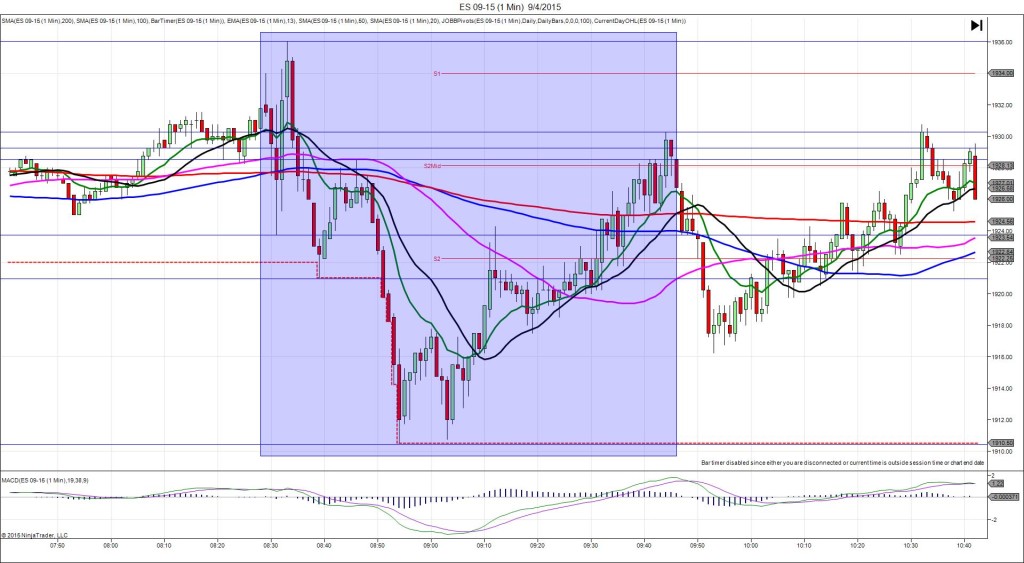

8/7/2015 Monthly Unemployment Report (0830 EDT)

Non Farm Jobs Forecast: 222K

Non Farm Jobs Actual: 215K

Previous Revision: +8K to 231K

Rate Forecast: 5.3%

Rate Actual: 5.3%

TRAP TRADE – DULL NO FILL

Anchor Point @ 2075.75 (on the 50 SMA)

————

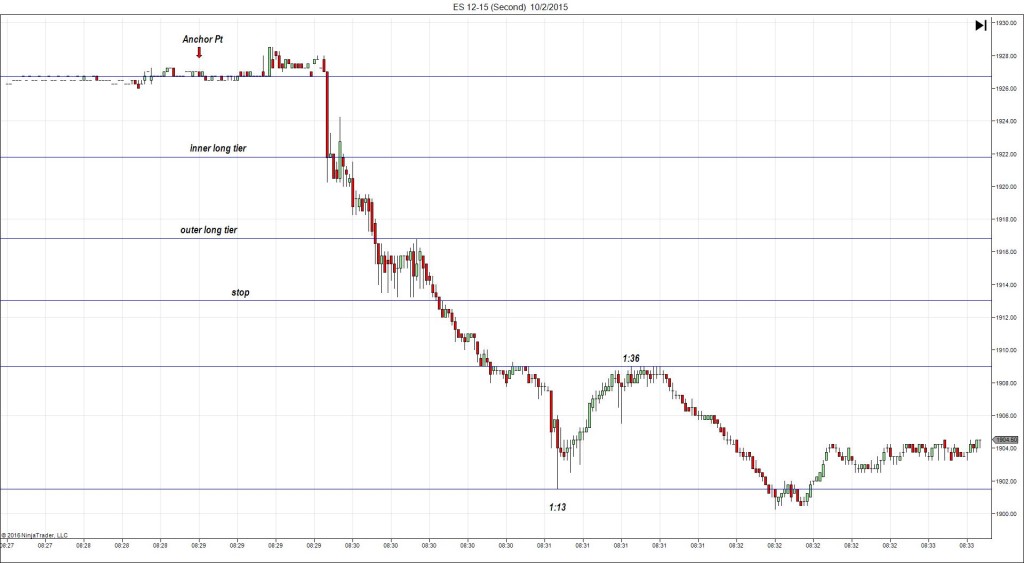

Trap Trade:

)))1st Peak @ 2078.00 – 0830:05 (1 min)

)))9 ticks

)))Reversal to 2073.50 – 0830:24 (1 min)

)))-18 ticks

)))Pullback to 2076.00 – 0831:02 (2 min)

)))10 ticks

)))Reversal to 2072.00 – 0832:03 (3 min)

)))-16 ticks

)))Pullback to 2075.50 – 0832:48 (3 min)

)))14 ticks

————

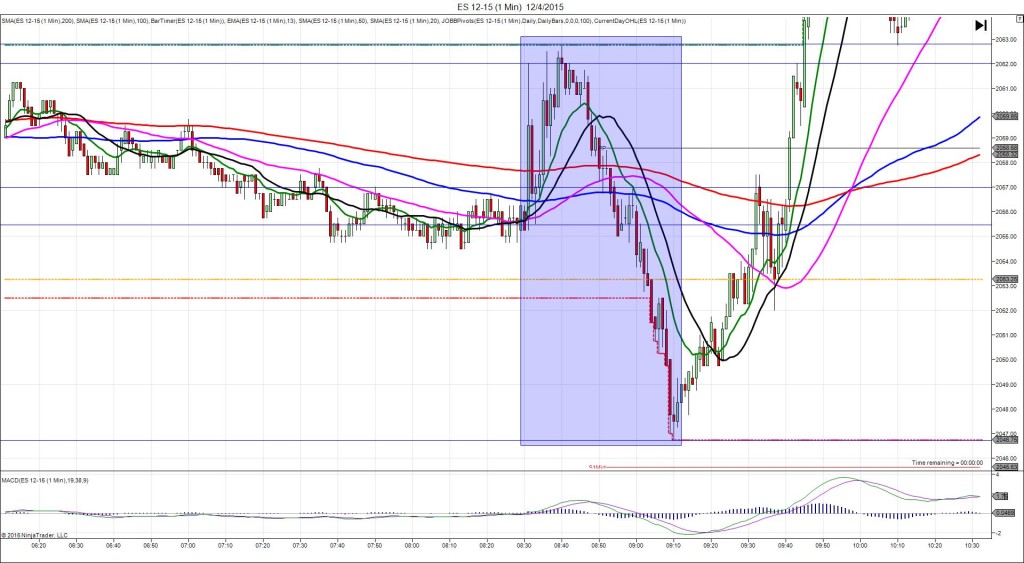

Reversal to 2071.25 – 0838 (8 min)

17 ticks

2nd Peak @ 2082.75 – 0901 (31 min)

28 ticks

Reversal to 2071.00 – 0936 (66 min)

47 ticks

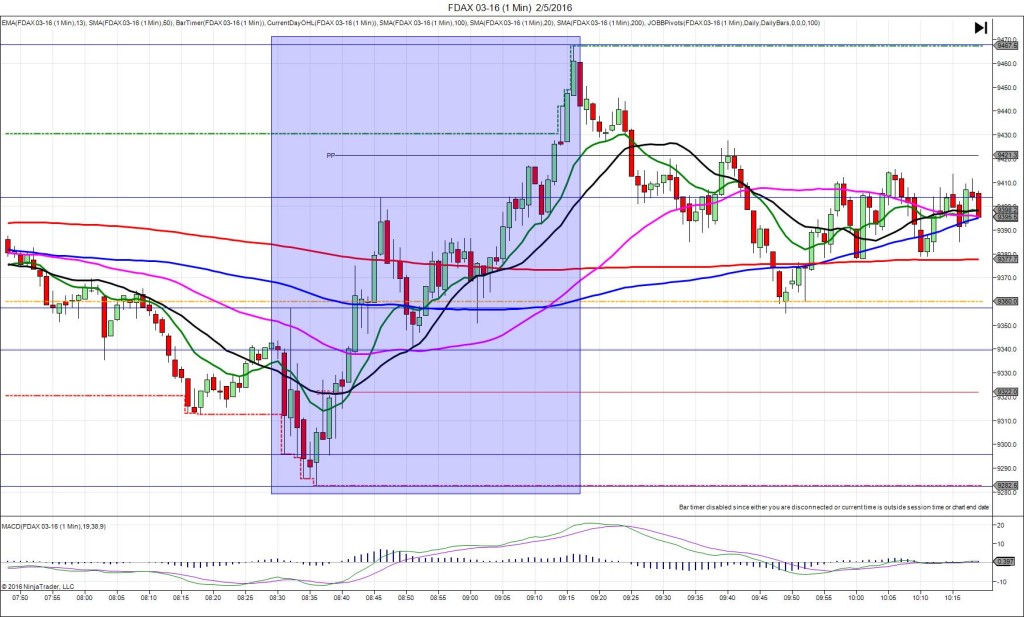

Trap Trade Bracket setup:

Long entries – 2070.75 (No SMA / Pivot near) / 2066.50 (just below the S1 Pivot)

Short entries – 2080.50 (just above the OOD) / 2085.75 (No SMA / Pivot near)

Notes: Mildly weak report with 7K less jobs added than the forecast, a modest upward revision to the previous report along with no change in the U-3 rate. This caused a small long spike of 9 ticks in 5 sec that crossed the 200 SMA before reversing 18 ticks in 20 sec to the LOD. This was too small be more than half to reach the inner short tier, so cancel the order with no fill. It continued to swing up and down several times with the cycle period growing until in reversed in the 8th min to extend the LOD, then climbed for a 2nd peak of 19 more ticks to the PP Pivot in 23 min. Then it reversed 47 ticks in 35 min to the LOD again.