ND PEAK

Started @ 164’01

1st Peak @ 164’21 – 0830:04 (1 min)

20 ticks

Reversal to 164’15 – 0832 (2 min)

6 ticks

Final Peak @ 165’14 – 0920 (50 min)

45 ticks

Reversal to 165’00 – 0951 (81 min)

14 ticks

Notes: Report was weak, falling short of the forecasts by 0.3% and 0.2% margins with modest upward previous revisions. PPI also released at the same time and was mildly disappointing. This caused a long spike for 20 ticks immediately that started on the 100 SMA and rose to cross the 200 SMA and reach the R3 Mid Pivot. Then it hovered in the area near the top for 9 sec before backing off. With JOBB, you would have filled long at 164’05 with 1 tick of slippage, then seen it continue to climb. This would have allowed an exit with the hovering around 164’18 with 13 ticks. After a 6 tick reversal on the next bar, it continued to step higher about 4 times to reach the R4 Mid Pivot on the final peak for 25 more ticks in 48 min. Then it reversed 14 ticks in 31 min to the R3 Pivot.