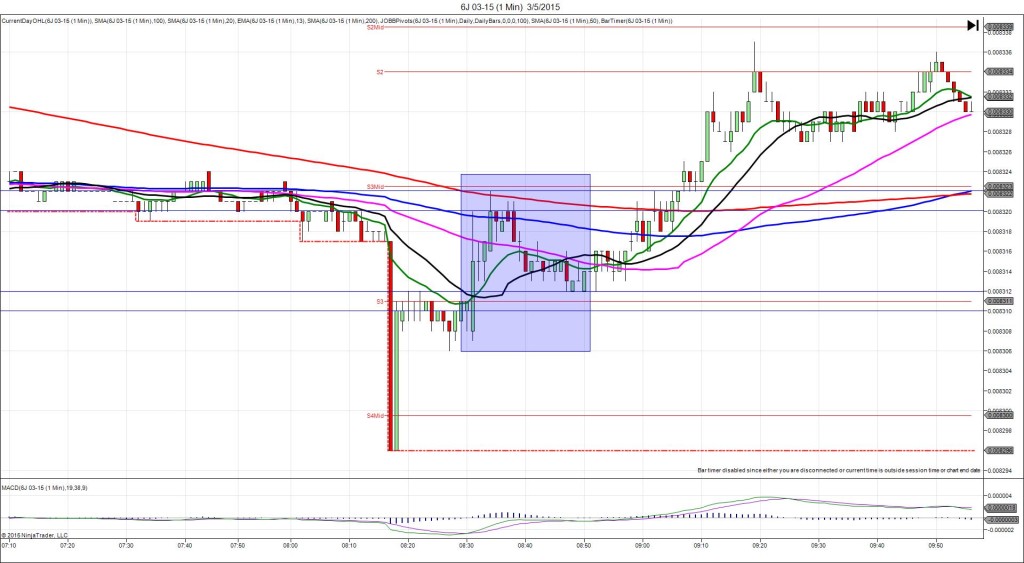

3/5/2015 Weekly Unemployment Claims (0830 EST)

Forecast: 293K

Actual: 320K

TRAP TRADE – DULL NO FILL

Anchor Point @ 0.008310

————

Trap Trade:

)))1st Peak @ 0.008320 – 0830:06 (1 min)

)))10 ticks

)))Reversal to 0.008312 – 0830:18 (1 min)

)))-8 ticks

————

2nd Peak @ 0.008322 – 0834 (4 min)

12 ticks

Reversal to 0.008312 – 0847 (17 min)

10 ticks

Trap Trade Bracket setup:

Long entries – 0.008300 (just above the S4 Mid Pivot) / 0.008290 (just above the S4 Pivot)

Short entries – 0.008320 (just above the 100 SMA) / 0.008329 (No SMA / Pivot near)

Notes: Report came in worse than expected with 27k offset. This caused a quick and unsustainable long spike of 10 ticks that would have touched the inner short entry on the 100 SMA but not filled. Since it retreated quickly, cancel the order with no fill. It reversed 8 ticks in 12 sec back to the S3 Pivot before climbing for a 2nd peak of 2 more ticks to the 200 SMA in 3 min. Then it reversed 10 ticks in 13 min to the S3 Pivot.